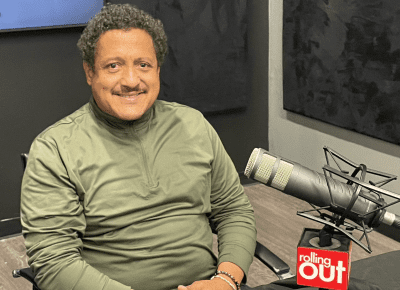

Jay Diallo is an expert in community economic development, specializing in loan risk management, underwriting, commercial, and Community Development lending under CRA initiatives. As Founder and CEO of First Community Capital Inc., he focuses on enhancing economic growth for underrepresented communities. Drawing from his own immigrant experience, Jay is dedicated to improving capital access for entrepreneurs of color and immigrant populations. With extensive banking experience and a strong educational background, including a BA from Westmont College and completion of the Pacific Coast Banking School, Jay is a passionate advocate for economic equality and community empowerment.

He spoke to rolling out Publisher and CEO Munson Steed about how recent political decisions have adversely affected the Black and minority communities.

Munson Steed: Hey, ladies and gentlemen, this is Munson Steed, and welcome to another seat at the table, where we bring those individuals who can explain to us, where and how and who, is getting a seat at the table, where and how, who, is being blocked from having a seat at the table, and how we can all make sure that life and humanity serve us better, so that we can all claim a seat at the table. It is important that you understand that.

So, a dear brother of mine in the movement, who truly believes that access should happen often for all of us, Jay Diallo, did I say that? Right, Jay?

Jay Diallo: Yes.

MS: Diallo. Welcome to a seat at the table! I’m Munson Steed, the host. Bring us up to speed on where we are, on actions that corporations can make to give what has been a very inequitable cut of the pie to our community.

JD: Well, thank you so much for giving me the opportunity. I am the President and CEO of a CDFI call first community capital. We provide micro lending to small businesses, and we always try to reach out to corporation foundation for capitalization of our loan funds, so we can provide access to capital. So having corporation, organizations, and foundation be part of the conversation. Equitable access to capital is so critical in this environment, especially when it comes to minority own small businesses, because for a long time we have rules and regulations at the Federal level that support these services of minority entrepreneurship. but with the new landscape with the Supreme Court, the recent Supreme Court decision on the affirmative action.

It’s really doing down the opportunities some of the minority own businesses have in terms of the safety net for making sure that minority small businesses have been protected. Especially when we’re talking about redlining in the past when the banks do not make loans to setting communities because of their race color ethnicity and because of their economic household levels. So this is a this is a critical topics for us to discuss, it’s even more prevalent during this time with this regulation that’s really nipping through all the protection that the small businesses have within the underserved communities, especially the minority-owned businesses.

MS: Thanks for that. And I just really wanna think about there seems to be one head actor in this scenario that is truly opposing and working to dispose of opportunities for not just black, but brown and green, and probably some blue entrepreneurs who are just entering the market, and would need both micro loaning and grants in order to move into a position for a community that’s been oppressed to, I would say, still depressed, and exists 400 years already.

JD: So you know, part of the reason why the CDFI Community Development Financial Institution was created in 1992 is the realization of minority own small businesses considered unbankables. They don’t have credit services that you need, they don’t have us to capital that they need. So, the organization was created within the CRA Credit reinvestment act within the CRA, so that to make sure that banks actually provide support and services to the community where they have branches and where they serve. So, it’s so critical to be without that we will go back to our old ways of doing things where minority small businesses in under safe communities have been left behind. One of the issues is that when it’s not about making loans to black or brown or Latinx people, it’s just the issue of making sure that those people who have been marginalized for a long time have now should be taken care of. That’s why we’re doing what we do.

MS: But, I don’t want to say it without the name, because there is a name in particular of an individual that has truly been out front about making sure that they actually stop these type of what we would call giving equilibrium to a very unequal situation which creates a certain, and I would say, drunkenness of oppression that would keep the dreams based on a Zip code, based on an area of a city from receiving any kind of reciprocity given that they are receipt shareholders, they do pay some level of taxes, they do, but are not afforded the same opportunities somebody else in another Zip code.

