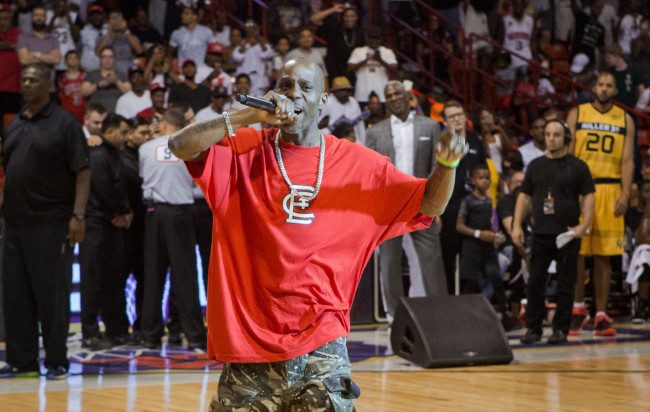

DMX, whose real name is Earl Simmons, has been arrested for tax evasion.

On Thursday, July 13, the rapper came face-to-face with a harsh reality, when he was thrown into the clinker for tax fraud. According to the United States Department of Justice, the “Party Up” artist is accused of concocting a multiyear scheme to hide millions from the IRS.

“While raking in millions from his songs, including his 2003 hit ‘X Gon’ Give it to Ya,’ DMX didn’t give any of it to the IRS,” U.S. Attorney Joon H. Kim said in a statement. In further efforts to evade Uncle Sam, Simmons allegedly refused to appear for a “Celebrity Couples Therapy” taping “until a properly issued check he was issued was reissued without withholding any taxes.”

The Yonkers, New York, native, who reportedly owes $1.7 million in back taxes, has been charged with 14 counts relating to tax evasion. Prosecutors say Simmons stopped paying taxes in the early 2000s at the peak of his career. Not only is he on the hook for evading the IRS between 2002 and 2005, but he failed to file personal income tax returns in 2010 through 2015, despite racking up more than $2.3 million in earnings from appearances, concerts and songs.

Special Agent James D. Robnett noted that “While most individuals file truthful tax returns and pay their taxes, the indictment against Mr. Simmons alleges various tax crimes, including that he failed to file personal tax returns for several years and did not pay his fair share of taxes. IRS-Criminal Investigation will continue to focus our investigative efforts on those who try to conceal their income in order to evade their taxes.”

As for how the 46-year-old pulled it off, Kim revealed that Simmons refrained from paying taxes by “avoiding personal bank accounts, setting up accounts in other’s names, and paying personal expenses largely in cash.”

On July 14, Simmons appeared in court, where he pleaded not guilty to the charges. He was later released on $500,000 bond.

“Celebrity rapper or not, all Americans must pay their taxes, and together with our partners at the IRS, we will pursue those who deliberately and criminally evade this basic obligation of citizenship,” said Kim.

If convicted, Simmons could face up to 40-years in prison.