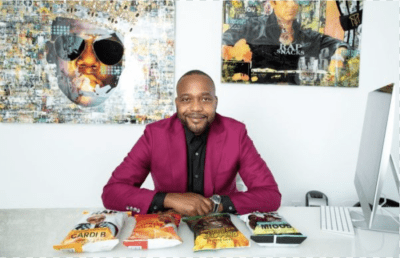

Courtney Johnson Rose, president-elect of the National Association of Real Estate Brokers (NAREB), is the Chief Executive Officer of George E. Johnson Development, Inc., a full-service real estate firm specializing in development services, owner representation, master planning, and residential and commercial brokerage services.

She holds a bachelor’s degree in economics, a master’s degree in community development, and a doctorate in organizational leadership. She is a certified project management professional (PMP) and a certified commercial investment member (CCIM). Since 2009, she has served as a faculty member and adjunct professor for Prairie View A&M University, an HBCU where she teaches Land Development and Real Estate courses.

Married with two children, in her spare time she enjoys her family, traveling, and being active in the community through Delta Sigma Theta Sorority, Inc. Also, every now and then, she finds time to talk to Munson Steed, the publisher and CEO of rolling out.

[Editor’s note: This is an extended transcription. Some errors may occur.]

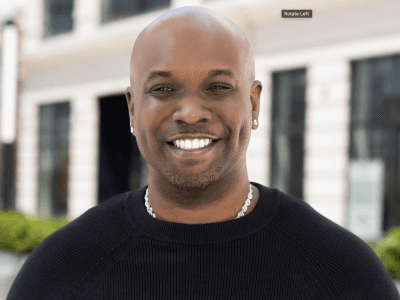

Munson Steed: Hey, everybody! This is Munson Steed. Welcome to CEO to CEO. I have the extreme pleasure of introducing you to my leader, the National Change agent for real estate, wealth, and everything related to our community—the Black community making progress—Courtney Johnson Rose. How are you?

Dr. Courtney Johnson Rose: Doing great. Doing great. I’m so excited to have this conversation with you.

MS: It really is an amazing effort, but can you describe it? There are 100 locations that are getting ready to get trained, changed, and inspired to own and work with a Black realtor. Can you describe the mission and what the community needs to know that they need to do immediately this Saturday?

CJR: Yes, what we are launching [is] our NAREB Building Black Wealth Tour. [It is] all of our local chapters for the National Association of Real Estate Brokers deciding that we [are] gonna go into our communities on the same day at the same time across the country [with] the message of building Black wealth. We’re very excited about this because the timing is so important. We produce a report once every year called The State of Housing in Black America. What our report shows us is that mortgage applications are down by 20% in our community. It’s down by 22% when we look specifically at Black millennials.

What does that mean? That means that right now, there is opportunity. We are losing ground in terms of real estate and wealth building. Our report also showed us that there [are] more than 2 million Black eligible-mortgage-ready home buyers out there. So, that means there’s a big market of African American consumers, probably a lot of your listeners that can afford a home, that have the credit to buy a home, but have not done it. This tour is designed to reach them.

[We] are very excited about going into our communities. To [see if we’re in a city] near you, go to NAREBBlackwealthtour.com. If we’re not in a city near you, though, we do have a virtual feed. So, all day long we’ll do all of our classes, one on one. Everything will be available online also at NAREBBlackwealthtour.com.

MS: Can you describe for those individuals the relationship between homeownership, Black homeownership, and Black wealth?

CJR: Well, that’s a powerful question because out of all of the wealth that we do have in this country, 67% of it is in real estate. So, of all the wealth that Black people have, 67% is in real estate. It’s our key. The other thing I always say is that real estate is the cheapest money that you can borrow. And [there are] programs and ways that are designed to give you access to. We don’t have the same access to tech. We don’t have the same access to stocks and bonds as we have through real estate. [There are] programs. [There are] opportunities. Mortgages are fairly accessible in our community.

