A win is a win.

On July 11, Americans got some long-awaited good news. President Joe Biden highlighted the consumer inflation report, which showed overall prices fell last month, bringing annual inflation to 3.0%. The IRS also announced that Biden’s new initiative to collect past-due tax debt from wealthy citizens brought in more than $1 billion. The initiative was a part of Biden’s Inflation Reduction Act.

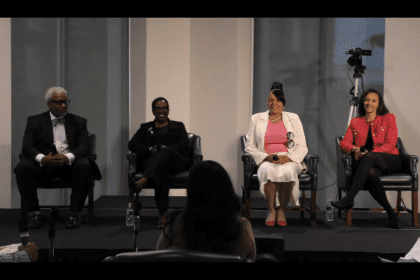

Council of Economic Advisers member Kirabo Jackson discussed the White House’s celebration of reducing inflation with rolling out.

Why is the latest consumer inflation report good news?

If you look at the level of prices, the Consumer Price Index, one of the ways we measure prices in this country, went down 2.1% in June relative to what it was a month before.

We saw prices are about 3% higher than they were a year ago, the lowest level of annual inflation we’ve seen since about 2021.

One thing that’s always helpful to think about is that when we talk about [the] standard of living, it’s a race between prices and wages. When we saw the massive spike in prices that happened when we had supply chain snags associated with COVID-19 and also the war in Ukraine, prices went up pretty fast and wages did not keep up.

What we’re seeing with this latest report is that wages have kept up with inflation. Over the past 12 months or even longer, wage growth outpaced price growth. What that means is, for the typical American, their paycheck can purchase more things today than it could a year ago.

If you look at 80% of workers who are in non-supervisory roles, wages have gone up about 1% faster than the prices have. So that’s sort of good news.

Even though we still see the prices relative to what they were in 2019, our paychecks have grown. So we’re able to have an improved standard of living, and that’s good news. All of that is due to bringing down inflation, while at the same time having faster wage growth.

What caused inflation in the first place?

It’s confusing. For people who don’t use the term all the time, inflation and prices are not the same thing. … Inflation represents the change in prices, not the level of the price. So if prices are going up, that means we have inflation. If prices are going down, then we have disinflation. One thing that is important to highlight is when we have a functioning healthy economy that is growing and positive economic growth, we have a little bit of price growth.

When we have a healthy economy, what you want is wage growth, which is strong, and you want to have price growth, which is below that. What that means is there’s a race between wages and prices, with wages winning out.

Over time, the quality of life is improving. But a healthy economy typically has a little bit of price growth, which is indicative of a growing economy.

What happened [in America] was that suddenly with COVID-19, people couldn’t get the goods they wanted because of supply chain issues. A lot of goods came in from outside [America], and since things were blocked up, people weren’t going to work for a variety of reasons. For example, we couldn’t get microchips for cars. So suddenly, people couldn’t get cars. When you don’t have enough cars, the price of cars goes up.