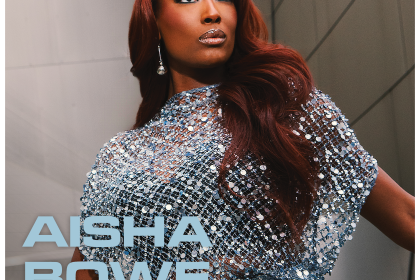

Professor Tonya M. Evans of Penn State Dickinson Law shared powerful insights about cryptocurrency‘s impact on Black America during her recent “Let It Be Known News” appearance, emphasizing education as key to successful digital asset investment.

As a fintech policy advisor and Digital Currency Group board member, Evans warns against “get rich quick” schemes while highlighting crypto’s potential for wealth building. “There are several trusted resources available to help investors learn more about crypto risks and rewards,” she noted.

The discussion addressed cryptocurrency’s role in addressing racial wealth disparities, though Evans cautioned about market volatility risks. She advocates for protective strategies and backup plans, particularly given the largely unregulated nature of crypto markets.

Political implications loom large, with crypto-backed super PACs investing millions to maintain loose regulations. Donald Trump’s pivot from crypto critic to launching World Liberty Financial (WLFI) raises transparency concerns.

Through her “Tech Intersect” podcast, Evans provides practical blockchain and digital asset guidance to the Black community. Her approach balances opportunity with careful risk assessment.

Financial analysts note how Evans’ expertise helps bridge knowledge gaps in underserved communities. Investment professionals praise her emphasis on education before participation.

Technology experts highlight how her guidance addresses specific challenges facing Black investors in the digital economy. Market observers commend her balanced perspective on crypto’s potential benefits and risks.

Industry veterans appreciate Evans’ focus on long-term wealth building over short-term gains. Consumer advocates support her calls for increased market protections.

Regulatory specialists cite her insights on navigating upcoming policy changes. Community leaders emphasize the importance of her educational initiatives.

Economic researchers study how improved crypto literacy could impact wealth distribution in Black communities. Policy analysts track potential effects of regulatory shifts on minority investors.

Financial education organizations report increased demand for cryptocurrency knowledge in minority communities following Evans’ advocacy. Workshop attendance and online resource engagement show significant growth.

Blockchain developers note how Evans’ insights influence inclusive design practices for new financial technologies. Innovation teams increasingly consider accessibility for underserved communities.

Investment firms study Evans’ recommendations for developing targeted outreach programs. Market research indicates growing interest in crypto education among Black investors.

Academic institutions incorporate Evans’ perspectives into financial literacy curricula. Educational programs expand to address specific needs of minority investors in digital markets.

Community banking representatives explore partnerships to enhance cryptocurrency education and access. Financial inclusion initiatives increasingly incorporate digital asset guidance.

Industry surveys reveal growing awareness of cryptocurrency opportunities among Black investors, attributed partly to Evans’ educational efforts.