Discover the hidden fees, unused benefits, and expensive oversights draining thousands from your healthcare budget

Health insurance represents one of the largest recurring expenses for most households, yet many policyholders unknowingly waste significant money through preventable mistakes and missed opportunities. A thorough examination of typical coverage patterns reveals numerous financial inefficiencies that, when addressed, could save the average family between $2,100 and $4,300 annually while maintaining or even improving healthcare access.

The true cost hiding in your premium payments

The average American household spends approximately 12% of their annual income on health insurance premiums – a figure that has increased 55% over the past decade while wages have risen just 27% during the same period. This growing disparity creates financial pressure that makes identifying wasteful spending particularly urgent.

When premium payments, deductibles, copays, coinsurance, and out-of-network costs are combined, the typical family of four with employer-sponsored insurance spends over $22,000 annually on healthcare. Yet much of this substantial expense may be misdirected through coverage inefficiencies, network limitations, and benefit underutilization.

The most concerning aspect of these findings involves how widespread these issues appear across different plan types, income levels, and age groups. Even financially savvy consumers often miss significant savings opportunities due to the deliberately complex nature of health insurance structures.

7 costly insurance mistakes draining your bank account

A detailed analysis of typical coverage patterns reveals seven specific areas where policyholders frequently waste money – often without realizing it. Addressing even a few of these issues could represent substantial savings for most households.

1. Paying for duplicate coverage you never use

Many households unwittingly maintain overlapping coverage that provides little additional benefit. This commonly occurs when both spouses have employer-sponsored insurance and automatically enroll in separate plans without analyzing their combined coverage needs.

The financial impact becomes particularly significant when considering that the average employee contribution for family coverage exceeds $6,000 annually. Maintaining two family policies often results in paying twice for substantially similar coverage.

Even more problematic are situations where parents maintain adult children under age 26 on their policies while those adult children simultaneously receive coverage through their own employers. This arrangement typically costs the family unit an additional $2,000-3,000 annually without meaningful benefit improvements.

The solution involves conducting a thorough comparison of all available plans, identifying overlaps, and selecting the option that provides the best combined coverage at the lowest total cost. This process should include calculating both premium expenses and expected out-of-pocket costs based on typical usage patterns.

2. Choosing the wrong deductible for your health status

Premium costs and deductible amounts exist in an inverse relationship – lower premiums mean higher deductibles and vice versa. Yet many policyholders select plans based primarily on familiar brand names or convenience rather than analyzing their specific health needs and financial situation.

High-deductible plans can save healthy individuals substantial money, with premium differences often exceeding $2,000 annually compared to low-deductible options. However, these savings evaporate for those with chronic conditions or planned medical procedures who will inevitably meet higher deductibles.

Conversely, many people with minimal healthcare needs overpay by selecting premium plans with low deductibles they never reach. This arrangement effectively means paying extra for theoretical coverage that remains unused.

The optimal approach involves calculating your expected medical expenses based on recent history and anticipated needs, then selecting a deductible level that minimizes your combined premium and out-of-pocket expenses. For most people, this calculation should be reviewed annually during open enrollment periods.

3. Ignoring free preventive services worth thousands

Under current health regulations, insurance plans must cover numerous preventive services without charging deductibles or copayments. These include annual wellness visits, vaccinations, cancer screenings, and many preventive medications. The retail value of these services typically ranges from $2,500 to $4,000 annually for a family of four.

Despite this substantial benefit, approximately 34% of policyholders fail to utilize any preventive services in a given year. This effectively means forfeiting thousands in prepaid benefits while potentially allowing minor health issues to develop into more serious and expensive conditions.

The oversight often stems from misunderstanding which services qualify as preventive or confusion about coverage limits. Many policyholders mistakenly believe they must pay for these services until meeting their deductible, leading to unnecessary postponement of valuable care.

Maximizing this benefit requires obtaining a complete list of covered preventive services from your insurer and scheduling appropriate appointments based on age, gender, and risk factors. The financial return on this time investment can be substantial, often exceeding $1,000 annually per person.

