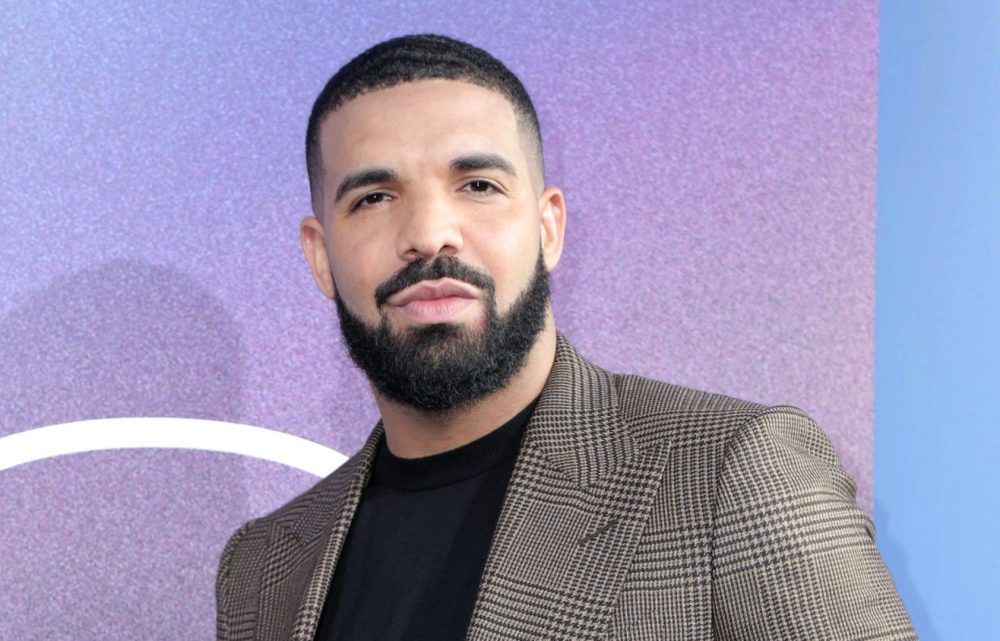

Rap superstar Drake faces serious accusations from a 20-year-old social media influencer who claims he was scammed out of $2 million in a cryptocurrency deal.

The influencer detailed the allegations during a live stream with DJ Akademiks, asserting that Drake and another individual known as Top5 failed to fulfill promises of investment growth. He claimed the arrangement included potential social media engagement, a music video appearance in Dubai, and an introduction to actress Jenna Ortega.

According to the influencer’s account, the investment was supposed to be placed on Stake, a crypto betting platform, with the goal of doubling the funds. However, he alleges Drake only generated $700,000, leaving the remaining funds unaccounted for.

During the stream, the influencer played a voicemail purportedly from Drake advising him to “chill out.” He also mentioned possessing screenshots of the Stake balance as potential evidence.

The incident highlights the complex dynamics of celebrity endorsements and cryptocurrency investments. Legal experts suggest such allegations require substantial documentation to substantiate claims.

Drake has not publicly responded to the allegations. Representatives for the artist have not yet issued a statement addressing the claims.

The situation raises significant questions about accountability in digital investment spaces. Young influencers often seek partnerships with high-profile celebrities, but the potential financial risks remain substantial.

The crypto investment landscape continues to present challenges for both investors and celebrities involved in endorsement deals. Regulatory bodies have increasingly scrutinized such arrangements, seeking greater transparency.

As the story develops, social media platforms and entertainment news outlets continue to track the unfolding narrative. The allegations have sparked widespread discussion about the responsibilities of celebrity influencers in financial transactions.

This incident serves as a cautionary tale about the potential pitfalls of high-stakes digital investments and celebrity-backed financial arrangements.

Verification of the claims remains pending, with many industry observers awaiting additional evidence or official statements from the involved parties.

The cryptocurrency investment landscape has become increasingly complex in recent years, with celebrity endorsements playing a significant role in attracting young investors. Experts point to a growing trend of high-profile personalities leveraging their influence in digital investment platforms, often without clear regulatory oversight.

Financial analyst Marcus Rodriguez noted, “The crypto space remains largely unregulated, creating significant risks for inexperienced investors. Celebrity involvement can create a false sense of security and credibility.”

Historical context suggests this is not an isolated incident. Several celebrities have faced legal scrutiny for cryptocurrency and digital investment endorsements. In 2022, Kim Kardashian settled charges with the Securities and Exchange Commission for promoting a cryptocurrency without disclosing paid endorsement, paying $1.26 million in penalties.

The platform mentioned in the allegations, Stake, has gained notoriety in sports and entertainment circles. Founded in 2017, the platform allows users to bet using cryptocurrency, attracting high-profile athletes and entertainers. However, the site has faced criticism for its potential to encourage risky financial behavior.

Drake’s broader involvement in digital investments and endorsements adds layers of complexity to the allegations. The rapper has previously demonstrated interest in emerging technologies and alternative investment strategies, making the claims particularly sensitive.

Legal experts suggest the burden of proof lies with the accuser. Documentation, communication records, and financial transactions would need thorough examination to substantiate such serious claims.

Social media’s role in amplifying such allegations cannot be understated. Platforms like Twitter and Instagram have become battlegrounds for public disputes, with influencers using live streams and direct messaging to share potentially damaging narratives.

The cryptocurrency market remains volatile, with daily fluctuations creating unprecedented financial landscapes. Young investors often find themselves navigating complex investment strategies with limited understanding of underlying risks.

Blockchain technology experts emphasize the importance of due diligence. “Investors must understand that celebrity endorsements are not guarantees of financial success,” said blockchain consultant Elena Martinez. “Every investment carries inherent risks.”

Drake’s potential legal team will likely scrutinize every detail of the allegations, considering potential defamation claims and reputation management strategies. The entertainment industry watches closely, understanding the significant implications of such public accusations.

The incident underscores broader conversations about financial literacy among young digital content creators. Social media influencers increasingly blur lines between entertainment, financial advice, and personal branding.

Regulatory bodies continue to develop frameworks to address the complex ecosystem of digital investments, celebrity endorsements, and potential fraudulent activities.

As the story develops, the allegations represent more than a simple dispute. They illuminate critical questions about accountability, financial responsibility, and the evolving nature of digital investment culture.

The cryptocurrency and entertainment industries await further developments, recognizing the potential systemic implications of such high-profile accusations.

Verification remains crucial, with many industry observers emphasizing the need for comprehensive evidence and transparent communication from all involved parties.