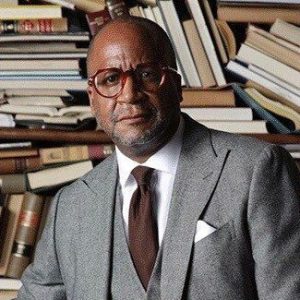

Theodore Lipscomb Sr. spent 12 years as a Milwaukee County Supervisor, before becoming executive director of LISC Milwaukee. He came in the door with a goal: to build on the organization’s $184 million portfolio of community development support throughout the city. Over the last 25 years, LISC Milwaukee programs and capital have leveraged more than $604 million in total development activity.

Lipscomb, deeply rooted in community development, has worked across the state of Wisconsin as a project manager for the Wisconsin Partnership for Housing Development and as director of community development for the West End Development Corporation. His private sector experience includes work at a prominent Milwaukee architecture firm and managing Urban Wealth LLC, which acquires and manages quality rental homes.

He spoke with Munson Steed, publisher and CEO of rolling out, about how the Rocket Community Fund is helping him take on some of the affordable housing challenges in Milwaukee through programs like the Rocket Wealth Accelerator. Here’s their conversation:

When you think of the Rocket Wealth Accelerator and any other program that brings housing opportunities to a community, how does [the community] change?

Well, there are multiple problems we’re dealing with. It’s one thing to try to build affordable housing, but the second piece is you’ve got to have people who are ready to access that housing. Are we only able to build rental, or can we move people along the spectrum to homeownership opportunities? We’re working on both sides of that.

At LISC Milwaukee, we work with emerging developers and nonprofits to do affordable housing, both rental and homeownership. We also work through our Financial Opportunity Center network, with funding from Rocket Community Fund and programs like Rocket Wealth Accelerator, to get people ready. We want people to get financially prepared, to have a plan that involves counseling and one-on-one work around budgeting, but also talking about how to improve their credit, save, and prepare for the future.

When you think about those principles, and even home protection, you understand that this one-on-one counseling makes a difference. Why do you think one-on-one counseling is something that people need before they make the plunge into understanding the responsibility of owning a home?

Yeah, I just think there’s value in having someone who can walk alongside you and talk you through your individual situation. It’s more than just watching a video or taking a class. Somebody needs to be able to talk through your situation with you, and give you examples from others they’ve heard about, how you might go along this journey. If you’re a low-wage worker with low wealth and assets, it’s very difficult to save. So, part of this conversation isn’t just about budgeting; it’s also about, how do we talk about your career path? Can we get you into a better, livable-wage job and have a savings mindset along the way?

You’re talented and have a clear understanding of what it is to be both a developer and a landlord, but you choose to serve the community of Milwaukee. Why?

You’ve been reading my bio, all right. Well, I’ve always cared about the community I live in. I’ve also always looked around at the physical decay and found it to be such a waste. I think all our communities should be thriving and safe, and I want people to have the opportunity. I’ve been blessed, educationally and otherwise. I made the decision to stay here in Milwaukee, and I want it to be better. I think part of that is we can’t leave so many people behind. We’ve got to make sure they get access to opportunities, and that’s the work we do.

If you had to talk to not just the disenfranchised but to young people who need to know why they need to become homeownership-ready, what would you say to some of the young people who just aren’t certain that this is the moment for them to lean in and begin to learn about the journey to homeownership?

Yeah, well, this moment happens to be a little tough with prices sort of out of control and higher rates, but I think part of that is that they need to be able to see themselves in a future state where homeownership is a real, attainable goal. It doesn’t have to be tomorrow or even next year, but they should be able to see themselves as part of the community they are in, and that they should be able to receive the same benefits as those who’ve been able to buy a piece of that community. It’s not as though renters aren’t part of the community, but it’s a different stake when you’re getting the financial reward as well of building a strong and stable community. We want everybody to have a piece of that.