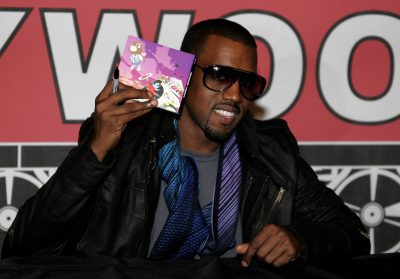

Kanye West and his touring company have launched a $10M lawsuit against multiple syndicates of insurance marketplace Lloyd’s of London.

According to court documents, “More than eight months” after the rapper canceled several planned performance dates for his Saint Pablo tour, the insurers “have neither paid on the multi-million dollar claim nor denied the claim”, “E! News” reports. “Nor have they provided anything approaching a coherent explanation about why they have not paid, or any indication if they will ever pay or even make a coverage decision.”

As you may recall, in November 2016, West pulled out of his tour after he was admitted to UCLA Medical Center following what sources called a “mental breakdown.” Other sources claimed that the rapper simply needed rest.

Per the suit, West’s Very Good Touring, Inc — which obtained “non-appearance or cancellation” insurance before the tour began — alleges that the cancellations were due to a “debilitating medical condition.” Meanwhile, the insurers are pushing back, claiming that the rapper’s “use of marijuana may provide them with a basis to deny the claim and retain the hundreds of thousands of dollars in insurance premiums paid by Very Good,” court documents say, per ET.

In 2016, the Saint Pablo tour hit the road for 38 scheduled stops between August 12 and November 2. Although West kept most of his commitments, he ccanceledtwo shows when his wife, Kim Kardashian, was robbed at gunpoint in Paris on October 2.

While West announced that he’d make up for the cancellations, offering what Very Good Tours referred to as “Leg 2” of the tour, West’s behavior was “strained, confused and erratic,” leading to the artist having to pull out of yet another show in Sacramento, on November 19.

“By the following day… Kanye’s medical condition showed no sign of improvement, prompting the decision by all concerned to cancel the show scheduled at the Los Angeles Forum that evening, and to cancel the entire balance of the Tour,” the documents state, according to ET. “As a result of his serious, debilitating medical condition, Kanye was hospitalized at the UCLA Neuropsychiatic Hospital Center on Nov. 21, 2016.”

Only, according to the suit, insurers thought something was fishy and asked the rapper to provide proof of his mental health issues while hospitalized.

“While Kanye was still under medical care for his disabling condition, the Defendant syndicates demanded that Kanye submit to an immediate [independent medical examination,” the suit states. “Kanye was made available for a purported IME by a doctor, hand-selected by the insurers’ counsel, who was predisposed to look for some reason to deny the claim. Yet even Defendants’ selected doctor had to admit that Kanye was disabled from being able to continue with the Tour.”

“As demanded by the insurers, Kanye was also subsequently presented for an examination under oath (‘EUO’), and at least 11 other persons affiliated with Kanye and Very Good were similarly presented for EUOs,” the documents continued.

Now, an extended stall regarding their claim has forced West’s hand, resulting in the hefty suit. “Performing artists who pay handsomely to insurance companies within the Lloyd’s of London marketplace to obtain show tour ‘non-appearance or cancellation’ insurance should take note of the lesson to be learned from this lawsuit: Lloyd’s companies enjoy collecting bounteous premiums; they don’t enjoy paying claims, no matter how legitimate,” West’s lawyer, Howard E. King, stated in the document, alleging breach of contract due to the insurers’ failure to adequately meet their financial obligations, the entertainment site reports.

“Their business model thrives on conducting unending ‘investigations,’ of bona fide coverage requests, stalling interminably, running up their insured’s costs, and avoiding coverage decisions based on flimsy excuses,” he added. “The artists think they they’re buying peace of mind. The insurers know they’re just selling a ticket to the courthouse.”

What are your thoughts on West’s claim? Should the insurance company have to pay up? Sound off in the comment section below.