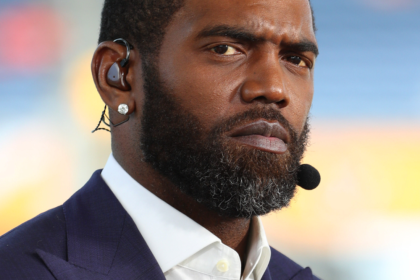

The NFL lockout began two months ago, but more than 100 players are already experiencing financial hardship. According to a recent report, players from 16 NFL teams have decided to take short-term loans with high interest rates in order to supplement the lifestyle since they are no longer being paid by NFL owners.

The NFL lockout began two months ago, but more than 100 players are already experiencing financial hardship. According to a recent report, players from 16 NFL teams have decided to take short-term loans with high interest rates in order to supplement the lifestyle since they are no longer being paid by NFL owners.

The NFL Players Association began issuing payouts up to $60,000 to the players two weeks ago. However, some players are in need of more money and getting loans of $100,000 to $150,000. The loans have interest rates that range from 24 to 36 percent. And some lenders are requiring that the players buy an insurance policy with premiums that cost $200,000.

NFL players, who all make $325,000 per year or more, should never have to turn to predatory lenders to remain afloat financially. It proves that most NFL players have not been taught how to handle their finances appropriately. The NFLPA, the union which is supposed to represent the players, should force every NFL player to take personal finance courses every off-season for at least three years.

They should also require each player to save at least 10 percent of their salary every year.

But this year’s financial disaster could get worse for NFL players. If the lockout continues past Labor Day, it’s likely that more players will decide to take out high-risk loans. –amir shaw