Wesley Brooks is the homeownership lead of Wells Fargo’s housing affordability philanthropy team. Wells Fargo is strategically focused on increasing homeownership and wealth in marginalized communities by deploying more than $80 million in philanthropy to address systemic and historic barriers.

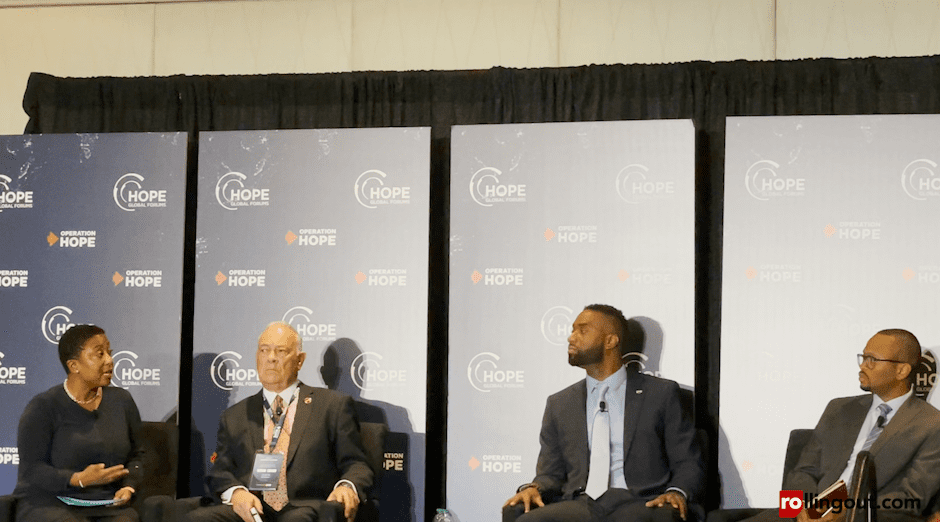

Brooks was a speaker at the HOPE Global Forums on Dec. 12, along with Ebony Reed, Lorenzo Amani, and Joe T. Rouzan, during which they discussed how to reboot the American dream and make upward mobility possible in challenging economic times.

What is your role at Wells Fargo?

The work that we’re doing, specifically around homeownership, is about going into marginalized communities and investing in resources that allow financial health, generational wealth growth, and putting the dollars back in the communities that we started.

How has the pandemic impacted affordable housing in the United States?

Homeownership was proven to be one of the more important factors in how successful folks were in surviving the pandemic. We saw that kids had better school outcomes if they had stable housing, and we saw that with inflation going up, people were able to be evicted. Fortunately, there were a lot of financial federal protections stopping that. If you were a renter, you had less housing stability than you did if you were a homeowner. If you bought before the pandemic or right [after the start of ] it, you had significantly lower interest rates than what you’re dealing with right now. Coming out of the pandemic, I think we have to adjust where our priorities are and where our focus is, and make sure that we’re making the right financial decisions to make homeownership successful for those who are already in it.

What should people look for when they’re thinking about homeownership?

As a homeowner, your taxes may go up, but your mortgage should be pretty solid. Your insurance may go up a bit, but what you’re paying on a monthly or annual rate is not going to change as much as those folks who are renting right now. Talk to your friends who are renting, and they’ll tell you that sometimes their rent is going up 30%-50% in a year. That type of instability in your housing becomes detrimental when everything else is going up in terms of how much it costs day-to-day. So now you’re in a house but the downside to that is now you’re responsible when stuff breaks. I would encourage folks to make sure they’re keeping an emergency fund and having access to that is really critical and making sure that you can keep up with [maintenance on] your home. The second part of that is there’s a lot of resources in your community. I know that we are coming out of a period where there was an eviction moratorium, and now we’re seeing the eviction numbers start to go up. So I want to encourage folks back home to get in touch with the legal aid organizations that are in your markets.