Homeownership is central to the American dream because it provides a strong foundation for families to build stable lives and create sustainable wealth. However, putting the down payment together to get that house can be more like a nightmare.

As housing prices continue to climb, especially in many major urban areas, potential homeowners are finding the planning, budgeting and saving that it takes to put money aside is a bigger challenge than they can handle. Statistics* show that this process is even more challenging for African Americans, who continue to own homes at a significantly lower rate (44%) than Hispanic Americans (50.6%), Asian Americans (62.8%) and White Americans (72.7%) according to the National Association of Realtors.

The same research also showed that Black homeowners spend more of their income to own their homes than all racial groups, with 30% being cost-burdened – defined as spending more than 30% of their income on housing.

The Rocket Community Fund, the philanthropic partner of Rocket Mortgage, recognizes the inequity of homeownership and seeks to build bridges toward closing the homeownership gap through strategic philanthropic investments. With programs geared toward supporting new homeownership and resident retention, the Rocket Community Fund is creating connections between aspiring homeowners and those houses they have their eyes on, connections that simply wouldn’t be possible otherwise. It’s working in at least four major metropolitan areas already — specifically, Atlanta, Cleveland, Detroit and Milwaukee.

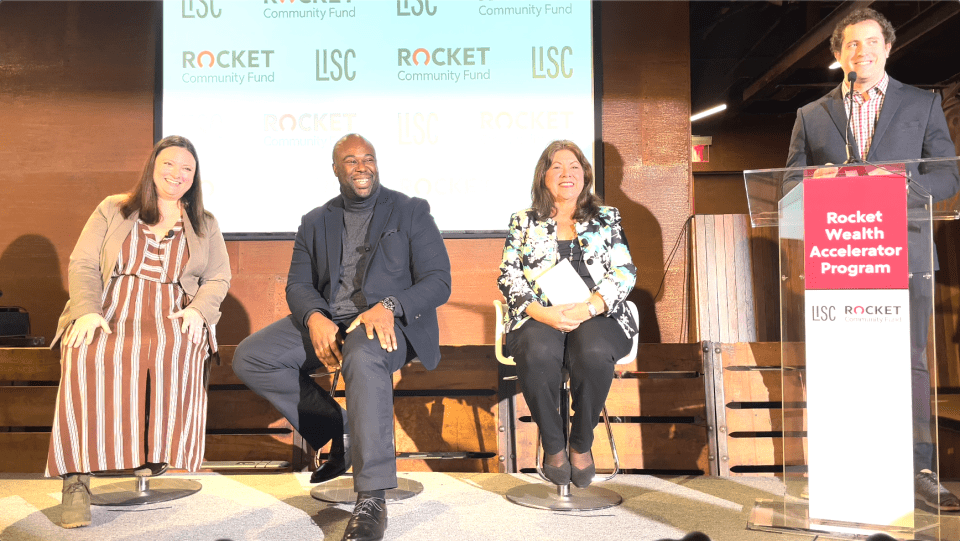

Here’s how Rocket Mortgage went to work with solution-oriented thinking: It created the $2 million Rocket Wealth Accelerator program in partnership with Local Initiatives Support Corporation (LISC) to provide residents in those four cities with coaches who work with them. The coaches help the residents improve their ability to meet emergency needs, build good credit and grow generational wealth.

The Rocket Wealth Accelerator program also provides matching funds up to $500 for participants who are saving up for large-dollar goals, such as purchasing a home or vehicle, and up to $300 for those with less-expensive needs, such as for short-term needs or emergencies. The program is paying off for participants.

“It’s hard to save for the future and be prepared for what might happen,” said Detroit resident Ieesha Hobdy. “Setting this savings target is getting me to make my plan.”

Fellow participant Carla Varner agreed, saying, “Before, I didn’t realize that I needed different types of savings. Now, I’m thinking about emergency savings, saving for retirement, saving for my children.”

Eva Garza Dewaelsche, President & CEO, SER Metro Detroit

(Photo credit: Porsha Monique for Rolling Out)

The Rocket Community Fund also looks out for longtime homeowners who are at risk of displacement because of increased property taxes, and especially in the bigger cities where meeting rising prices is already challenging. The Rocket Community Fund supports efforts to reduce property tax burdens for low-income residents so that, rather than being victims of rising property values, they can be beneficiaries instead.

For example, in Atlanta, the Rocket Community Fund invested $500K in the Atlanta BeltLine Partnership’s Legacy Resident Retention Program. The fund also contributed another $250K for the Atlanta Neighborhood Development Partnership’s Closing the Gap plan, with the goal of creating 2,000 units of affordable housing by 2025.

The Rocket Community Fund is also producing tangible results in Milwaukee, where it invested $300K with the Greater Milwaukee Committee, supporting that city’s MKE United Anti-Displacement Fund.

The Rocket Community Fund’s commitment to creating and maintaining homeownership aligns with the work of Rocket Mortgage and complement programs like the ONE+ product, which allows clients to put down 1% on a home and receive a 2% grant, so that the potential homeowner has a 3% total down payment.

By properly recognizing the challenges and coming up with innovative solutions, the Rocket Community Fund is going a long way toward solving some of the most basic American homeownership problems and helping make our country an even better place to own a home and create wealth.

Sources:

* https://www.nar.realtor/newsroom/more-americans-own-their-homes-but-black-white-homeownership-rate-gap-is-biggest-in-a-decade-nar