So, we will explain that and walk our community through that on Saturday. But I think that it’s the fundamental tool [for] building wealth, and there’s a strong connection [between] wealth building and home ownership. The last thing that I’ll say about it is, think about it like this. Everyone has to pay for somewhere to live. Why not make that your largest investment? You gotta pay for it anyway. So, I’ve seen several cases where people are paying more for rent than they are when they purchase a home. So if you’re paying it out anyway, every single month, it has to get paid. Why not make it a mortgage and build wealth through it?

MS: For those millennials who really don’t know, what is the issue? If a person in Chicago, for example, [where] the average age for homeownership and purchases is 41, why is delaying buying a home a negative thing for an individual?

CJR: Delaying [is] so negative because time is your friend in real estate. Everything in real estate typically goes up over time. We average about a 5.5% increase [in] appreciation every year. Of course, we have ups and downs, but on average, for the past 100 years, [there has been] at least a 5.5% increase in real estate values every year. So, if you have that ability to get into the game earlier, every year, you’re getting that 5 to 6%, 5 to 6%, 5 to 6% that you’re getting. So, if you get in 10 years earlier, instead of 41, 31. Then you have ten more years worth of equity that you have built up, which is well.

We share a story about a family that bought a house. A White family bought a house ten years earlier than a Black family, and it shows how the Black family that waited had to pay more for the same house. Because of appreciation, they didn’t have as much equity when [it was] time to send their key to college. They can’t pull money out because they don’t have the equity. When it’s time to retire, the house is not paid off yet. So, time, time, time is our friend in real estate, and the more time that you can leave the asset out there, [the more] equity, the more [value] and the more wealth you gain with them.

MS: For the women, you have a group of women that are there. If you could speak to all women about this Saturday, or just participate and understand the role that they play. What would you say to those sisters who will hear your voice right now and know that wealth, real estate, and women have a real role, as they are the breadwinner in many homes right now?

CJR: Yes, and I appreciate this question. We have an initiative called WIRE — Women Investing in Real Estate for NAREB, where we’re very focused on Black women. A couple of reasons why, and I’ll share this with my sisters. We are beating the race in terms of mortgage applications. No one applies more for loans as Black people than single Black women, which is great. But we’re also leading in terms of foreclosures. Black women are three times more likely than any other ethnic group to receive a subprime loan, which means we’re not shopping for loans.

We don’t know what to look for when we get a loan. We’re taking bad terms and bad interest rates because we are not educated. So, education, education, education is so key for Black women because we’re paying more than we should. And we’re putting ourselves susceptible to foreclosures, and we do not have to do that. The education and the resources are out there. So, I would say to my sisters, come Saturday, April 13th, [to] a city near you to be educated on the right way to do it. I’m so proud of us that we are out there. We’re willing to do it. We have the gumption to do it.

But let us teach you the right way to actually do it so that we are not setting ourselves up for failure. The last thing that I will say on this is that our data shows with NAREB that the No. 1 reason why Black women don’t get approved is not credit [and it’s] not down payment. It’s debt-to-income ratio. Debt-to-income ratio. So, for my sisters who want to purchase real estate, be conscious of how much [debt] you are carrying. Sisters, particularly Black women, carry our family. We have car notes on there. We have people’s cell phone bills. They come to us for everything we carry in the family.

But just know that when it comes to [building] wealth and getting your home, that catches up with you. So, I would tell my sisters to [protect] their credit and their assets. Understand how to utilize credit effectively because what we’re seeing is that our sisters are overloaded, and that’s the reason why we are being rejected when it comes time to purchase a home.

MS: You are participating in more than this education. Why, as a leader, have you dedicated this effort to really outreach to our community and to get all the chapters excited? I’ve talked to some of them.

CJR: Yeah.

MS: To really reach out into the community so that the educational process and partnership with those Black realtors who believe in the community and want them to own homes. Why is it so important that they have a partner and a realtor who believes that they deserve the best?

