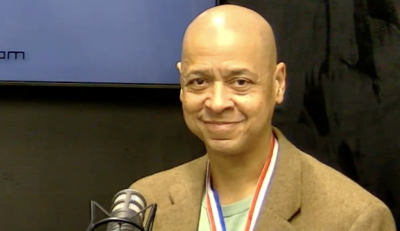

Michael Davis is the deputy executive director for the Atlanta BeltLine Partnership and is raising awareness of the Legacy Resident Retention Program, a resource to help longtime homeowners living near the Atlanta BeltLine stay in their homes by covering the costs of property taxes through the 2030 tax year. As the program protects the most legacy homeowner residents of any program in Atlanta, many of the participants have been open about the amazing opportunity that this presents for them and their future.

Davis spoke with rolling out to give more details about the program and what it means for residents in Atlanta.

Tell us about the Atlanta BeltLine Legacy Resident Retention Program.

I believe the Legacy Resident Retention Program is the most important program that we have. I wake up every day trying to figure out how we get the word out and how we connect and give more of our legacy residents on the west side and south side that are in our areas the opportunity to participate. The Legacy Resident Retention Program is a program where for qualified residents, the Atlanta BeltLine will pay your property tax increases all the way to 2030, and what that means is not only are we allowing legacy residents who may be on fixed or modest income to stay and not have to worry about trying to pay those, but more importantly, folks who already are in the home, who are paying it for escrow, they don’t have to pay that large note, and they can just pay the same amount they paid in 2019, all the way to 2030.

Why is it important to have something like this in Atlanta?

I think it’s huge. The BeltLine [is] two organizations that are helping this project fulfill its vision. It’s the people’s project. What that means [is] that it’s about inclusion, it’s about access, [and most importantly, it’s] about opportunity. Traditionally with large projects like this, and this is one of the largest projects like this in the country, everyone doesn’t have a seat at the table. Everyone doesn’t have the connection or access to benefit from all the opportunities, so this is really important. The other aspect of this also is with partners like rolling out, [we’re able to increase access]. Sometimes, a program like this, when we’re paying property tax increases, you don’t have to pay it back, and it’s not taxable; sometimes, it seems too good to be true. We are the largest program like this in the city I’m proud to say, and we’ve increased the number of participants by 100% each and last two years coming out of COVID. We need help to get the word out because [we want everyone to believe in this opportunity].

Why is homeownership important, and what should people know about property taxes?

Homeownership is the most important thing for us. I was reading a survey that [said, for] 85% of people, having their own home is the American dream. Our strongest neighborhoods and communities, our healthiest communities, are when you have high levels of homeownership and stability because that allows us to build the strongest families. One thing I want to stress is we have free workshops to help people reduce those taxes. There’s something called a homestead tax exemption, and there are eight different versions of it for seniors. … More importantly, we’ve got free tax appeal workshops for in the summertime, to help people lower their taxes or appeal it, and then lower that. We have ways to bring that down, and obviously, there’s a lot more attention now for how you have lower property taxes, and there’s all kinds of talk about legislation that might make it so you just can’t increase property taxes.