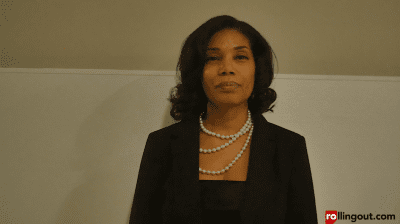

Teri Williams, president and chief operating officer at One United Bank talks about improving your credit and the launch of their new secured credit card.

One United Bank is the largest African American-owned bank. Why did you decide to take on a secured card?

One of the reasons we decided to take on the secured card was because we feel that the prepaid card is not the best product for many people in our community and there was not an alternative to a better product, which is a secured card.

The secured card is like any other credit card; it reports to all three major credit bureaus so it can help people rebuild their credit. The prepaid is a debit card, does not report to the bureaus and cannot help people rebuild their credit.

Many people have been hit by the recession and have been using prepaid cards because they no longer have their credit cards.

The problem with prepaid cards is that they have a lot of fees without the benefit of rebuilding credit. With that understanding, we decided to do something that can actually help people.

When will the Unity secured card be launched?

The actual launch date is Jan. 15, but it is available now.

What are some of the programs and benefits for people applying for this card?

In addition to the card there is an actual program behind it, How to Build Your Credit. We help people and give them advice about what they can do to rebuild their credit. We really want to be a partner with people to show them that they can improve their credit score. We also realize a lot people feel their credit is gone and [there’s] nothing [they] can do about it and [they’ve] given up, put their head in the sand. We want people to know they don’t have to be a second-class citizen in the credit world.

Where can they apply?

They can go online to www.Unityvisa.com or to one of our branches in Miami, Los Angeles and Boston. The card is nationwide, or you can apply by mail. You do not have to live in those cities to apply.

Please name three books that will help people with their finances.

The Mortgage Wars, by Timothy Howard; Black Wealth White Wealth, by Melvin L. Oliver and Thomas M. Shapiro; and I Got Bank, by Teri Williams, a literacy book for kids.

What advice do you have on how to build stronger finances?

No matter what income level are or where you come from, you must have some savings. It can be hard, so I recommend people get it taken out of their checks before they get the money in their hands. The reason that saving money is so important is that it allows you to take risks. Whether that is taking the risk of buying a house, moving to another area that offers a better job opportunity, or leaving one job and moving to another job. Just having that cushion allows you step out in ways you may not feel you can; everyone needs to save in order to cover risks.