CJR: Yeah, this process can be daunting. You’re getting into a lot of debt. It’s a lot of decisions that have to be made. Where should I buy? What’s a good neighborhood? It’s a long-term asset. So, having a trusted advisor [who’s] a member of the National Association of Real Estate Brokers is very key. Munson, I want to share that our members are called realtists. because when NAREB was founded in 1947, we could not become realtors because of discrimination. They did not let Black people become realtors, so our founders founded the realtist.

And the realtists have been focused on our community for the past 77 years. Now, several of our members are realtors also. But this organization is focused on helping our community build Black wealth. So, this is not something that the average consumer does every day. Sure, you can figure it out by watching videos [and] reading up on it. But why not use the expertise of someone who does this every day? Why not have a trusted advisor [who] cares about you and your community help you through this process? And that’s what NAREB realtists do. We guide our community through this process.

We did a survey last year, Munson, of our members, and we asked them why [they joined our] association. No. 3 reason was education. You know our education is great, our conferences are great, they learn so much being a member. The second reason was the network. Being a part of this realist network I get referrals, I get mentors, I get business partners; so, being a part of a network of other Black real estate professionals was powerful for them. But the number one reason why our members, realtists, paid the National Association of Real Estate Brokers to be a member was for our mission to increase Black homeownership and bring democracy to housing.

So, we’re not your average realtors. We’re not your average real estate professionals. We have the heart for [and] we are here for the mission. So, just know when you come on Saturday, April 13, you work with a realtist member. You’re working with somebody who has a heart for the community and really takes joy and pride in making you a homeowner.

MS: Well, thank you for that. Lastly, if you were going to talk about those individuals who are still in college and literally thinking about being homeowners, how would you challenge them as they’re getting ready to graduate at this moment?

CJR: [They should understand that they deserve a home, that they should own a home, and that their future and wealth are built on having a home.]

MS: What would you title your speech to them about homeownership?

CJR: I love this question. Because we have an opportunity to affect our young people [who] are coming out of college. And I would share with them that homeownership matters and not let the media talk them out of wealth building. What I’m finding right now, for example, with Black millennials, is that white millennials own 50% more real estate than Black millennials do. Black millennials are down 22%; the year before that, they were down 27%, which means we’ve let the media talk us out of it. But white millennials have not let the media talk them out of it.

[If you’re gonna be moving cities and things of that nature with a transient career, that’s fine], but you always have a home base. You know where you grew up, where your family is, [and] where you know you always have opportunities to go back there. Think about buying an investment property, [an] AirBnB. Think about being able to plant some roots and [being] able to see an asset grow. Think about your parent’s home and your grandparent’s homes, not letting those properties go by the wayside.

So, I would just encourage our college graduates to take advantage of the opportunity that’s been given. You have [an] education, which is gonna lead you to a great career. But invest that money into real estate. Time passes really fast. I can share that with you. I’m 45, and it seems like 20 years ago, I was graduating from college, and I had more time than anything else, and it goes by fast. I bought my first property at 23, and that property doubled in value in 2 years, and I was able to build my first wealth nest egg, if you will, from real estate.

But I did it when I was 23 and kept on going from there. So it’s possible. It works—it has always worked—and that’s why it’s the No. 1 wealth-building tool in this country. So again, my advice is don’t let the media talk you out of it.

MS: Well, ladies and gentlemen, you heard it first. We want you all to join this tour. NAREB is definitely making a difference in our community. Dr. Courtney Johnson Rose, ladies and gentlemen, we thank you for coming on to CEO to CEO and making sure that we understand you do not have to be in the streets. But you do have to be in this real estate movement, and I want you to definitely follow Dr. Rose’s advice and understanding that you deserve a home, you can afford a home, and today is the day to participate with NAREB and have one of their agents be a partner in your progression for acquiring and achieving wealth for you and your family. I’m Munson Steed for CEO to CEO.