In the intricate realm of insurance, finely tuned policies serve as guardians of financial stability for policyholders, meticulously navigating the landscape of risk. Amidst the myriad criteria used to assess an individual’s eligibility for coverage, the seemingly intrusive request for blood samples stands out. Yet, far from an arbitrary imposition, this practice is driven by the insurers’ commitment to delivering precise evaluations of an individual’s health. This article delves into the underlying reasons why insurance companies insist on acquiring blood samples during the policy approval process and unravels the mutual benefits bestowed upon both insurers and policyholders. By peering into the intricacies of this practice, we uncover the role blood samples play in shaping insurance policies that not only safeguard financial interests but also foster a health-conscious partnership between insurers and those they serve.

Understanding the need

Blood samples sets the stage for unraveling the necessity of such a seemingly personal requirement. Insurance companies strive to offer comprehensive and accurate coverage, and an individual’s health plays a pivotal role in determining the level of risk they pose.

Why blood samples matter

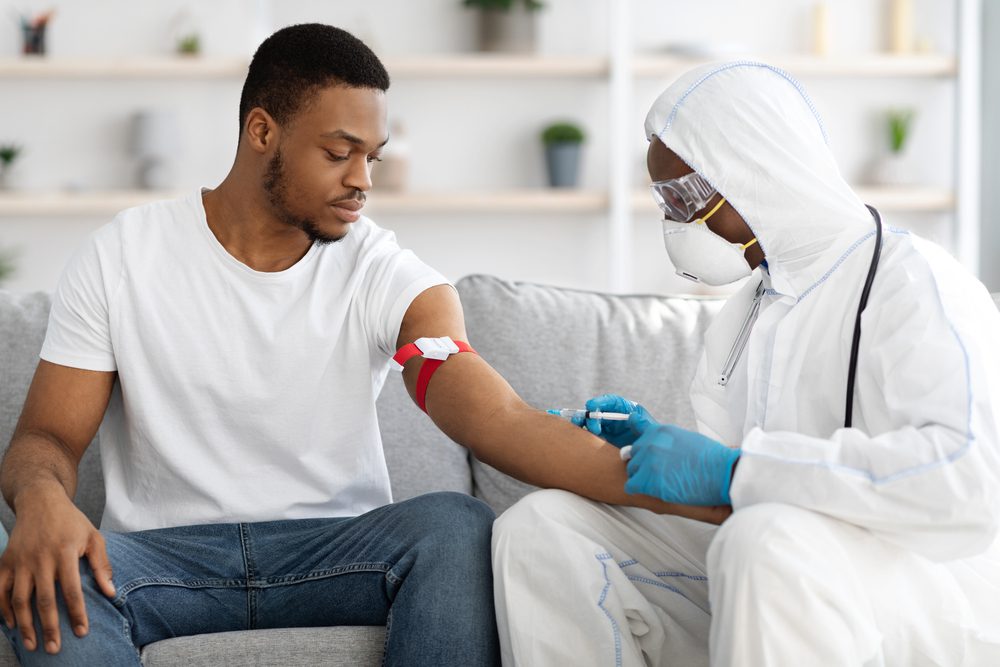

At the beginning of the policy application process, insurance companies often request blood samples for a thorough health assessment. These samples can reveal crucial information about an individual’s overall health, detecting potential risks and underlying conditions that might impact the policy’s terms.

Assessing health risks

Insurance policies, especially life and health insurance, rely on an accurate evaluation of an individual’s health to determine the level of risk they present. Blood samples provide valuable insights into cholesterol levels, blood sugar, and other biomarkers that can indicate potential health issues. Identifying these risks allows insurance companies to tailor policies accordingly, ensuring that individuals with higher health risks receive appropriate coverage.

Ensuring accurate underwriting

Underwriting is the process by which insurance companies evaluate and price risks. The information gathered from blood samples contributes to accurate underwriting, allowing insurers to set premiums based on the individual’s specific health profile. This precision benefits both parties – policyholders receive fair premiums based on their actual health status, and insurers can maintain financial stability by appropriately pricing the risks they undertake.

Preventing fraud

In the realm of insurance, fraud prevention is paramount. Blood samples serve as a concrete and objective source of information, reducing the chances of individuals providing inaccurate or misleading health details. This not only protects the insurance company from potential fraud but also ensures that policyholders are transparent about their health, fostering a fair and honest relationship between the two parties.

The impact on premiums

Health status is a significant factor in determining insurance premiums. Individuals with healthier lifestyles often receive more favorable premium rates. By providing blood samples, policyholders have the opportunity to showcase their good health, potentially leading to reduced premiums. This incentivizes a proactive approach to health and wellness.

Navigating privacy concerns

While the necessity of blood samples is clear from an insurance perspective, it’s essential to address privacy concerns. Insurance companies are bound by strict confidentiality regulations, and the information obtained from blood samples is handled with the utmost care to protect the privacy of policyholders.

The imperative for blood samples is geared toward achieving two paramount goals: ensuring accurate risk assessment and facilitating equitable policy pricing. By embracing this practice, insurance companies fortify their pledge to furnish comprehensive coverage that resonates with the unique health profiles of their policyholders. This symbiotic relationship between insurers and policyholders is underpinned by the pillars of transparency, accuracy and privacy. As policies take shape based on genuine health insights, policyholders can revel in the assurance that their financial safeguards are intricately tailored to their individual needs.

This story was created using AI technology.