Economic inequality and lack of access to capital are two of the main issues for minority-owned businesses. The UP Community Fund is a resource for these businesses.

The Charlotte, North Carolina based company was founded in 2017 by investment expert David Sharp. The UP Community Fund provides flexible business loans up to $2 million for high potential small businesses that serve the community.

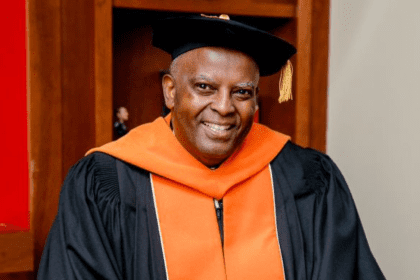

We spoke with Sharp and his partner Tawruss Sellars on “A Seat at the Table.”

What are some of the challenges you face when it comes to relationships with small minority-owned businesses?

Sharp: One of the very first things that we have to do as a funder and a partner, is we have to establish trust. One of the things that’s very interesting that we experienced with a number of our entrepreneurs of color is the fact that there’s a lack of trust with folks that provide capital. Most of their experiences around people that have resources have usually been in a kind of a master-slave relationship. It hasn’t really been viewed as a partnership. For a lot of those small business owners, the notion of trust is something that takes a while for them to establish with a funding partner, or even a consultant. People have to feel comfortable enough to tell you what’s really going on. Everybody will tell you what they want you to know, but tell me what’s really going on with the business.

So it’s very important from our perspective to start to establish trust with those entrepreneurs. If you run a business, some things are gonna go right and some things are gonna go wrong and you need to make sure that you have enough rapport with that business owner so that they can talk to you about both.

Does the UP Community Fund help businesses overcome issues of securing employees?

Sellars: When somebody comes in, we spend a lot of time understanding what it is they actually need. As we start to tease out what the business owner is actually doing, one of the questions that I really like to ask is, “How would you like to spend your time?” That may be sales, it may be marketing, it may be actually executing the job, but as we go through, we ask those questions. We build that rapport that allows us to actually see what some of those other needs are. It might go from getting this one job funded, to setting up a process, to setting up some staging, so that you go from being able to get this one job funded, to maybe bringing on additional people and … additional jobs.