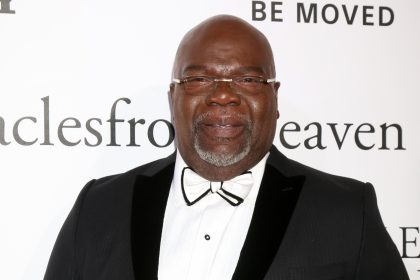

Vice President of Community Development Services, Third Federal Savings and Loan

The lack of employment opportunities in the financial sector for African Americans during the ’60s and ’70s wasn’t enough of an obstacle for Charles Thigpen to be dissuaded from pursuing his passion. For 37 years Thigpen has worked in banking, and today as the vice president of community development services at Third Federal Savings and Loan, he looks to educate the community on the importance of establishing good relationships with local financial institutions.

As a liaison between the bank and the local community, Thigpen supervises educational seminars for the community through his Home Today program, which discusses issues of credit, budgeting and life skills.

“The genesis of this program was the fact that I’ve been in this business for a number of years and over the years have seen the African American community not always having the type of credit score or financial background that our counterparts have relative to borrowing,” says Thigpen, a graduate of Grambling State University.

“I would submit to you that collectively we have a zero net worth, meaning we spend more than we make,” he says. “We do not accumulate wealth.”

To improve financial independence and build wealth, the African American community must look to local institutions. “We should be into community building and supporting those businesses and organizations that are giving back to the community,” explains Thigpen. – gavin philip godfrey