Sandra L. Richards is the head of Morgan Stanley‘s global sports and entertainment (GSE) division under the firm’s wealth management division. She plays a significant role in the growth of the GSE business and its strategic leadership for over 250 financial advisors.

Richards is spearheading an amazing financial educational program that promotes financial literacy for athletes and entertainers and has made it available to all from Morgan Stanley’s E*Trade program.

Describe and share your title, and why financial literacy needs to start early and often.

I’ve been at Morgan Stanley for 17 years, and I run our global sports and entertainment business in our wealth management business. The business was founded based on financial education and building upon those principles as we think about our clients and prospective clients in the sports and entertainment industry, and financial education was important for this foundation. Having those tools and knowledge and resources, you’re able to at least navigate the place that you’re playing in, the cameras you’re going to be in front of, and the contracts you’re going to get. Having that as a tool and resource we know that was important. And to have it earlier on is valuable for anyone, whether you’re the talent on screen, or talent in the executive suites in an entertainment company, or a sports league.

Tell us about your new program, “Money in the Making.”

We just launched a new program in partnership with our E*Trade colleagues, and it’s called “Money in the Making.” It’s a digital financial education program, and it deals with everything from budgeting to saving and investing. We also know that college athletes can now make money off their name, image, and likeness (NIL), so we have a whole section dedicated to that. Before the establishment of the rules around name, image, and likeness, we had always been delivering financial education to colleges, universities, and programs that were dealing with student-athletes, and with this, we saw it as a way to respond to the number of inquiries that we were getting and how can they stay in touch with us? How can they keep their education going? And now this also brings us to a point where we can scale the opportunity. We can go to only so many schools and institutions and be there live, but at least this allows us to provide that education on a scale and you can access it anytime you want. To be able to get financial education means for people to consume it in a way that works for them, works for their schedule, and they could take it in bites, whether article by article, podcast by podcast, or video by video.

Who is a part of this program?

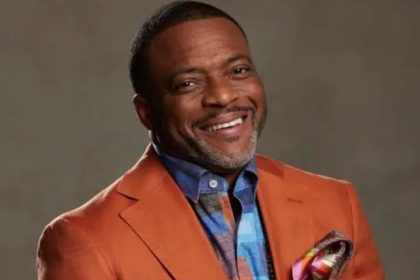

We’re excited to have Larry Fitzgerald, Jr., who many people know played for the Arizona Cardinals for 17 years in the NFL. He has joined us as our financial education advocate, and if you go to our website, there’s a video where it prominently starts with Larry talking about money in the making. What we love about having him as one of our advocates is that he shares his own stories. You can learn from somebody when they’re sharing stories and their own stories, and he has a lot of them, given his career and the things that he’s doing off the field.

We will have Jamie Hector, an actor who everyone may remember from “The Wire,” “Bosch,” and many other things.

We also have an organization called Parity, which is an organization that works with female athletes, and we have about 14 of those athletes who will be talking via social media about their personal financial journey.

How can individuals understand how this program can provide a vision for themselves?

It’s for everyone. It’s for people who are already savvy in the saving part now and want to know about investing or budgeting. It’s for people going back to school, or trying to get their first deal; or they’re going on their third or fourth deal, and they want to make sure that they’re checking the boxes on everything that they should be doing. We have things on there like the do’s and don’ts of financial literacy. I would say at least just get to the site and start wherever you feel comfortable. There’s no step one, step two, or step three, it’s for you to take in and consume the information as you need to.

What would you like to see universities do as it relates to understanding that they’re educating their athletes while they’re receiving such huge financial help?

The market is big and it’s growing. The understanding of NIL and the power of what this can perceive, not only for the student-athletes, but also for the brands the universities, and everyone in the ecosystem is good. Think of this piece as an accomplishment and extension of the education that you’re providing to your student-athletes. Whether you’re running your financial education programs or workshop, this just could be another compliment. It’s not to be competing with any other programs that you’re already running, this is just another tool that you can add that could be accessible anywhere, and it can be accessible 24/7. I think this is a great tool to add to existing resources, or if you don’t have the resources, this is a great place to start. We want people to have information. Knowledge is power, and what we want to do is empower these young people who are the next generation of leaders, we need them to have this information because they’re going to be the “next,” they’re going to be the ones in various seats and those that we’re entertained by. We want them to be having sustainable and successful lives and not get caught in the opportunity and not knowing how to leverage this important moment in their lives. It’s our responsibility, and we take it seriously. I just want everybody to win.

As a sister with superpower who has a commitment to educate, inform, and empower financial literacy for entertainers and athletes, Richards is a committed financial professional.