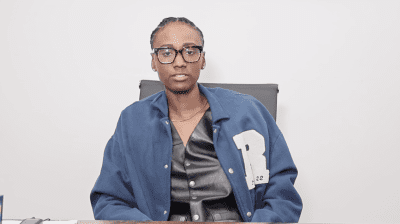

With his venture capital fund, Lightship Capital, Brian Brackeen offers the tools necessary for startup success while empowering and elevating underrepresented ecosystems and investing in exceptional businesses run by founders of color, LGBTQ+, women, and innovators with disabilities.

Brackeen spoke with rolling out about the challenges of being a funder and how communication goes a long way in a relationship with companies.

What led you to become a funder?

I knew about solving the problem of funding for women or minority founders the second I was a minority founder. I didn’t have great investors; in fact, I had some of the worst investors. I saw the problems that hurt the business and how [they] hampered our growth and how [they] hampered my ability to serve our community and my family. If I could be the investor that I didn’t have, I could change everything, not just for me but for everyone.

What is the biggest challenge of being a funder?

One of the biggest challenges [is] getting all these calls from founders because there’s so much need out there. We’ll make about 50 investments in this fund, and company 51 is perfectly investable, as well as 52, 53, and 54. You’re saying no to good people often. I think the thing that moved me most is not a “need” because we’re about to close, but a “need” because we’re about to expand, or if that growth is killing them, essentially, they need the dollars so they can fulfill a big contract or a big opportunity.

Tell us about venture capital.

Venture capital is some of the most expensive money you’ll ever get. It’s more expensive than debt; it’s more expensive than borrowing from your family or friends if you can afford to do that or if they can afford to do that. If I make an investment for half a million, $1 million, or $2 million, I’m going to want three, five, 10, or even 1,000 times my money back over a 10-year period. Those are real numbers. What we want to see is early investing on our side and hypergrowth on your side, and one of the interesting things about partnerships in these kinds of investments is [that they’re] highly geographic.

As a funder, how often do you want to hear from companies?

Communication plays a huge role in how I feel about the relationship. When things are good, and it’s good news, I get those updates on the first day of the month right away. When things are bad, I get them on the 29th day. I have so much deeper respect for the early bad news because sometimes, together, we can fix something, but if you delay, you’re doing it on your own. Venture capital is all about transparency.