Who is the chief individual that seems to be on the the forefront of this discussion, so that our community can begin to look up and see the actions that are being taken. Because it’s not just our black sisters that are actually being attacked, it is now the Hispanic community as well as any other opportunity.

JD: Yeah, I think it’s .. I forgot the name of this individual that just went recently to the Supreme Court to dismantle the affirmative action. Unfortunately, I can’t remember his name right now, because, I think it’s Edward Blund. That I think that. Yeah, Edward Blund

MS: Bloom.

JD: Yeah, Edward Bloom. Sorry. I think that’s what his name is. But let’s just be realistic though, he’s just one individual that’s making all this noise. But he has a plethora of support, helping him go about his stance at the Supreme Court. The dismantling of affirmative action is really telling us that, you believe that racism doesn’t exist within our system, within our community. And when you look at even our justice system, when they are more minority Latinx and African American go to jail, then actually get accepted to colleges. That’s mind block. that’s what that’s really doing to service for the struggles that black and brown people have suffered in the last 200, and 5,400 years.

MS: I think the very onset of what we would consider a seat at the table, and many people may not know what a CDFI is or does. Can you share? Because I don’t wanna get lost on just the “Bloom effect”, but I would like to know what the effect is for you in even establishing and becoming a Founder, because Founders are important to our community, and I don’t want anyone to get lost on the fact that you are dedicating your life at this moment to making sure that Founders can found their businesses and Founder like you can actually be able to stay in existence as well without attack. So, can you share what a CDFI does, and what the initials mean, and really your mission with your organization, and why micro-loans are important. So I said about 20 things, just help me out here, my dear brother.

JD: Absolutely, well CDFI means Community Development Financial Institution. What it really means at the end of the day, is that we are financial institutions certified by the US Department of Treasury that focuses on providing financial services and business development services to communities that are considered underserved, to communities that are considered unbankable, and to low and income minority individuals.

Part of the reason why this community development financial institution was established is to ensure that the people who are considered unbankable, we as a CDFI, we will train them, we will provide them with the capital that they need to start their business, so they eventually will become a position of a viable businesses that can now go to a bank and get a loan without taken into consideration just based on their race, but also based on their financial capacity. So that’s why the CDFI Fund help us a CDFI first community capital to provide micro-loans, small business lending and business development services to communities in underserved communities including black and brown entrepreneurship.

MS: I want to thank you for those insights micro-lending. Why is micro-lending thing that we need to, you know many people don’t think of it. But when I think about a pawn shop or a quick loan. What’s the value of a person being able to go to a CDFI and actually obtain a micro-loan?

JD: So the value is a multiple. There’s a there’s multiple values to it. Right? So we provide micro-loans. CDFIs, when we talk about micro-loans, we’re talking about loans up to $50,000, it could be as low as $10,000, as low as 5,000, as low as 1,000 right. But the reason why the CDFI has value is because they provide that loan at an affordable interest rate. So instead of them going to the pawn shop are going to title auto loan or those loan sharks. They will come to us, and we did get the loan at an affordable rate, that include providing them with the business plan education, credit education, financial literacy education, and all that.

It’s a holistic approach of helping them. So now, for example, you have a salon that is only need $5,000 or $10,000 to buy an equipment so that they can expand their business, you would also have a truck driver who’s been driving swift, and they wanna become owner operators, and the truck that they wanna purchase might cost $45,000. They will come to us, and then we will be able to help them to finance a loan, so they become one of our operators. Now, all these resources that you need banks do not make loans anything under $250,000, let alone $50,000 or $5,000, right? So that’s why having a CDFI, it’s so critical, within our economic development, because,we help small businesses start their businesses, grow their businesses, and eventually they become bankable so they can go to a bank and get much more larger loans.

