Kandis Williams has more than 25 years of community and economic development experience, and most recently was the Vice President for Economic Opportunity with Cleveland Neighborhood Progress, a community development intermediary in Cleveland, Ohio. In this capacity, she supervised work related to asset building, economic development, and workforce development to advance greater equity, inclusion and opportunity for Cleveland residents and the broader community.

Before rejoining Cleveland Neighborhood Progress, Williams was with Citizens Bank as the Vice President of Community Development Lending for the state of Ohio and western Pennsylvania. In this role, she was responsible for fostering lending opportunities in affordable housing, and community and economic revitalization. Prior to her tenure at Citizens Bank, Williams spent several years as the Senior Vice President of Village Capital Corporation, the CDFI lending subsidiary of Cleveland Neighborhood Progress.

Williams’ professional career has also included experience as a program officer for Local Initiatives Support Corporation, the Commercial Development Director for Mt. Pleasant NOW Development Corporation, and as a city planner for the City of Cleveland. Kandis has a bachelor’s degree in urban studies from the College of Wooster and a master’s degree in urban planning, design, and development from Cleveland State University’s Levin College of Urban Affairs.

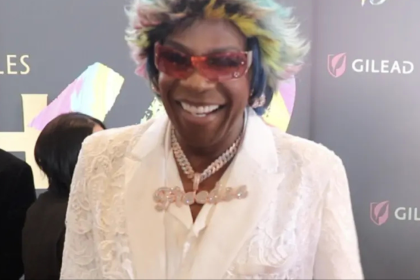

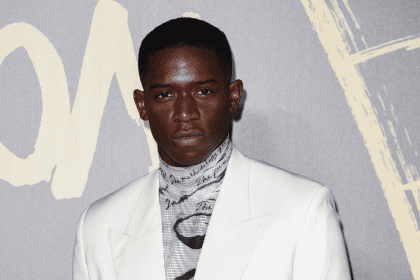

Williams spoke to rolling out publisher and CEO Munson Steed about the connectivity between homeownership and intergenerational wealth acceleration. Here’s their conversation:

When we think of wealth generation, wealth in general, and housing at the same time, what comes to mind as it relates to LISC and what they’re doing and what’s available?

That’s a wonderful question. For many communities, one’s greatest asset is their home. Ensuring that our work aligns with the preservation of what a home can mean for families, not just as a safe place, but also to create opportunities for wealth creation and wealth generation for future generations is a big part of the work.

The Rocket Wealth Accelerator that you run, can you share just how important it is for the community?

It’s been an incredible catalyst to the work that we’re doing around financial stability. We’ve had the generous opportunity to partner with the Rocket Community Fund on the Rocket Wealth Accelerator Program as a complement to the work that our Financial Opportunity Centers do. That work is really to work one-on-one with residents to create personal goals around employment and financial stability.

As our financial opportunity partners here on the ground provide employment coaching, income support, and financial coaching, they have this wonderful complement provided by the Rocket Community Fund. We can provide one-on-one matched-savings accounts for long-term and short-term goals to really help accelerate what we’re referencing here around wealth creation and ensuring that families can weather the storm of the current economic climate.

As a person who’s been in the space serving our community, how important is homeownership?

Homeownership is critically important. As I mentioned before, it’s not just a place for families to call home, but it also creates stability for children in terms of education and having a place to grow and thrive. Financially, I think that sometimes we don’t elevate enough the importance of what homeownership can bring, which is the ability to leverage in the event of an emergency or have access to resources to ensure that over time, the home can be sustained. Whether it be through home repair programs or other incentives that help to preserve that home, including weatherization activities or other resources that local municipalities may bring to a family to preserve that home.

When we think about coaching one-on-one, can you share how important establishing a relationship and giving people the courage and the confidence and the hope to know that there’s somebody there?

Having that resource is critical, and it’s a personal journey. As you mentioned, having that relationship with a financial coach is important. Talking about finances puts one in a very vulnerable state, regardless of where you are in terms of your economic status. Having that one-on-one coach to support you in creating a financial plan, whether it’s short-term or long-term, or planning down the road for future generations, helps individuals feel empowered by the choices they’re making versus being told or having steps be prescriptive.

It’s important to have that one-on-one relationship to share goals and dreams and have someone in your corner to help advocate for those resources and steer you in directions of other resources you may not be aware of to achieve your goals.

When you have goal setting, the idea of learning how to budget, the idea of learning how to save, those two principles, when you add that to someone’s financial intelligence and armor, what are you really doing?

It’s allowing one to take those two critical steps in a very personal way, based on their current income, and then create a path for getting there. We’re really trying to ensure that every step is celebrated. You may have a goal of a certain amount in your emergency savings account or to purchase a large asset like a home, but sometimes it starts very small with $5 a month or $10 a month. Every milestone is critically important, and celebrating those moments really helps to build that confidence to grow in terms of financial stability.

Why do you do what you do so well in providing hope, confidence, compassion, and empathy for a community that, if not for you and your organization, could be forgotten?

Oh, absolutely. It’s important for all of us. We all represent the community. We are in community and live and participate in community every day. When you are involved in this work, there is a passion and a commitment that is personal because it’s important to the collective overall that our communities are healthy and thriving, and there’s equitable access to resources for everyone to, as they say, “a rising tide lifts all boats.”

When we talk about the blocking and tackling that’s happening one-on-one with our financial coaches, we’re really looking down the road at the broader outcome, the end goal, where we’re trying to create financial stability that will impact the health of the neighborhood. You’re talking about the fabric of the community. You are creating opportunities for more disposable income to support small businesses and build wealth through homeownership. There’s a ripple effect for each individual participating in this work, connected to the broader fabric of the neighborhood. When we see that collective, that’s where the motivation and the passion come from, to ensure that each person has an opportunity to grow and thrive.

You’re invited to “Dream Doors Lunch & Learn.” Tap here to RSVP –