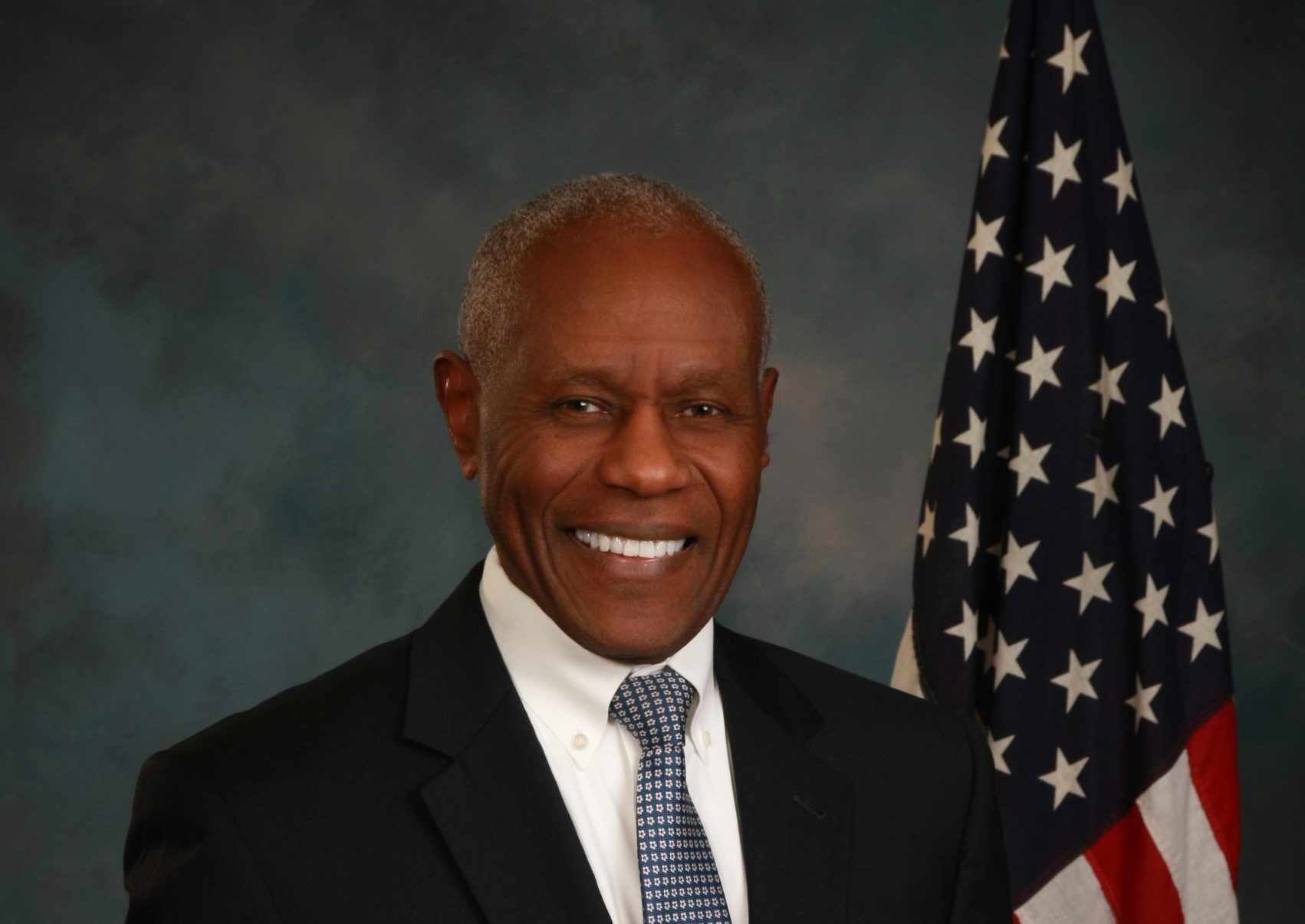

Georgia is “a very dynamic place for entrepreneurship. I always tell people it is the most entrepreneurial of all the places I have worked with the SBA [Small Business Administration]. That holds true for women entrepreneurs as well,” shares Terri L. Denison, the district director of the U.S. Small Business Administration’s Georgia District office. “According to American Express Open, their annual survey, Georgia leads the nation in the rate of growth … in terms of the number of women-owned businesses. A lot of that growth resides in the Atlanta metropolitan area.”

Denison’s stats were welcomed at the “Atlanta, A Trailblazing City: The Importance of Diversity & Innovation in Entrepreneurship” open meeting which was held at the Georgia Tech Scheller College on Aug. 2.

Here, are tips from Denison, a key player in Georgia’s ecosystem.

How can the SBA help women who are seeking to start a business or grow their existing business?

There are three pillars, the 3Cs.

1. Capital – “We provide that assistance primarily through loan guarantees. We also have a micro-loan program that provides financing. In 2015 in the state of Georgia, we had $203 million in SBA-backed loans. These were commercial loans that SBA guaranteed, which was an increase of 56% over the previous year. We would like to see that number continue to grow.”

2. Counseling and training – “We are very grateful that we have two women’s business centers here in metro Atlanta: The Edge Connection and Access to Capital for Entrepreneurs, or ACE, which is also a micro-lender and one of our community express lenders. We also have the Small Business Development Center network that provides counseling and training for startup and existing entrepreneurs. We partner with the University of Georgia to deliver that program. And, we have SCORE, our volunteer partner organization.”

3. Contracting, specifically federal government contracting. “We have a variety of resources and programming to help women-owned small businesses that would like to enter the market. One of the SBA’s responsibility is to oversee the Women-Owned Small Business Federal Contracting Program. Just as a matter of statistic, in FY ’15, we had a $551 million of Georgia’s federal contracting dollars go to women-owned small businesses which is about 9 percent of all the federal contracting dollars that was issued to Georgia-based contractors. Keep in mind the national goal is 5 percent.”

How can women-owned businesses access these resources?

“I always tell people to go to our website as a starting point, www.sba.gov. It lays out in detail our various programs and resources. It also offers online training on a variety of topics for those who are thinking about starting a business, in the process of starting a business or have had a business for awhile and are trying to figure out the next step to take. The online video training prepare you for discussions with our resource counselors and to help prepare for those meetings at the SBDC and women’s business centers.

“We also have the Emerging Leaders program with about 50 plus locations around the country. It is a seven-month program, like a mini MBA, geared specifically to those businesses that have been around at least three years, have a certain level of revenue and are looking to scale up. As you know, it is one thing to have the number of women-owned businesses grow, but to scale them up so they are employing people and really becoming entities, a part from the owner, is always the ultimate goal.”