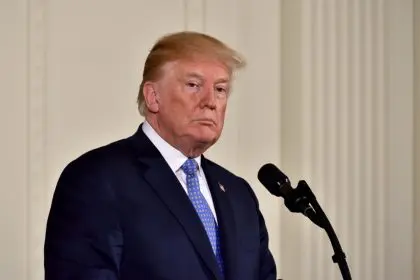

President Donald Trump’s ambitious 940-page legislative package promises significant tax relief while fundamentally reshaping federal spending priorities. The Senate bill emerged near midnight as Republicans race toward their self-imposed July 4 deadline, despite uncertainty about securing sufficient votes for passage. Senate Majority Leader John Thune continues behind-the-scenes negotiations to build consensus among divided Republican members.

The legislation’s centerpiece extends Trump’s 2017 tax cuts that would otherwise expire December 31, 2025, preventing what supporters characterize as a $4 trillion tax increase. High-income earners would maintain their current 37% tax rate instead of facing a jump to 39.6%, while middle-class individuals earning between $9,525 and $38,700 would continue paying 12% rather than 15%. The bill preserves popular provisions from the 2017 law, including the doubled child tax credit of $2,000 and nearly doubled standard deduction.

Addressing Trump’s prominent 2024 campaign promise, the legislation eliminates federal taxes on tips and overtime wages through 2028. Tipped employees like waiters and hairstylists would benefit from new tax deductions, as would workers receiving overtime compensation. The Senate version includes a $25,000 annual cap on deductions and phases out benefits for individuals earning above $150,000 or married couples making more than $300,000 combined.

Social safety net programs face dramatic reductions

The bill’s most controversial elements involve substantial cuts to programs serving low-income Americans, particularly Medicaid and SNAP benefits. Medicaid, which provides health insurance to more than 71 million Americans, would face deeper reductions than initially proposed by the House, potentially causing 7.6 million people to lose coverage over the next decade while saving at least $625 billion in federal spending.

Senate Parliamentarian Elizabeth MacDonough removed several Medicaid restrictions during legislative review, including prohibitions on coverage for non-citizens and restrictions on gender-affirming care funding. The final version maintains new work requirements forcing able-bodied adults to work 80 hours monthly until age 65 to qualify for benefits. The mandate includes exemptions for parents or guardians of children under 14 and individuals with disabilities.

SNAP program modifications survived the parliamentary review process after initial rejections, with Republicans successfully adjusting language to shift costs onto state governments. The revised approach gives states additional time before implementing cost-sharing requirements and provides Alaska and Hawaii temporary exemptions for up to two years. Political observers view these concessions as attempts to secure support from Alaska’s Republican senators, particularly Lisa Murkowski.

Defense spending and border security receive major increases

Republican priorities receive massive increases in defense and border security funding, areas where party leaders showed no restraint despite fiscal concerns. The proposal injects approximately $150 billion into military programs, including $9 billion for service member quality of life improvements covering housing, healthcare, childcare, and education benefits. An additional $25 billion supports Trump’s promised Golden Dome missile defense shield, which the administration pledges will become fully operational by 2029.

Border security receives substantial investment through a $150 billion increase to the Department of Homeland Security budget, more than doubling the agency’s current funding levels. The legislation authorizes $45 billion for new immigration detention centers to supplement the more than 160 facilities currently operated by Immigration and Customs Enforcement. Another $27 billion funds the mass deportation campaign, including hiring 10,000 additional deportation agents to expand ICE’s current workforce of approximately 6,000 agents.

Border Czar Tom Homan emphasized the funding’s necessity during a June 26 White House press conference, stating that without additional resources, achieving the president’s goal of deporting 1 million immigrants this year would prove extremely challenging. The expanded funding would enable dramatically increased community arrests and enhanced cooperation between federal agents and state and local law enforcement agencies.

Political battles intensify as deadline approaches

The Trump administration strongly supports the Senate version through an official White House Office of Management and Budget statement released June 28, describing failure to pass the legislation as the ultimate betrayal of campaign promises. Democratic opposition remains unanimous, with Senator Richard Blumenthal of Connecticut characterizing the proposal as a big, ugly betrayal that provides tax breaks for wealthy Americans while cutting services for low-income families.

The bill also raises the national debt limit by $5 trillion, potentially complicating support among fiscal conservatives already concerned about long-term budget implications. Senate floor debate begins around 2 p.m. EDT on June 28, with Republican leadership still uncertain about securing the necessary votes for passage.

Trump has applied public pressure on potentially defecting GOP senators while Senator Lindsey Graham, chairman of the Budget Committee, frames the legislation as essential for preventing higher taxes, open borders, weak military defense, and unchecked government spending. The outcome will determine whether Republicans can deliver on their most significant legislative priority during Trump’s second term, with the self-imposed July 4 deadline adding urgency to negotiations.