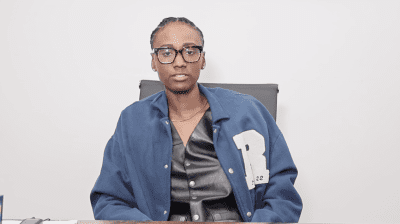

For sneaker buyers who are trying to find the best price for their favorite shoes, Venita Cooper created Arbit, a pricing intelligence platform for the sneaker aftermarket. With her experience as a reseller and a true sneakerhead to the core, Cooper is helping others make better decisions when it comes to buying shoes.

How did you come up with the idea for Arbit?

Arbit started as a data and analytics platform to be able to bring a little more predictability to highly speculative sneaker resale markets. This was at the height of the pandemic, and there was a lot of volatility in pricing. The Air Jordan 1s retail drop would be $180, and they might resell for $400, the day after the drop or the day of the drop. Then two hours later, [it] might be $350 or $450. A lot of it was just speculation, so I thought there’s all this data in the world, there has to be a way for us to feed it into something that helps us make sense of it faster than human intuition can. That’s where the idea of bringing AI into the fold came from and let’s build an algorithm that can process these massive amounts of data faster. Originally, it was a tool for me as a reseller, but now it has evolved into a marketplace that is leveraging that technology to help consumers and sneaker buyers make better, more informed choices for themselves.

As a reseller and as a collector, I understand resellers are going to charge what they believe they can get for a product. It makes a lot of sense. What Arbit is trying to do is to move some of that negotiating power into the hands of buyers, so buyers can check these resellers, check the prices in the market, and demand greater fairness there.

How do you collect the data?

We have a data scientist, and she’s brilliant. The great thing about algorithms is that as long as you’re feeding it data, it just gets smarter and smarter. We’re just at this stage where we have created an algorithm that is getting it right most of the time in terms of predicting prices for sneakers on the resale market. Now we’re just like how do we incrementally make it even better, even stronger? Where do we go next in terms of the application of this algorithm to create even more value for a larger base of users? [There are] different types of supply and demand indicators. Of course, we look at historical sales from different marketplaces to get as much data as we can get our hands on. For example, we’re grabbing data from Instagram. When there’s a post about a shoe that’s about to be dropping, and this post is getting a million likes and all the other posts are getting 50,000 likes, what does that mean for the future value of this sneaker and the current value of this sneaker when it drops? Those are the things that we’re testing out.