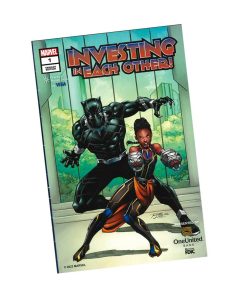

OneUnited Bank, the nation’s largest Black-owned bank, announced a collaboration with Marvel Comics and Visa, for a free custom Black Panther comic book highlighting financial literacy. The comic book features focused exercises developed by OneUnited Bank, in an effort to improve money management among youth in the Black community.

Teri Williams, the president of OneUnited Bank, spoke with rolling out about the comic book and financial literacy for youth and the Black community.

How does it feel to be a part of something that can help kids regarding managing finances?

It’s wonderful. When we started talking about this collaboration, we thought it was perfect, because it’s really our passion and focus to instill financial literacy in our community. Then to partner with Marvel, using the Black Panther comic and superhero, we thought that was a perfect combination.

What should young Black people know about fiscal responsibility?

I think the important thing to know is that the youth are aware of money. Before we teach them anything, they can see that money is a part of life, and they’re trying to figure it out. What financial literacy does is it allows them to connect the dots because they [can] see what’s going on, but they have questions.

We have a focus on financial literacy for our youth, and what we’re hoping to do is to allow our children to be able to connect the dots to understand the importance of saving, to be able to distinguish between wants and needs, and to make good money decisions. If we can instill that in our youth at a very young age, they might waver a little, but they’ll always know what the right path is.

What can this product do for older people?

When I was growing up, we had something called home economics, and we were actually taught economics in school. That doesn’t happen today. For a lot of us, it’s like trial and error. We try something and it doesn’t work, and we screw up our bank account. We have a ChexSystems record and we screw up our credit or have a bad credit score, and then we find that it gets in the way of us taking full advantage of everything that life has to offer.

The idea here is for all of us to make better money decisions, and specifically in the Black community we’re taught a lot of things that are also incorrect about our community. We’re taught that we’re not good with money, which is not true, or that we are in this situation where there is this wealth gap because we spend too much or we spend on the wrong things, which is also not true. The key is to find out what is true and what can help us move to the next level.