|

If

you’re waiting for the appropriate time to start investing in your

future, there’s no time like the present. The earlier you invest, the

more opportunity you give your money to grow. Your money should be

working for you at all times. Understanding the rate of return that

your accounts are yielding is key to gaining financial independence.

The most common method that the financially savvy use is the Rule of

72.

The Rule of 72 estimates the time it will take for your money to double

in an investment by using your rate of return.

For example: Traditionally, people are taught when you get a job, you

open a checking and a savings account. The checking account is for your

daily expenses and the savings is the investment in your future. The

average savings account yields around 1 percent interest.

According to the rule of 72: If you have $1,000 in a savings account

that yields 2 percent interest, it will take your money 36 years to

double (72 / 2 percent interest = 36). Clearly, a savings account is

not the proper vehicle to use in building wealth.

The next step up on the investment chart would be a CD. A CD

(certificate of deposit) is a risk-free savings account insured by the

FDIC where the depositor must leave money in the account for a fixed

term (usually 3 months, 6 months, or 1 to 5 years) until maturity is

reached. The average CD boasts a 4 percent return. A quick calculation

reveals that at that percentage rate, it would take your investment 18

years to double in value (72 / 4 percent interest = 18). While better

than a savings account, a CD still isn’t the fastest way to grow your

savings.

If you’re serious about investing for the longer term, mutual funds

have historically been one of the best vehicles for most investors. A

mutual fund pools money from many investors to invest in stocks, bonds,

short-term money market instruments and securities. A professional

portfolio manager manages the account, and though there can be bad

times to access your money (during down periods in the stock market),

your money is always available to you by liquidating some or all of

your shares in the funds. Your investments in mutual funds can boost

returns from the safe 1 percent up to a riskier 15-20 percent. The key

is to average your investments at a healthy 12 percent (72 / 12 percent

interest = 6), this will allow you to double your money every 6 years.

When investing, it’s not about how much you initially invest, as much

as where you invest and how consistently. Educate yourself on which

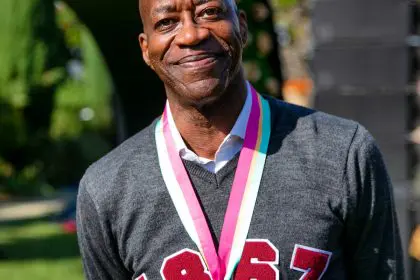

vehicles will help you achieve your financial goals. -adam jones