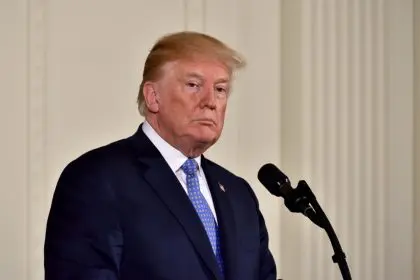

The trade war that everyone thought would drag on forever just took a dramatic turn that nobody saw coming. President Trump announced Wednesday that he’s secured a deal with China that could fundamentally reshape the global economy, giving America access to critical rare earth minerals while imposing a tariff structure that heavily favors the United States.

This isn’t just another incremental trade agreement that affects some agricultural products or manufacturing quotas. This deal strikes at the heart of China’s strategic dominance in the materials that power everything from electric vehicles to military defense systems. If the agreement holds, it represents one of the most significant shifts in global economic power in decades.

The timing couldn’t be more crucial, as the world transitions toward renewable energy sources that depend heavily on rare earth minerals. China has been using its monopoly-like control over these materials as leverage in international relations, but Trump’s deal appears to have broken that stranglehold in ways that could benefit American industries for years to come.

The rare earth revolution that China controlled

Understanding why this deal matters requires grasping just how completely China has dominated the rare earth mineral supply chain. These aren’t materials that most people think about, but they’re absolutely essential for modern technology and the green energy transition that every developed nation is pursuing.

China produces roughly 60% of the world’s rare earth minerals and processes nearly 90% of global supply, which means they control materials that are crucial for manufacturing everything from wind turbines to smartphone batteries to military equipment. That level of dominance gives them incredible leverage over other countries’ industrial and defense capabilities.

The strategic implications of China’s rare earth control became clear when they imposed export restrictions on several critical elements and magnets used by automotive and defense sectors. Suddenly, American companies found themselves potentially cut off from materials they needed to manufacture products essential to national security and economic competitiveness.

This dominance wasn’t accidental, it was the result of decades of strategic investment and willingness to accept environmental costs that other countries weren’t prepared to tolerate. China essentially cornered the market while other nations were focused on different priorities, creating a dependency that became increasingly problematic as tensions escalated.

The tariff structure that tilts everything toward America

The most striking aspect of Trump’s announced deal is the tariff arrangement that appears to heavily favor the United States. According to his Truth Social post, America will receive 55% tariffs while China gets only 10%, creating an economic structure that benefits American interests far more than Chinese ones.

That kind of tariff imbalance represents a massive shift from previous trade relationships, where agreements typically aimed for more balanced arrangements. The fact that China apparently agreed to such unfavorable terms suggests either significant pressure or strategic calculations that aren’t immediately obvious.

The 55% versus 10% split could provide American companies with substantial competitive advantages while making Chinese exports more expensive in the U.S. market. Over time, that kind of differential could encourage domestic manufacturing and reduce American dependence on Chinese supply chains.

However, the sustainability of such an arrangement depends on China’s willingness to honor the agreement and their calculation that access to American markets and students justifies accepting unfavorable tariff terms.

What China gets in return

The concessions that America is apparently making in this deal center around allowing Chinese students to attend U.S. colleges and universities, which might seem like a small price to pay for such significant trade advantages. However, educational access represents important strategic value for China’s long-term development goals.

Chinese students studying in American universities gain access to cutting-edge research, advanced technologies, and professional networks that can benefit China’s economic and technological development. The knowledge and connections developed through American higher education often translate into competitive advantages for Chinese companies and industries.

The student exchange component also maintains people-to-people connections that can help stabilize broader U.S.-China relations even when government-to-government tensions remain high. Educational partnerships create mutual understanding and shared interests that can provide foundation for future cooperation.

For China, maintaining access to American higher education might be worth accepting unfavorable trade terms, especially if they calculate that educational advantages will provide long-term benefits that outweigh short-term economic costs.

The oil market reaction that signals bigger changes

The immediate jump in oil prices following Trump’s announcement reveals how markets interpret this deal as potentially transformative for global energy dynamics. Brent crude futures rose $1 per barrel to $67.87, while West Texas Intermediate futures climbed 1.8% to $66.14.

Oil market reactions might seem counterintuitive for a deal focused on rare earth minerals, but the connection becomes clear when you consider how this agreement could accelerate America’s transition to renewable energy sources that require those critical materials.

If American companies gain reliable access to rare earth minerals at favorable terms, it could speed up domestic production of solar panels, wind turbines, and electric vehicle batteries. That acceleration of renewable energy adoption could eventually reduce oil demand, but in the short term, economic growth from new industries could actually increase energy consumption.

The oil price movement also reflects broader market optimism about improved U.S.-China relations and the potential for increased economic activity resulting from more stable trade relationships. When two of the world’s largest economies reduce trade tensions, it typically creates conditions for global economic growth.

The strategic implications that change everything

This deal represents more than just trade policy, it’s about reshaping global strategic relationships and reducing American vulnerability to supply chain disruptions. For years, U.S. officials have warned about the national security risks of depending on China for critical materials needed for defense systems and emerging technologies.

The agreement appears to address those concerns by securing guaranteed access to rare earth supplies while creating economic conditions that could encourage domestic processing capabilities. If American companies can access raw materials reliably, they might invest in domestic processing facilities that reduce long-term dependence.

The timing is particularly significant as the United States and other developed nations accelerate their transitions to renewable energy sources. Having secure access to the materials needed for that transition removes a major strategic vulnerability while potentially accelerating the pace of change.

However, the deal’s success will depend on implementation details and both countries’ willingness to honor their commitments even when political tensions arise in other areas of the relationship.

What this means for the global economy

If this agreement holds and gets implemented as described, it could represent a fundamental shift in how global supply chains operate and how countries approach strategic resource management. The deal suggests that even dominant suppliers like China can be pressured into making significant concessions when faced with determined negotiation.

The agreement could also encourage other countries to reassess their own dependencies on Chinese supply chains and develop alternative arrangements. If the United States can successfully secure favorable terms for critical materials, other nations might pursue similar strategies.

For American businesses, the deal potentially provides competitive advantages that could translate into increased domestic manufacturing, job creation, and reduced costs for products that depend on rare earth materials. Industries ranging from automotive to defense to renewable energy could benefit significantly.

The global implications extend beyond trade to geopolitical relationships, as countries align their economic interests with their strategic partnerships. This deal could influence how other nations approach their relationships with both the United States and China.

The agreement that reshapes everything

Trump’s announced trade deal with China represents the kind of strategic breakthrough that could influence global economic relationships for decades to come. By securing access to critical rare earth minerals while imposing favorable tariff terms, the agreement addresses fundamental American vulnerabilities while creating conditions for economic growth.

The success of this deal will ultimately depend on implementation and both countries’ commitment to honoring their agreements even when other tensions arise. However, if the terms hold as described, it could mark a turning point in U.S.-China economic relations and America’s strategic independence.

Most importantly, the agreement demonstrates that even seemingly insurmountable trade challenges can be resolved through determined negotiation and willingness to make strategic concessions. The deal provides a template for how major powers can address economic conflicts while maintaining the cooperative relationships necessary for global stability and prosperity.