4. Overlooking your plan’s money-saving programs

Modern health insurance plans frequently include supplementary programs designed to reduce costs and improve outcomes. These may include telehealth services, condition management programs, prescription discount arrangements, and fitness incentives. The combined value of these programs can exceed $1,200 annually.

However, research indicates that fewer than 15% of policyholders fully utilize these supplementary benefits. Most remain unaware of their existence or misunderstand how to access them, effectively paying for services they never use.

Particularly valuable are condition management programs for chronic issues like diabetes, asthma, or hypertension. These programs often waive or reduce copays for related medications and supplies while providing personalized guidance that improves outcomes. Annual savings from these programs typically range from $800 to $1,500 for affected individuals.

Similarly, telehealth services offer consultations at approximately one-third the cost of in-person visits while saving travel time and reducing exposure to other illnesses. Yet only about 22% of policyholders utilize these services despite their widespread availability.

Identifying and utilizing these supplementary benefits requires reviewing your plan documentation and contacting member services for specific enrollment instructions. Many insurers have simplified this process through dedicated smartphone apps that centralize access to these money-saving options.

5. Using out-of-network providers unnecessarily

Out-of-network care represents one of the largest avoidable expenses for insured individuals. Using providers outside your plan’s network typically increases costs by 60-80% through higher copays, separate deductibles, and balance billing where patients must pay the difference between the provider’s charge and the insurer’s allowed amount.

These expenses add up quickly, with the average out-of-network surgical procedure costing patients an additional $16,000 compared to the same procedure performed by an in-network provider. Even routine care from out-of-network physicians can increase annual costs by $1,500 to $2,300.

More concerning, approximately 16% of in-network hospital stays involve at least one out-of-network provider, often without the patient’s knowledge or consent. This commonly occurs with anesthesiologists, radiologists, pathologists, and emergency physicians who work at in-network facilities but maintain separate network arrangements.

Preventing these expenses requires verifying network status for all providers before receiving care, including those working at in-network facilities. For scheduled procedures, this verification should include the primary physician, the facility, and any supporting providers who might participate in your care.

When out-of-network care becomes necessary due to specialized needs, many insurers offer network gap exceptions that provide in-network coverage levels if you obtain prior authorization. This simple administrative step can save thousands on necessary specialized care.

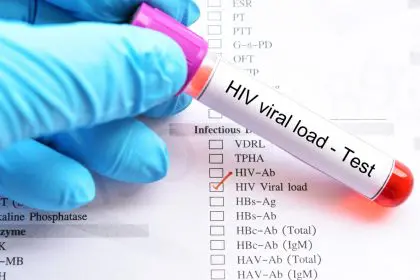

6. Mismanaging pharmacy benefits and medication costs

Prescription medications represent approximately 18% of total healthcare spending for the average family, yet this category contains numerous overlooked savings opportunities. The same medication can vary in patient cost by 400-600% depending on where and how it’s purchased, even within the same insurance plan.

The most expensive mistake involves using out-of-network pharmacies, which often results in paying full retail price for medications despite having insurance coverage. Using an in-network pharmacy for the exact same prescription typically reduces costs by 55-70%.

Even when using in-network pharmacies, many patients waste money by failing to review their plan’s formulary – the list of covered medications with their associated cost tiers. Switching from a non-preferred brand name drug to its preferred alternative or generic equivalent can reduce costs by 80-95% while providing the same therapeutic benefit.

Mail-order options for maintenance medications offer another frequently overlooked savings opportunity. These programs typically provide a three-month supply for the cost of two months at retail pharmacies, representing an immediate 33% savings on medications taken regularly.

Perhaps most significantly, many patients fail to utilize their plan’s prior authorization process for non-covered medications. This simple paperwork process, typically requiring physician documentation of medical necessity, can convert a non-covered $400 monthly prescription to a covered $40 alternative.

