College students and graduates alike are celebrating around America thanks to the latest news coming out of Washington, D.C.

Following up on a campaign promise he made in the 2020 General Election, President Joe Biden announced he would relieve up to $20,000 of student loans for current and former students.

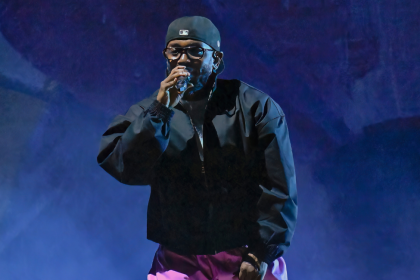

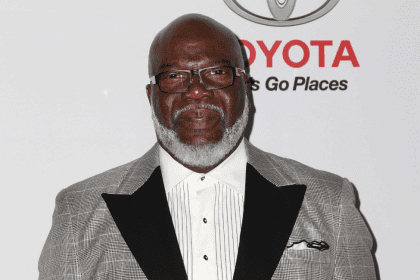

Recently, Tony Allen, Delaware State University president and president of the White House’s HBCU Board of Advisors, spoke to rolling out about the announcement.

Why is it a great day for America?

What the President has done today is the most comprehensive, transformational effort on student debt relief in American history, full stop. There have been many folks, pundits, other administrations, members of Congress who have talked about these issues for a long time. But President Biden, his administration, stood up and put some action behind those words, and we could not be more excited. This particular effort, as you know, touches 43 million Americans, 43 million. I think it’s been economically judicious the way he has framed it.

For the HBCU community, it matters a great deal. To give back of the envelope numbers, we were doing some analysis over the last 10 years. This particular effort will affect about 1.1 million HBCU alumn, and to the tune of about $15 billion dollars in student debt. So we are very excited about what it means, not only for our community, but for the entire country.

What do you think this move does for people who were hesitant about continuing or starting higher-level education?

Across the HBCU community, we’re seeing a lot of exceptional enrollment growth already. The elevation and profile of Historically Black Colleges and Universities is at an all-time high, and we’re excited about that, and trying to take advantage of that by making sure that those students not only come to us, but they graduate, walk across that stage, and, most important, find a career in their discipline. Having said that, two things of note. First, this particular effort, 90% percent of the debt relief will go to folks who are earning less than $75,000 a year. That really means young alum who are starting out, thinking about their next career move, thinking about graduate school and thinking about their debt burden. The opportunity for this to go directly to that particular thought is important.

The other thing I’d say is July 1, 2022, is the date where borrowers are eligible. Anybody who originated alone on July 1, 2022 or before, will be eligible for this effort.

What does that mean? That means I’m at moving day to day at Delaware State University. I have a lot of excited incoming students

and parents, by the way, and a lot of excited existing students who have seen this opportunity to reduce their debt before they ever even finish school. So I think it goes to really this notion of what we all think about college affordability, which I think is a critical issue for us.