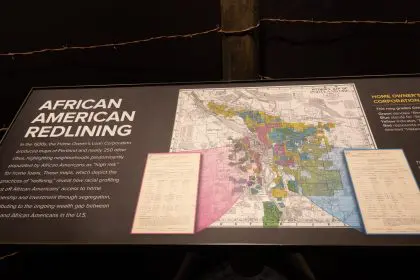

Redlining is a term that evokes painful memories of discrimination, systemic inequality and economic hardship for countless communities, particularly those of color. Historically, redlining referred to the practice where banks and financial institutions would deny or limit financial services — such as mortgages and loans — to residents of certain neighborhoods based on racial or ethnic composition. This practice was not just a moral failure but a significant driver of economic disparity that has persisted for generations.

The focus of this article is to explore why banks should categorically avoid engaging in redlining or any practice that resembles it, as the consequences are far-reaching and deeply damaging. It is crucial to understand that redlining is not merely a historical artifact but a practice that has evolved and persists in different forms today. By delving into the reasons banks should reject redlining, we will underscore the moral, economic and social imperatives that demand equitable treatment for all communities.

The ethical responsibility of banks

At the heart of the argument against redlining lies the ethical responsibility of banks to uphold justice and fairness. Financial institutions are pillars of economic stability and growth, and their operations must reflect principles that promote equality. Redlining — by its very nature — is a discriminatory practice that perpetuates inequality and disenfranchises entire communities.

Engaging in redlining contradicts the fundamental principles of fairness that should guide any reputable institution. When banks participate in such practices, they effectively send a message that certain communities are less deserving of financial opportunities solely based on their racial or ethnic makeup. This not only violates ethical standards but also erodes trust in financial institutions, which are supposed to serve as neutral and equitable entities in society.

By rejecting redlining, banks affirm their commitment to justice and fairness, ensuring that every individual — regardless of background — has equal access to financial services. This commitment is not just a moral obligation but a crucial step in building a more inclusive and equitable society.

Economic consequences of redlining

Redlining has profound economic consequences that extend beyond the immediate communities affected. By denying financial services to certain neighborhoods, banks stifle economic growth and development in those areas. This leads to a vicious cycle of poverty, where residents are unable to invest in property, start businesses or access credit, further entrenching economic disparities.

The ripple effects of redlining are felt across the entire economy. When certain neighborhoods are excluded from financial opportunities, the overall economic potential of a city or region is diminished. This lack of investment leads to blighted neighborhoods, reduced property values and a weakened tax base, which in turn impacts public services like education and health care.

Moreover, redlining contributes to the racial wealth gap, a persistent issue that has long-term implications for the economic stability of marginalized communities. By refusing to engage in redlining, banks can play a pivotal role in closing this gap and fostering economic growth that benefits everyone.

Social and community impact

The social consequences of redlining are equally devastating. When banks engage in discriminatory practices, they contribute to the segregation and fragmentation of communities. Redlined neighborhoods often become isolated, with limited access to quality education, health care and other essential services. This isolation not only exacerbates poverty but also undermines social cohesion and stability.

Communities that are redlined are often left to struggle with inadequate infrastructure, higher crime rates and a lack of opportunities for upward mobility. The psychological toll on residents is significant, as they are made to feel marginalized and excluded from the broader society. This sense of exclusion can lead to social unrest and a breakdown in trust between communities and institutions.

By choosing not to participate in redlining, banks can help to build stronger, more cohesive communities. When all neighborhoods are given equal access to financial services, it fosters a sense of inclusion and belonging, which is essential for the social fabric of any society.

Legal and regulatory risks

Participating in redlining also exposes banks to significant legal and regulatory risks. In many countries, redlining is not only unethical but also illegal. Regulatory bodies have implemented strict laws and guidelines to prevent discriminatory practices in the financial sector. Banks that engage in redlining face severe penalties, including hefty fines, legal action and reputational damage.

The cost of noncompliance can be enormous, far outweighing any perceived short-term benefits of engaging in redlining. Banks that are found to have engaged in discriminatory practices may also face public backlash, leading to a loss of customers and a tarnished brand image. In today’s world, where consumers are increasingly conscious of the ethical practices of the companies they support, the reputational damage from redlining can have long-lasting effects.

By proactively rejecting redlining, banks can avoid these legal and regulatory risks, ensuring that their operations are in full compliance with the law and aligned with the expectations of their customers and stakeholders.

The path forward: Building an inclusive financial system

The rejection of redlining is not just about avoiding negative consequences; it is also about actively building a more inclusive and equitable financial system. Banks have the power to drive positive change by adopting lending practices that prioritize inclusion and fairness. This means providing equal access to financial services for all communities, regardless of their racial or ethnic makeup.

Inclusive lending practices can have a transformative impact on marginalized communities. By offering mortgages, loans and other financial products to underserved neighborhoods, banks can help to stimulate economic growth, reduce poverty and promote social mobility. This not only benefits the communities themselves but also contributes to the overall health and stability of the economy.

Furthermore, banks that embrace equitable lending practices are better positioned to build lasting relationships with customers and communities. These relationships are built on trust and mutual respect, which are essential for long-term success in the financial industry.

The moral and economic imperative

The reasons banks should not participate in redlining neighborhoods are clear and compelling. Redlining is a practice that undermines the ethical responsibility of banks, stifles economic growth, damages social cohesion and exposes institutions to significant legal and regulatory risks. Beyond these negative consequences, rejecting redlining is also an opportunity for banks to contribute to a more inclusive and equitable society.

By committing to fair and inclusive lending practices, banks can play a crucial role in closing the racial wealth gap, fostering economic development and building stronger, more cohesive communities. The path forward is clear: Banks must prioritize justice, fairness and inclusion in all of their operations, ensuring that no community is left behind.

In a world where the fight for equality and justice is more important than ever, banks have a moral and economic imperative to reject redlining and embrace practices that promote equity for all. The impact of such a commitment will be felt not only in the present but for generations to come.