7. Failing to challenge incorrect medical bills

Medical billing errors occur with surprising frequency, affecting approximately 80% of hospital bills and 40% of physician statements. These errors typically increase patient costs by $500 to $1,300 per hospitalization and $120 to $260 per outpatient procedure.

Despite this prevalence, fewer than 7% of insured individuals thoroughly review their medical bills or explanation of benefits statements. This oversight results in millions of people overpaying for healthcare services through unchallenged errors.

Common billing mistakes include duplicate charges, incorrect service dates, procedures never performed, incorrect quantity multipliers, and upcoding where provided services are billed at higher complexity levels than actually delivered. Each of these errors artificially inflates patient responsibility.

Even more problematic are coordination of benefits errors where procedures should have primary coverage through one insurance plan and secondary coverage through another. When these claims process incorrectly, patients often pay amounts that should have been covered.

Preventing these losses requires carefully reviewing all medical bills and comparing them against your explanation of benefits statements. Discrepancies should be reported promptly to both the provider’s billing department and your insurance company’s claims division.

How to stop the financial bleeding starting today

Addressing these costly insurance mistakes requires a proactive approach to managing your healthcare coverage. While insurance structures remain complex, implementing specific strategies can substantially reduce wasteful spending.

Calculate your true healthcare costs

Most people focus exclusively on premium amounts when evaluating insurance costs. A more accurate assessment combines premiums with actual out-of-pocket expenses from the previous year, including deductibles, copays, coinsurance, and uncovered services.

This calculation provides your true healthcare spending baseline, which serves as a comparative metric when evaluating alternative plans. Without this comprehensive figure, meaningful cost comparisons become impossible.

For maximum accuracy, categorize these expenses by family member and service type (preventive, primary care, specialty care, emergency, prescriptions). This breakdown often reveals spending patterns that indicate which plan features deserve priority during selection.

Create your personalized savings action plan

Based on your specific insurance arrangement and healthcare needs, develop a prioritized action plan addressing the most financially significant issues first. This approach ensures your time investment generates maximum returns.

For most households, the evaluation sequence should begin with eligibility for premium subsidies or alternative coverage sources, then address network utilization, pharmacy benefits, preventive care, and supplementary programs. This sequence typically identifies the largest saving opportunities first while building momentum through visible financial wins.

The implementation timeline should align with relevant deadlines, particularly annual enrollment periods when plan changes become possible. Many savings strategies require specific timing to maximize effectiveness, especially those involving plan selection or coverage changes.

Know when to seek professional guidance

While many insurance inefficiencies can be self-corrected, complex situations sometimes warrant professional assistance. Health insurance navigators, benefits consultants, and patient advocates specialize in identifying coverage optimizations and resolving complicated billing issues.

These services typically charge either flat consultation fees ranging from $75 to $250 or contingency percentages on documented savings, usually 25-30% of recovered amounts. For households with particularly complex medical needs or substantial billing disputes, this investment often generates returns of 300-500%.

The optimal approach involves handling routine optimization independently while reserving professional assistance for particularly complex scenarios like coordination of benefits across multiple policies, major billing disputes, or appeals of coverage denials.

The financial reward of insurance optimization

Addressing these costly insurance inefficiencies can transform healthcare from a financial burden to a manageable expense. Households that implement comprehensive optimization strategies typically reduce their effective healthcare costs by 15-25% while maintaining or improving care quality.

For a family spending the national average of $22,000 annually on healthcare, this represents potential savings between $3,300 and $5,500 per year. These reclaimed funds can significantly impact financial security, particularly when redirected toward emergency savings, retirement accounts, or debt reduction.

Beyond immediate savings, optimized insurance utilization often improves healthcare outcomes through increased preventive care, better chronic condition management, and more appropriate provider selection. This combinaton of financial and health benefits makes insurance optimization one of the most impactful financial moves available to most households.

With healthcare costs continuing to outpace wage growth, the financial consequences of insurance inefficiencies will likely increase. Developing effective insurance management skills now provides both immediate savings and long-term financial protection against these escalating costs.