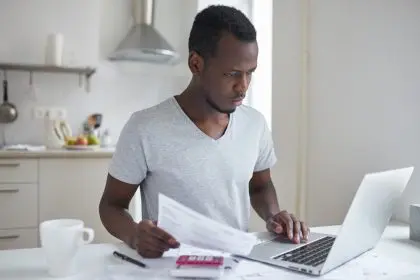

Reestablishing your credit score is a crucial step towards financial stability and freedom. Whether you’ve faced unexpected financial challenges, made some missteps with your finances, or simply want to improve your credit standing, taking action to rebuild your credit score can open doors to better opportunities, lower interest rates and increased peace of mind. Your credit score is more than just a number; it’s a reflection of your financial health, influencing everything from loan approvals to the rates you pay on insurance premiums.

The journey to reestablish your credit score may seem daunting, but with the right strategies and dedication, you can see significant improvements over time. The following five methods are not just effective; they are essential for anyone serious about regaining control of their financial future. Let’s dive into the practical steps you can take to get your credit score back on track.

1. Assess your current credit situation

The first step in reestablishing your credit score is to take a detailed look at where you currently stand. Start by obtaining a copy of your credit report from the three major credit bureaus: Experian, Equifax and TransUnion. This report will provide a comprehensive view of your credit history, including any missed payments, outstanding debts and the length of your credit history.

Look for any errors or discrepancies that might be negatively affecting your score. Incorrect information, such as accounts you never opened or payments marked as late when they were actually on time, can drag down your score unnecessarily. If you find any inaccuracies, dispute them immediately with the credit bureau to have them corrected.

Understanding your current situation helps you identify the specific areas that need improvement. This awareness can be empowering, giving you a clear starting point and motivating you to make the necessary changes. Remember, you can’t fix what you don’t know, so this initial assessment is key to your success.

2. Develop a plan to pay down existing debt

One of the most significant factors affecting your credit score is your credit utilization ratio, which is the amount of credit you’re using compared to your total available credit. A high utilization ratio can indicate that you are over-reliant on credit, which is a red flag for lenders.

To reestablish your credit score, you need to develop a plan to pay down your existing debts, particularly revolving credit like credit card balances. Start by prioritizing high-interest debt, which costs you the most in the long run. The snowball method, where you pay off smaller balances first to build momentum, or the avalanche method, where you tackle the highest interest rate balances first, can both be effective strategies depending on your situation.

Paying down debt not only lowers your credit utilization but also demonstrates to creditors that you are capable of managing your finances responsibly. This positive behavior will gradually reflect in your credit score, helping you to rebuild your financial reputation.

3. Make consistent, on-time payments

Payment history is the most significant factor in your credit score, accounting for about 35% of your total score. Therefore, making consistent, on-time payments is one of the most critical actions you can take to reestablish your credit score. This applies to all your bills, including credit cards, loans, utilities and even rent payments if they are reported to the credit bureaus.

To ensure you never miss a payment, consider setting up automatic payments or calendar reminders. If you’re struggling to make ends meet, contact your creditors to discuss alternative payment arrangements before you miss a payment. Many creditors are willing to work with you to find a solution, as they prefer receiving partial payments over none at all.

Every on-time payment you make is a step towards rebuilding your credit score. Over time, these positive marks on your credit report will outweigh any past delinquencies, helping to boost your score and restore your creditworthiness.

4. Consider applying for a secured credit card

If your credit score is low or you have a limited credit history, getting approved for a traditional credit card can be challenging. However, a secured credit card can be an excellent tool for rebuilding your credit. Unlike a traditional credit card, a secured card requires a security deposit, which acts as collateral and usually sets the credit limit.

Using a secured credit card responsibly, such as keeping the balance low and making timely payments, can help you establish a positive payment history. Over time, this can improve your credit score and may even lead to the opportunity to upgrade to an unsecured credit card with better terms.

When selecting a secured credit card, be sure to choose one that reports to all three major credit bureaus. This ensures that your responsible credit behavior is reflected in your credit reports, contributing to your score improvement.

5. Diversify your credit mix

Your credit score is influenced by the variety of credit accounts you have, known as your credit mix. This includes revolving credit, like credit cards, and installment loans, such as car loans or mortgages. A diverse credit mix shows lenders that you can handle different types of credit responsibly, which can positively impact your credit score.

If you only have one type of credit, consider adding another to diversify your credit mix. For example, if you have only credit card debt, you might take out a small personal loan or a credit builder loan, which is designed specifically to help people rebuild credit. Just be cautious not to take on more debt than you can manage, as the goal is to improve your credit, not to worsen your financial situation.

Successfully managing a diverse credit mix over time can lead to a stronger credit score, making you more attractive to lenders and giving you access to better credit terms.

Stay committed to rebuilding your credit

Reestablishing your credit score is a journey that requires patience, persistence and a proactive approach. By assessing your current situation, paying down debt, making consistent payments, considering a secured credit card and diversifying your credit mix, you can gradually rebuild your credit score and regain financial control.

The process may take time, but the rewards — greater financial freedom, lower interest rates and increased opportunities — are well worth the effort. Remember, every positive step you take, no matter how small, brings you closer to achieving your financial goals. Stay committed, keep your focus and watch as your credit score begins to climb, reflecting the responsible financial behavior that will serve you well for years to come.

This story was created using AI technology.