As millions of Americans diligently save for retirement, a less visible threat lurks within their carefully crafted financial plans: hidden fees. These often-overlooked costs can significantly diminish retirement savings over time, potentially derailing even the most well-intentioned strategies. Understanding and addressing these hidden fees is crucial for safeguarding one’s financial future.

The insidious nature of hidden fees

Retirement accounts, including 401(k)s, IRAs, and various mutual funds, come with an array of fees that are not always transparent to the average investor. While individually these fees may seem insignificant, their cumulative impact over decades can be substantial.

The true cost of small percentages

Even a seemingly modest 1% fee can translate to tens of thousands of dollars lost over the life of a retirement account. This compounding effect means that by retirement age, investors could be missing out on a significant portion of their potential savings.

Common culprits in fee erosion

Several types of fees contribute to the gradual depletion of retirement savings:

Expense ratios in mutual funds

Mutual funds, a staple in many retirement portfolios, charge annual fees known as expense ratios. These cover administrative and operational costs but are often deducted directly from returns, making them less noticeable to investors.

Administrative fees in 401(k) plans

Many employees are unaware that their 401(k) plans come with administrative fees, often passed on by employers. These fees, covering services like recordkeeping, can accumulate significantly over a career spanning decades.

Investment advisory fees

Those utilizing financial advisors may be paying more than they realize. Whether charged as a percentage of assets under management or a flat fee, these costs can substantially impact long-term savings.

Trading and custodial fees

Every trade within a retirement account can incur fees, as can the mere act of holding assets with a custodian. While these may seem minor, frequent trading or long-term asset holding can lead to considerable expense over time.

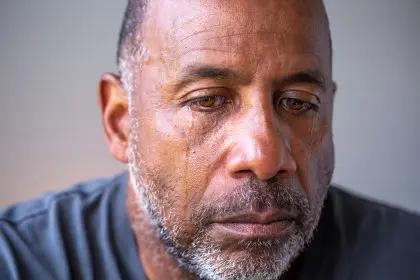

The emotional toll of hidden costs

The realization that a portion of one’s hard-earned savings is being quietly eroded can be distressing. This emotional burden adds to the already complex task of ensuring financial security in retirement.

Strategies to combat hidden fees

Investors can take several steps to identify and mitigate the impact of hidden fees:

Regular statement reviews

Carefully examining retirement account statements is crucial. Look for terms like “expense ratios,” “administrative fees,” or “advisory fees” to understand the full cost structure of your investments.

Opting for low-cost funds

Consider switching to low-cost investment options like index funds, which often have significantly lower expense ratios compared to actively managed funds.

Engaging with employers

For those with 401(k) plans, engaging with employers about plan fees can be enlightening. Some companies offer lower-cost options or may be willing to negotiate better terms with plan providers.

Considering fee-only advisors

If working with a financial advisor, exploring fee-only options can lead to more transparent and potentially lower costs compared to traditional percentage-based fee structures.

Limiting trading activity

Adopting a more passive investment strategy can help minimize trading fees, which can add up quickly with frequent buying and selling.

Account consolidation

Merging multiple retirement accounts into a single account can often lead to reduced fees and simplified management. Many custodians offer lower fees for larger account balances.

The power of proactive management

Taking control of retirement savings means being vigilant about identifying and eliminating hidden fees. The sooner investors address these costs, the more time they have to benefit from the resulting savings.

Securing your financial future

Hidden fees represent a significant but manageable threat to retirement savings. By becoming aware of these costs and taking decisive action, investors can protect their financial futures. The goal is to ensure that hard-earned savings are working efficiently towards a comfortable retirement, not quietly diminishing due to overlooked expenses.

As retirement planning continues to evolve, staying informed about the true costs of investing becomes increasingly crucial. By tackling hidden fees head-on, savers can take a significant step towards achieving the retirement they envision, free from the worry of unnecessary financial drain.

This story was created using AI technology.