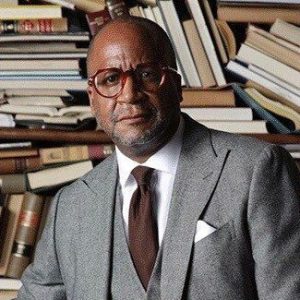

As Bank of America’s newly appointed Detroit President, Ed Siaje embodies the intersection of local roots and global banking innovation. A Southeast Michigan native with 26 years in financial services, Siaje leads a team of 1,300 professionals while serving as Private Bank market executive for Michigan and Minnesota. His appointment comes at a pivotal time for Detroit’s financial landscape, where technology meets tradition and community development remains paramount. In this exclusive interview, Siaje reveals how Bank of America is transforming banking in Detroit, from pioneering digital solutions to investing in first-time homeowners and local nonprofits.

[Editor’s note: This is a truncated transcription of a longer video interview. Please see the video for the extended version. Some errors may occur.]

When you think of your mission and your recent promotion, what’s it like to be a leader in Detroit?

First of all, it was a sense of achievement for me personally, to be frank. I’ve worked hard and put my heart in the right place. I’ve spent a lot of time in different lines of business across the bank, shoulder to shoulder with over 1,300 teammates. So it was a great feeling, to be honest with you. But the greatest part of it was the applause, the recognition, and the support from the teammates that I’ve received. That’s what makes it all real and come to life.

Let’s talk about Bank of America and its role in Detroit.

Bank of America is a great organization in a lot of ways. I’m honored and proud to work for them and represent my teammates here locally. My focus is on working with our clients here locally, in the nonprofit world, and in our communities where we live, work, and play. And, of course, the teammates who deliver it all. If you don’t have the right people who are engaged, you can’t really get anything done.

From a client and community perspective, we do so much. I’m in awe every day. For example, we’re leaning hard into homeownership. We have programs where we provide up to $7,500 for closing costs, and 3% or up to $10,000, to help with down payment assistance. We’ve helped 300 people locally over the last few years get into their first home. We also do a lot of education around that, which is awesome. We have a community officer focusing on the small business community, helping small business owners build plans, budget, and access tools and resources to operate their first business and grow.

Just this week, we awarded to two nonprofits—Empowerment Plan and National Faith Homebuyers with $200,000 grants each, along with executive education for their senior leader and an emerging leader in their organization. They’ve told us that the executive education is worth more than the $200,000 because they usually don’t have the money to invest in leadership development. We logged over 18,000 volunteer hours this year. It’s just a great feeling to be involved and help in a place I’ve personally grown up in my entire life.

What advice would you give to young people wondering if they can become president of a major market bank?

The door is wide open—very wide open. We need and want more people of color in the industry, especially in the wealth management space. It’s a great career and an incredible opportunity. We have a lot of programs to help people develop within the bank. I’m also proud that we pay a minimum wage of $24 an hour now, which will increase to $25 an hour by 2025. We want young minds from all races and backgrounds to come in, learn, and grow with us.

Regardless of which line of business they start in, we’re keenly focused on developing people and helping them advance their careers. We want individuals with passion, and we’ll take care of the rest. Welcome. Give me a call. Apply online. The more, the merrier.

Did you ever imagine the level of technology where a person can bank from home?

Honestly, it’s incredible. And it’s moving so fast. A bank of our size has the tools, resources, and, frankly, the money to invest in technology at a great level. The things you can do at an ATM machine today are incredible. You really don’t ever have to walk into a financial center or branch anymore. Most of your banking can be done online.

We’re redesigning our branches to be destinations where our clients come for advice—not to make deposits or cash checks. Through our tools, our clients can build balance sheets, prioritize spending, and set budgets. We also have a program called Keep the Change. When you swipe your debit card for something like a $2.50 coffee, it rounds up to $3 and deposits the extra 50 cents into your savings account. The power of this program is unbelievable. You wouldn’t believe how much you can save by just rounding up transactions.

Why should families understand that rounding up and putting a little away is key to their financial future?

The power of compound interest and consistent saving, no matter how small, is huge. Life is unpredictable. Whether it’s a car repair, a leaky roof, or a broken furnace, these events happen. People who budget and save are better prepared for these challenges, while others might fall into credit card debt with growing interest that’s hard to escape. We spend a lot of time educating clients about budgeting, saving, and investing for their future. If your workplace offers a 401(k) plan, take advantage of it. If not, save separately and aim for six months’ worth of expenses. Building that financial cushion is critical, and we’re here to help in any way possible.

What’s the best way for individuals or small business owners to establish a relationship with Bank of America?

Walk into any of our 64 locations across Metro Detroit and tell us you need help. We’re happy to sit down and guide you step-by-step through opening your first checking or savings account, budgeting, and planning. We’ve also launched Family Banking, which is an excellent tool for teaching younger generations about finances. Parents can open accounts for their kids under 18, set limits, and encourage saving habits. For adults, we have experts ready to help with small businesses, home loans, and financial planning. We’re excited to welcome everyone and provide the support they need.

What title would you give to a speech at major Michigan universities, and what challenges would you present to future financial leaders?

I’d title it “The Power of Passion and Purpose in Finance.” The three challenges I’d present are: First, immerse yourself in learning. This industry requires deep knowledge of individual banking products, commercial lending, credit underwriting, risk, compliance, and regulations. It takes years to gain that expertise, so be curious and proactive every day.

Second, be passionate about what you do. Money is one of the most important aspects of people’s lives. It supports their families and futures, so we have a responsibility to be stewards with honesty, integrity, and focus.

Lastly, give back to the community. Get involved in employee networks, community events, and volunteer opportunities. It’s important to bring your whole self to work and uplift those around you. Those are the three keys to growing in this industry and potentially becoming the next president.

How do you stay culturally plugged in and leverage cultural insights to help business leaders?

I get involved. I show up. Whether it’s attending events or meeting with community leaders, I make an effort to stay engaged. I’m also lucky to have 1,300 teammates who support me. If I can’t attend an event, I tag someone else to be there. It’s all about leading by example and uplifting everyone around me. Just last Saturday, I attended the Michigan Hispanic Chamber of Commerce Gala. Staying involved in every part of the community creates a collaborative environment where everyone benefits. It’s amazing to see how everything works together.