New Year resolutions can be difficult to make, and even harder to keep. This year, as I made resolutions around my health; spending time with family and friends; and spiritual growth, I also made a point to include financial related goals. For 2012, my family set two financial goals: to eliminate credit card debt and meet with a financial specialist to review our plans for retirement and college savings. I say family because my husband and I felt it was very important to include our five and seven year old sons in the process. They each established their own financial goal – my seven-year old decided he would save money to buy and care for a guinea pig (wonderful!).

New Year resolutions can be difficult to make, and even harder to keep. This year, as I made resolutions around my health; spending time with family and friends; and spiritual growth, I also made a point to include financial related goals. For 2012, my family set two financial goals: to eliminate credit card debt and meet with a financial specialist to review our plans for retirement and college savings. I say family because my husband and I felt it was very important to include our five and seven year old sons in the process. They each established their own financial goal – my seven-year old decided he would save money to buy and care for a guinea pig (wonderful!).

In setting these goals, we made sure they were realistic, specific and measurable. This way, we remain clear on what we are working to achieve, and are committed to holding ourselves accountable as a shared family responsibility.

As far as our credit card debt repayment goal, we first determined how much money in our budget we would allocate towards repayment. For us, this meant making a decision to spend less in certain areas so we can direct more funds toward debt repayment. Then, we decided to use an online tool to create a payment strategy and timeline based on paying down the highest balance, with the highest interest rate, first. The tool also provided a chart where we can regularly track and monitor our progress. This is great because we have a visual representation of how well we are doing. Being able to see just how every dollar makes a difference is extremely motivating!

In meeting with a financial specialist, we will work together to develop a list of recommendations based on our long-term financial goals and in consideration of our current financial picture. Once we have a plan, we will then monitor our progress against the plan throughout the year. This might look like a simple spreadsheet where we can create an action list based on the plan objectives that serves as a checklist to keep us on track.

I must admit, even though I work in the financial services industry, sometimes I feel overwhelmed when it comes to financial management, particularly in light of the current economic state. This is why it is very important to seek guidance from someone trained in financial management regardless of your profession, stage in life or income-level. Some people assume that you have to be wealthy to meet with a financial specialist, but this isn’t true. A great place to start is visiting your local bank and speaking with a banker. They can provide basic guidance or direct you to other resources.

I understand that finances are a private matter for most, and so you might be hesitant about speaking to a “stranger” about your money. However, speaking with a professional who can direct you on different financial management strategies, tools and resources can mean the difference between where you are today and where you want to be in the future. If you are not ready to speak with someone professionally, take advantage of the online resources that are available. Many of them are free.

Wells Fargo also offers a number of online tools and resources that will help you with your financial goals in 2012. Whether its credit management, retirement savings, wealth building, or budgeting, visit WellsFargo.com for a wealth of financial information that can definitely bring you closer to realizing your goals.

Whatever you decide regarding your financial goals, be sure to make time to regularly review your plan and track progress.

All the best in the New Year!

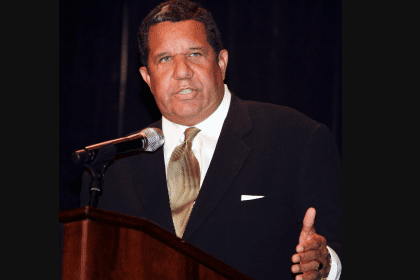

Michelle Thornhill is senior vice president, Diverse Segments for Wells Fargo & Company. Visit www.wellsfargo.com/aspirations for more information.

This article has been prepared for informational purposes only. The accuracy and completeness of this information is not guaranteed and is subject to change. Since each individual’s financial situation is unique, you need to review your financial objectives to determine which approaches might work best for you.