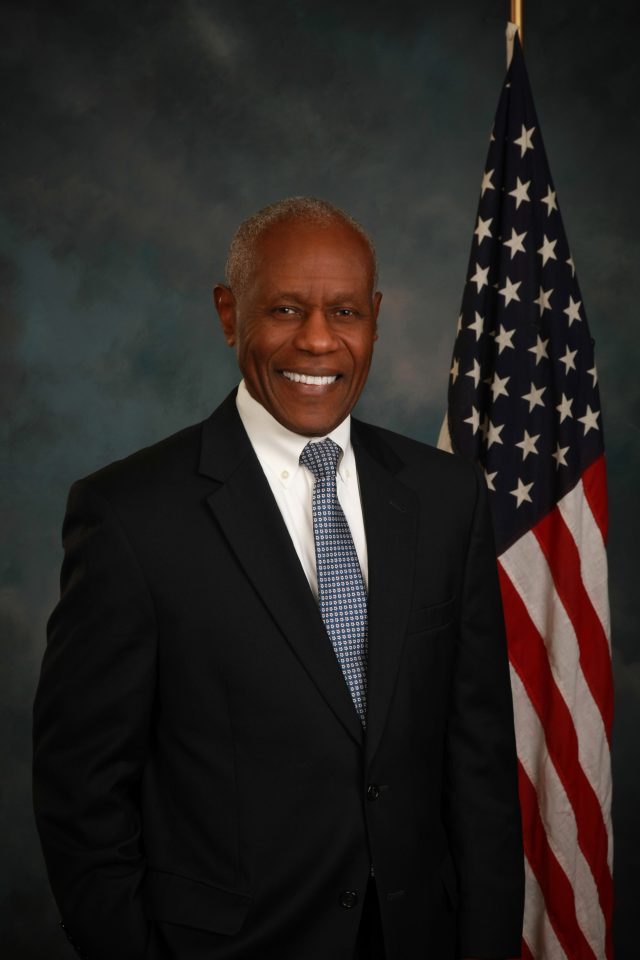

Herbert Austin, the SBA Dallas-Fort Worth district director, is responsible for overseeing, managing, and delivering SBA programs and resources. Austin shares with rolling out how the government agency has helped small businesses keep their doors open during the pandemic through the loan programs offered through the SBA.

Have many small-business owners from marginalized communities taken advantage of the PPP and Economic Injury Disaster Loan programs?

Absolutely, a very large percentage of the loans that have been approved are $50,000 or less. This suggests that these [businesses] are minority-owned, self-employed, and sole proprietorships.

Besides access to capital, what are some of the biggest challenges you are seeing among small-business owners’ ability to make a full recovery from the economic disaster brought on by the pandemic?

Many minority-owned businesses shut their doors and will never reopen. It is tragic when one cannot survive despite what one does. Others, of course, were able to pivot successfully and moved to another line of business that was more sustainable during these hard times.

How do you measure the success of your programs?

By the number of entrepreneurs who start a business after visiting with one of our funded resource partners like the Service Corps of Retired Executives [SCORE], the Small Business Development Center [SBDC], the Women Business Center [WBC], and Veteran Business Outreach Center [VBOC]. Also, when a small business can secure an SBA guaranteed loan, it allows them to hire one part-time employee or expand.

Continue reading on the next page.