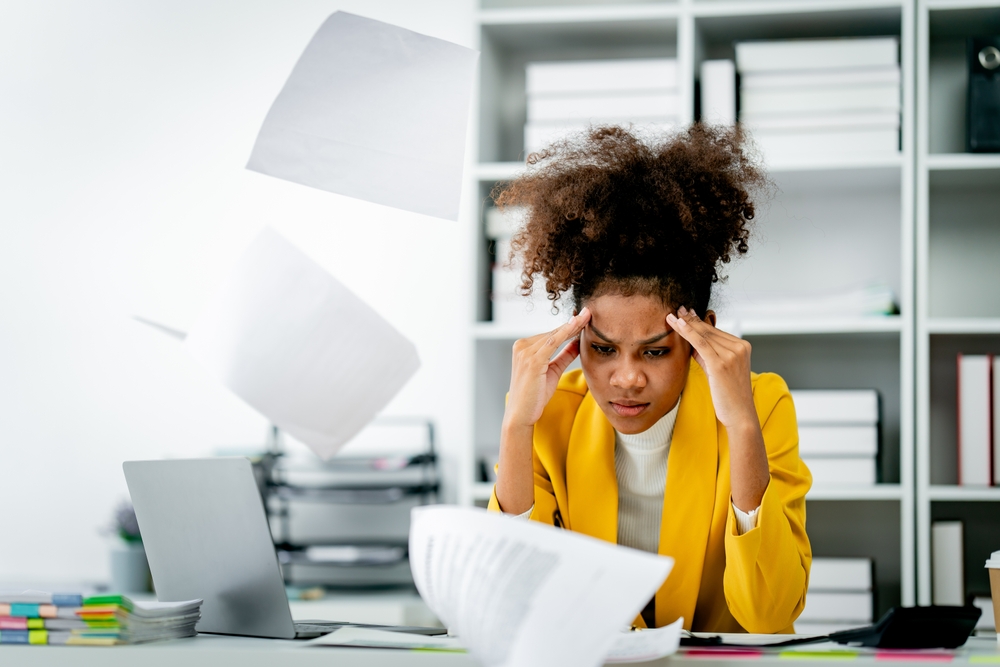

Tax season can be a stressful time, even for the most organized individuals. But for those who are behind on filing their taxes, the pressure can feel overwhelming. Fear of audits, penalties, and the unknown can lead to procrastination, making a bad situation even worse. However, avoiding the issue won’t make it disappear. It can lead to significant financial consequences down the road.

This article addresses the common fear of filing back taxes and explores the benefits of seeking help from a tax accountant. Here’s how a tax professional can help you navigate the complexities of tax filing and achieve peace of mind.

Understanding Tax Anxiety: Why We Procrastinate

Tax anxiety is a real phenomenon, and it can stem from a variety of factors. Here are some common reasons people might avoid filing their taxes:

- Fear of the Unknown: The tax code can be complex, and those unfamiliar with it may feel intimidated. Unclear filing requirements and the possibility of errors can lead to paralysis.

- Shame or Embarrassment: People who owe back taxes may feel ashamed or embarrassed about their situation. This can prevent them from seeking help and taking action.

- Fear of Audits: The possibility of an audit can be a significant source of anxiety. Even if you haven’t done anything wrong, the fear of scrutiny can be enough to deter people from filing.

- Procrastination: Sometimes, the sheer volume of paperwork and the looming deadline can be enough to make people put off filing their taxes.

The Price of Procrastination: Why Ignoring the Issue Hurts

While avoiding the issue may seem easier in the short term, the consequences of not filing your taxes can be severe. Here’s what you risk by not filing:

- Penalties and Interest: The IRS charges penalties and interest on unpaid taxes. These fees can accrue quickly, adding significantly to your tax burden.

- Wage Garnishment: In extreme cases, the IRS can garnish your wages to collect unpaid taxes. This means a portion of your paycheck will be automatically withheld to pay your tax debt.

- Bank Levies: The IRS can also freeze your bank accounts or seize assets to collect unpaid taxes.

- Damaged Credit Score: Unpaid taxes can damage your credit score, making it difficult to qualify for loans or other forms of credit.

- Future Tax Filing Issues: Not filing current tax returns can complicate future filings and potentially disqualify you from receiving tax benefits.

Facing Your Fears: How a Tax Accountant Can Help

A tax accountant can be a valuable asset in overcoming your fear of filing back taxes. Here’s how a tax professional can assist you:

- Expertise and Guidance: Tax accountants have the knowledge and experience to navigate the complexities of the tax code. They can help you understand your filing requirements and ensure you’re taking advantage of all available deductions and credits.

- Accuracy and Peace of Mind: Tax professionals can prepare your tax return accurately and efficiently, minimizing the risk of errors and penalties. This can give you peace of mind knowing your taxes are filed correctly.

- Negotiation and Representation: If you owe back taxes, a tax accountant can negotiate with the IRS on your behalf. They can help you explore options such as payment plans or penalty abatements.

- Reduced Stress and Anxiety: Knowing you have a qualified professional handling your tax situation can significantly reduce stress and anxiety. This allows you to focus on other important aspects of your life.

Finding the Right Tax Accountant

The first step to overcoming your fear of filing back taxes is to find a qualified tax accountant you trust. Here are some tips for finding the right professional:

- Ask for Referrals: Talk to friends, family, or colleagues who have used a tax accountant in the past. Get recommendations and ask about their experiences.

- Check Qualifications: Ensure the accountant you choose is a Certified Public Accountant (CPA) or an Enrolled Agent (EA). These designations indicate they have the education and experience to handle complex tax situations.

- Consider Fees: Discuss fees upfront and ensure you understand the accountant’s pricing structure.

- Schedule a Consultation: Many tax professionals offer a free consultation to discuss your situation and answer your questions.

Conclusion: Taking Control and Moving Forward

Filing back taxes can be daunting, but it doesn’t have to be a source of fear and anxiety. By seeking help from a qualified tax accountant, you can navigate the process efficiently and achieve peace of mind. Remember, the IRS is more likely to work with you if you come forward voluntarily. Don’t wait any longer; take control of your tax situation and move forward with confidence.

This story was created using AI technology.