What are the most important things that people should know about personal finance?

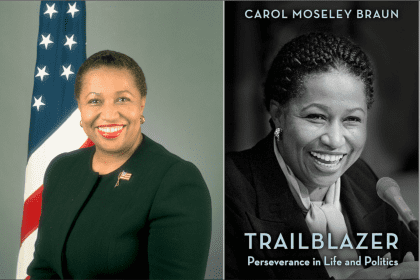

In my book, I cover the seven foundations of personal finance, which include credit, credit cards, investment, retirement, budgeting, taxes, and a section about student loans. So basically, if you didn’t know anything about finances you could read the book and learn the basic principles, tips and tricks and start putting some of them into play.

Is unlocking personal finance the key to closing the wealth gap?

Absolutely. There are systematic factors that are widening [the] wealth gap, like access to capital and predatory lending. Like when we see payday loans in poor neighborhoods. Financial literacy is a way that even if those systematic burdens come in your way you have the knowledge to work around it. Most of the time people don’t know where to start. But when you get a foundation you can put yourself in a better position. Especially when people work in industries like tech where they are making a lot of money but aren’t making the right financial decisions.

What is the most important first step to getting your finances in order?

Understand how your credit score is calculated and understand where you are credit wise.