MS: So when you think about, you know individuals who clearly, obviously, are Latinx community, who is growing huge entrepreneurs, might be first generation, might just be getting here, but have the entrepreneurial spirit need to be able to buy those things when Jay Bloom tells a young intern who might be a future entrepreneur at the Smithsonian that they shouldn’t have an internship program. What do you think that does for the hopes and dreams of that dad whose child needs that in order to support his child through these programs and through having a vision of themselves that they deserve the American dream, just like everyone else.

JD: It’s really devastating, to be honest with you. We see, I see, this first hand where I have people walk into our office, sometimes they just wanna start a business as a supplementary income, because the income that they receive from that employment might not be sufficient enough for them to take care of their family, let alone be able to have enough money to send them to school. So attacking that support system where we trying to provide resources to support our young entrepreneurs Latinx, whether Latinx, whether black, owned businesses, whether women own businesses, it’s really devastating.

Let me put it this way though, the fastest growing what allows us to have a greater economy is through the support of the micro small businesses that we have within our communities. A lot of the black and brown communities rely heavily on small businesses. They rely heavily on bummin pop businesses where they can go in there and get the services, and in retrospect those small businesses also rely on trying to get small funding so they can either start their business or scale their business.

So attacking this group of people or this community, it’s gonna have a dominant effect within our own economic system. And to be honest with you, we it’s gonna try and bring us back to the age of, you know, civil right movement where, you know, we have to now start fighting, go on the street and start fighting. Let me put it this way, right we as a CDFI, we rely heavily on government regulations and government rules that support small businesses. That’s how we get our funding. Now, stripping that away, is gonna strip away from support from CDFI getting, and what happens when CDFI stop not getting the being, be marginalized.

But I mean, Dr. Lynn would always say something like CDFI is an underserved organization that is trying to serve underserved communities. So it’s an interesting thing that is that the CDFI need the support of the government, so that we can also continue to support the community. And I think, what Mr. Bloom is doing, is stripping away little by little, chopping away, little by little, some of the struggles that we overcome. and then he’s trying to, and he’s done that. He’s done that in a big way, because getting rid of affirmative action at the Supreme Court? That’s just a huge blow for all minority, all, all underserved communities, because the domino effect is happening right now, as we see within our community.

MS: When you think about a fearless fund that was giving grants to black women entrepreneurs. What do you think that does for black women, black children, black families, when he is willing to go after the fearless fund, and corporations, to make sure that black women who would qualify for grants would become entrepreneurs would have their dreams deferred?

JD: Well, so now let’s just put this in perspective right? Because black women or black people are not getting grant, because for some reason they don’t have the capacity to run a business. Let’s just be realistic. Black women cannot get a loan when they go to a bank in a conventional manner. So there’s a racism component aspect of it. Now, when we strip that away, when we strip the support that the black women are getting so that they can build their business, it’s really breaking down the fabric of the family structure. I’m gonna give you one example, I’m just gonna even take it more further. Right?

We deal with a lot of formally incarcerated people who came out of jail and trying to make a living for themselves, so they don’t have to go back to jail. Right? What end up happening, these people, they have families, they have children. So what I learned in my experience is that when I support a black woman or a former incarcerated person, I’m not supporting that person in particular, but I’m supporting their children and their whole generation to come. So that it’s gonna create you know, we scream and yell about crimes in our community and yet we don’t provide the resources that it’s needed, so those crime will not continue to diversity that our community, which means providing support system. So those people who don’t have anything to do may have something to do for their lives, and you know I believe in financial self-sufficiency when you can help individuals, when you look at you can have community and we can have family become financial self-sufficiency, the whole country is going to be benefiting from it.

MS: Well, ladies and gentlemen, you heard it first, and I wanna thank Jay Diallo, for really his commitment to make a difference in the lives of our community, creating a seat so that you don’t have to beg. But you actually bring something to the table, given the fact that you gotten something from the table. This is Munson Steed, for more, a seat at the table with CEO. Jay Dialio. I appreciate you, brother, thank you so much for all you continue to do, for those underserved and those who deserve to be served today I’m Munson Steed with a seat at the table.

JD: Thank you for the opportunity.

MS: Thank you, brother.