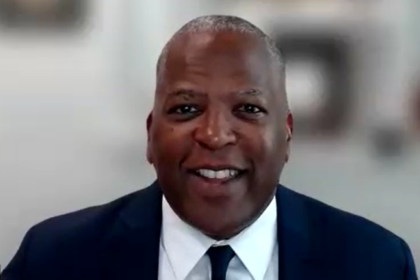

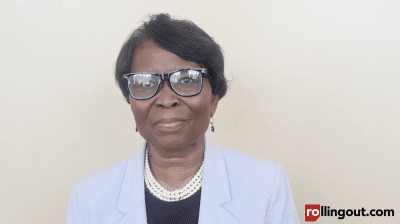

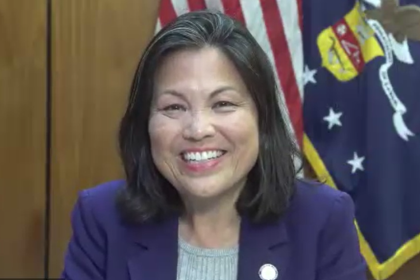

Veronica Pugin has placed a focus on assisting minority-owned businesses in her position as the senior administrator of the U.S. Small Business Administration. Recently, Pugin caught up with rolling out to discuss how the government can give your business a boost.

What are three SBA myths you can dispel immediately so people can use its resources?

Number one, a lot of people think their business needs to be a very big business so they can get access to SBA resources, and that’s not true. The SBA is here to serve any small business that has between one and 500 employees. So, if you have one, if you’re a sole proprietor, if this is you, you’re running the whole show, you have access to the SBA resources. If you have 500 employees, you have access to the SBA resources. All small businesses get that information.

Number two, another myth small businesses think what they need first to grow is a small business loan, so they try to get small business capital or a loan. That’s not the first step, because you want to make sure that the loan is an investment. A small business loan should not be used to cover expenses. It should be an investment to grow your business.

The first step is to make sure you have your small business finances in order before you get a loan. The way to have your small business finances in order is to make sure your personal and business finances are divided, especially sole proprietorships. I meet people who, either there’s just one person running the whole show, and a lot of times their personal and business finances are grouped together. Get those divided, because it’ll set you up for future benefits and programs. The second one in having your finances in order is, finally, your taxes, and all your income reported on the taxes.

That gets us to the third myth. The third myth is the way I qualify for capital. Once I’m ready, I have all my finances in order, now it’s time for me to get a loan to invest and grow my business. That next myth is, I can just qualify for any amount I want.

No bank or lender will do that.

You need to make a case for the amount of money you need, and what you’re going to invest. The way you do that is by showing the financial standing of your business. The way you share the financial [standing] of your business is oftentimes your tax returns. I meet small business owners, especially cash-based small business owners, who don’t report all their income on their taxes. So, when they show those tax documents, their business looks smaller than it actually is because then they don’t qualify for as much funding.

What are two services the SBA provides beyond loans?

The contracting training program … [and] the SBA can help you find a lender.