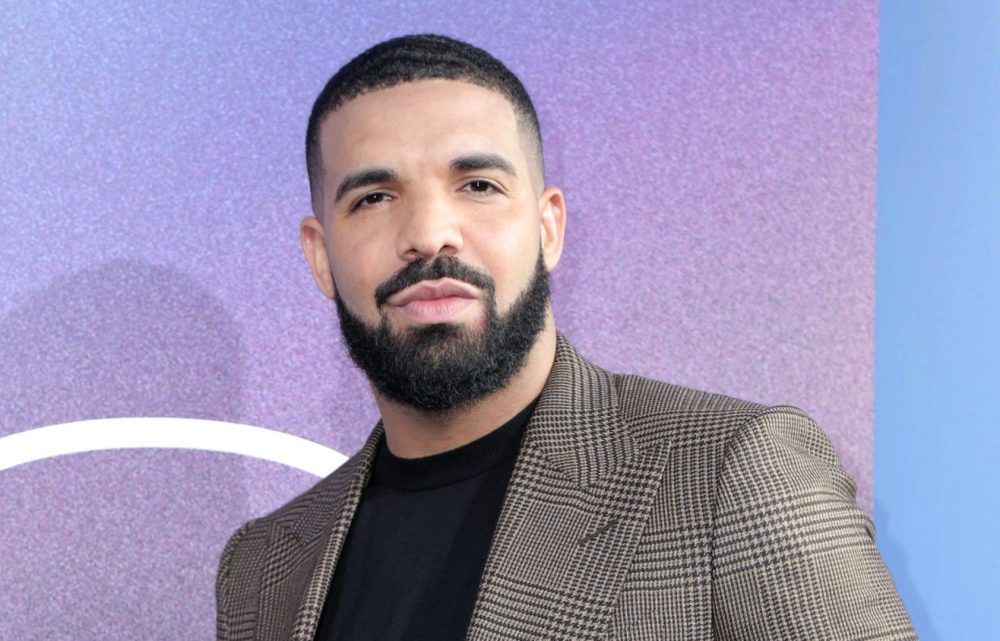

Music industry figure Wack 100 suggested Drake’s lawsuit against Universal Music Group (UMG) may serve a hidden financial agenda during “The Adam 22 & Wack 100 Show.”

He speculated the lawsuit could affect UMG’s stock price, theorizing that if Drake drops the case after stock purchases by shell companies, it might indicate coordinated market manipulation.

“If that stock drops … and we see a shell company come in and buy a bunch of it. And then, out of nowhere, Drake drops the lawsuit. And that stock shoots up to 30, 40. I’mma think it was a play,” Wack 100 stated.

Co-host Adam 22 defended Drake’s position. “Anyone acting like Drake is just a bad loser hasn’t read this shit yet. If half of this gets proven, Drake will look like a hero,” his argument suggests that successful litigation could position Drake as an industry whistleblower.

The lawsuit, filed in April, challenges UMG’s business practices. Wack 100’s connections through Birdman and Cash Money Records add credibility to his market speculation.

His theory suggests potential coordination between artist lawsuits and stock market movements. The case could influence broader industry practices regardless of underlying motives.

The situation highlights complex relationships between music industry litigation and financial markets. Industry observers note increased scrutiny of label-artist relationships amid streaming era challenges.

Wack 100’s perspective draws attention to potential financial strategies behind high-profile music industry disputes. His comments reflect growing awareness of connections between entertainment litigation and market dynamics.

The outcome could reshape artist-label dynamics and industry transparency. The case’s resolution may impact how future disputes between major artists and labels unfold.

As the lawsuit proceeds, attention focuses on both legal merit and potential market implications, demonstrating the music industry’s evolving business landscape.