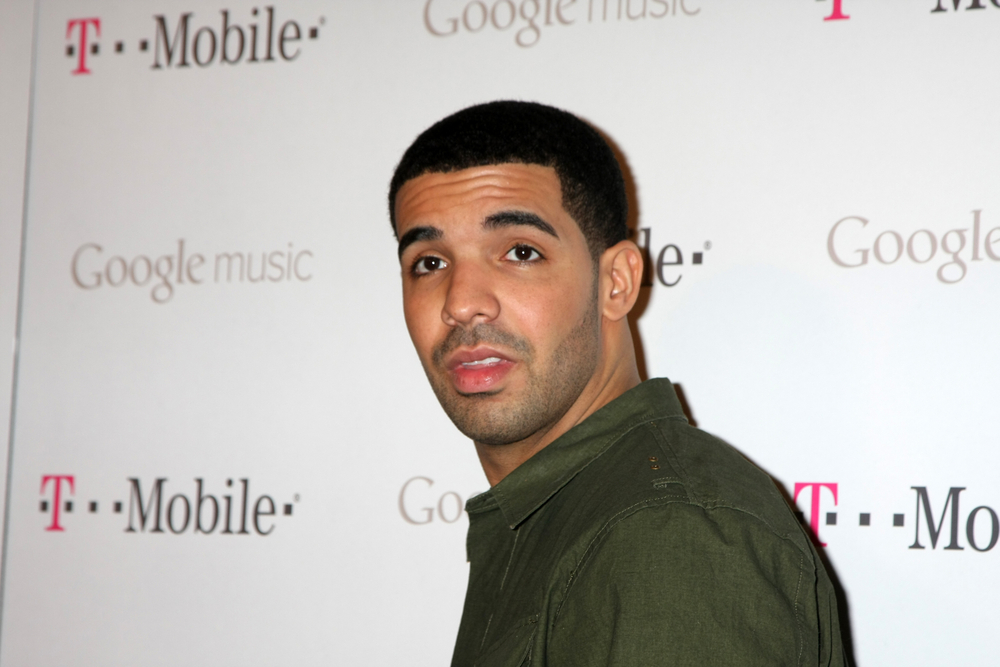

The Canadian hip-hop superstar’s recent financial transparency exposes the harsh realities behind celebrity betting culture

The glittering facade of celebrity gambling culture received a sobering reality check when one of music’s biggest names pulled back the curtain on an uncomfortable truth. The Toronto-born artist, Drake, whose musical achievements have earned him global recognition and substantial wealth, recently disclosed financial losses that underscore the precarious nature of high-stakes wagering.

Social media posts revealed that the Grammy-winning performer had wagered approximately $125 million over a single month, resulting in losses exceeding $8 million. These figures represent more than mere entertainment expenses for someone of his stature—they illuminate the potentially destructive nature of compulsive gambling behaviors that can affect anyone, regardless of their financial standing.

The mathematics of celebrity risk-taking

The entertainment industry has long romanticized the image of successful artists living lavishly and taking extraordinary risks with their fortunes. However, the recent disclosures provide a stark mathematical reality that challenges this narrative. When someone acknowledges losing more than $8 million in thirty days, it forces a reconsideration of what constitutes responsible financial behavior, even among the exceptionally wealthy.

The disclosed wagering patterns reveal a systematic approach to risk-taking that extends far beyond casual entertainment. Monthly gambling expenditures approaching nine figures suggest an involvement level that transcends recreational activity and enters territory typically associated with problem gambling behaviors.

Financial experts note that such substantial losses can have cascading effects beyond immediate monetary impact. The psychological pressure associated with chasing losses often leads to increasingly reckless decision-making, creating cycles that can be difficult to break even for individuals with seemingly unlimited resources.

Industry partnerships and conflict of interest concerns

The situation becomes more complex when considering the subject’s professional relationship with online gambling platforms. Serving as a brand ambassador for digital casinos while simultaneously experiencing substantial losses raises questions about the authenticity of promotional content and the potential influence on impressionable audiences.

This dual role—both promoter and participant—creates an inherent conflict that consumer advocacy groups have increasingly criticized. When celebrities endorse gambling platforms while simultaneously struggling with their own wagering behaviors, it sends mixed messages to fans who may view such endorsements as genuine recommendations rather than paid promotional content.

The gambling industry has faced mounting scrutiny regarding celebrity partnerships, particularly those involving younger demographics who may be more susceptible to influence from their favorite entertainers. Recent regulatory discussions have focused on establishing clearer guidelines for celebrity endorsements of gambling services.

Cultural impact and social responsibility

The broader cultural implications extend beyond individual financial decisions. When prominent figures in entertainment normalize extreme gambling behaviors through social media sharing, it can inadvertently encourage similar risk-taking among followers who lack comparable financial resources.

Research conducted by gambling addiction specialists indicates that celebrity gambling content significantly influences public perception of wagering activities. Young adults, in particular, often underestimate the risks associated with gambling when they observe their favorite entertainers treating substantial losses as mere inconveniences.

The psychology behind public disclosure

The decision to publicly acknowledge significant gambling losses represents an unusual departure from typical celebrity financial privacy. This transparency may serve multiple purposes, from attempting to humanize an otherwise impossibly wealthy public figure to potentially seeking accountability through public acknowledgment.

Behavioral psychologists suggest that public admission of gambling losses can sometimes serve as a form of self-imposed intervention. By making private struggles public, individuals may create external pressure to modify their behaviors, though this approach carries risks of its own.

Technological influences on modern gambling

The disclosed losses included specific references to artificial intelligence-generated betting advice, highlighting how technological advancement has complicated traditional gambling dynamics. The integration of AI systems into wagering decisions represents a new frontier in gambling behavior that regulators and mental health professionals are still learning to address.

This technological element adds another layer to contemporary gambling addiction, where individuals may feel they are making informed, data-driven decisions while actually engaging in the same fundamentally risky behaviors that have characterized problem gambling throughout history.

Economic implications for the entertainment industry

The financial losses disclosed represent more than personal setbacks—they reflect broader economic trends within the entertainment industry. As traditional revenue streams face disruption from changing consumer habits and market conditions, some entertainers may be taking increasingly desperate risks to maintain their accustomed lifestyles.

Industry analysts note that gambling losses of this magnitude can significantly impact an artist’s long-term financial stability, potentially affecting their ability to make strategic career decisions or weather periods of reduced income.

Lessons for financial literacy and risk management

The situation provides valuable insights into risk management principles that apply across all income levels. Even individuals with substantial wealth must consider the psychological and practical implications of their financial decisions, particularly when those decisions involve activities with inherently negative expected outcomes.

Financial advisors emphasize that no amount of wealth provides immunity from the consequences of poor risk management. The principles of diversification, loss limitation, and emotional discipline remain relevant regardless of an individual’s net worth.

The disclosed gambling experiences serve as an unintended case study in how quickly substantial sums can disappear when risk management principles are abandoned in favor of emotional decision-making. This reality applies whether someone is wagering millions or modest amounts relative to their financial capacity.

These revelations ultimately highlight the importance of maintaining perspective on risk and reward, regardless of one’s financial circumstances, and the ongoing need for greater awareness about gambling’s potential consequences across all segments of society.