Do you know your credit score? If you don’t, you should. Here’s why. Your landlord, your potential employer, insurance companies and even cellphone providers are keeping tabs on it. As part of Get Smart About Credit month, Wells Fargo is giving free credit scores to its customers.

Do you know your credit score? If you don’t, you should. Here’s why. Your landlord, your potential employer, insurance companies and even cellphone providers are keeping tabs on it. As part of Get Smart About Credit month, Wells Fargo is giving free credit scores to its customers.

Why you can’t let this opportunity pass …

For example, in a city like Atlanta, average credit scores are now 727, according to Experian, below the national average of 750 and down from 736 five years ago. Atlanta’s current ranking among larger metros is even lower than its ranking of 96th in 2007.

“We have a real opportunity to help many Atlantans start managing credit and debt in a better way,” offers Pamela Cross, senior community development manager for Atlanta. “We want our customers to take charge of their credit and we believe we have an important role in helping them do just that.”

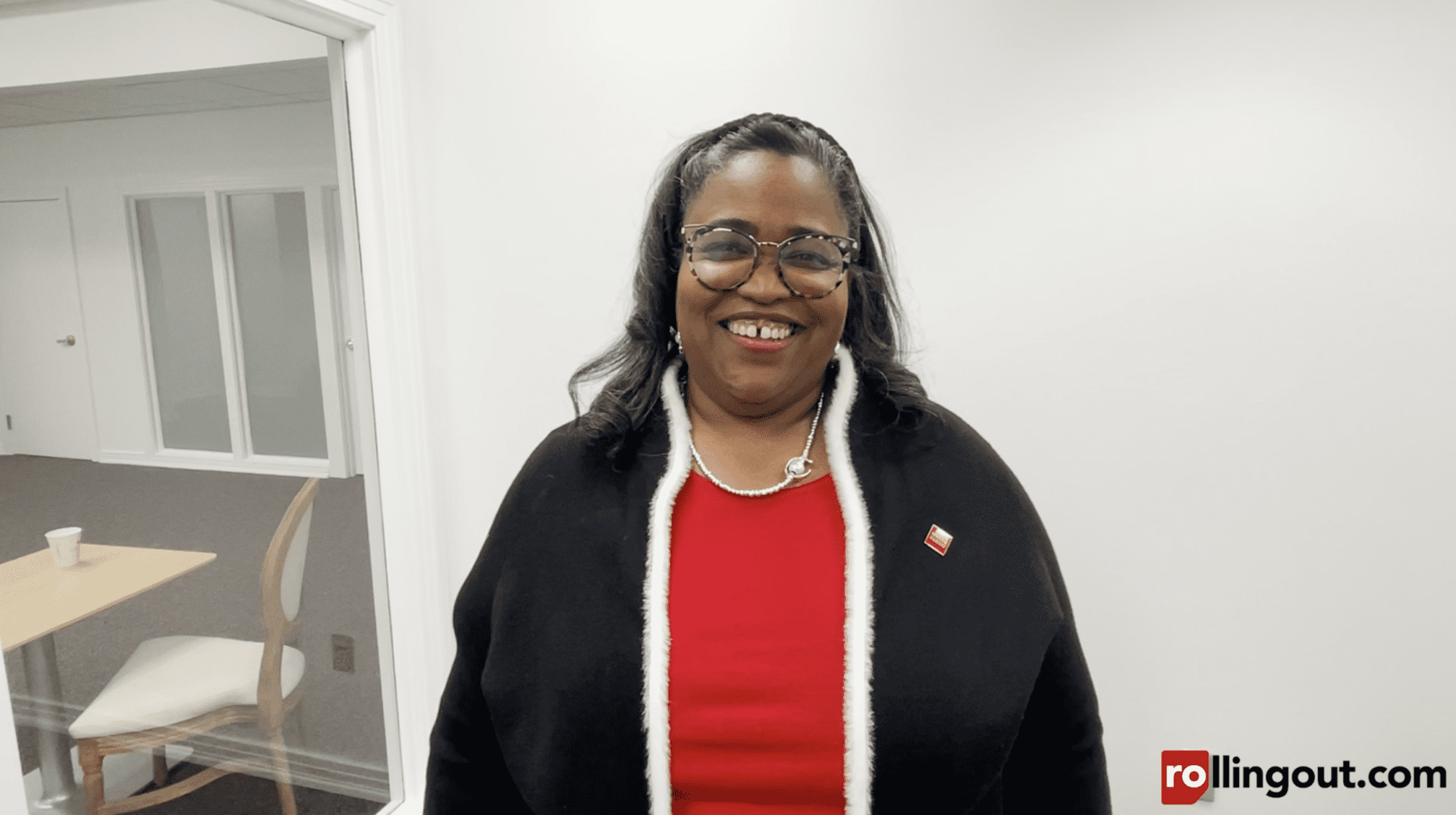

Mechel Glass, vice president of community outreach for CredAbility, a nonprofit credit counseling service based in Atlanta, adds that credit scores are “very important.”

“Your credit score determines the interest rate you will pay for mortgages, automobile loans, credit cards, personal lines of credit, and more,” she said. “Consumers with lower credit scores will be less likely to get approval for zero interest rate promotions or take advantage of opportunities to transfer balances to credit lines with lower interest rates. Knowing your credit score and how to earn and maintain the best possible score should be part of an overall strategy to maintain your fiscal health.”

Here, Cross expounds on next steps and why customers should take advantage of this free opportunity.

Once you know your credit score, what is the next step?

Schedule an appointment to go see your banker. Your banker can give you advice on how to improve your score — sometimes it’s a matter of paying off an old forgotten bill. Or, if you already have a great score, he or she can talk to you about financial options that will let you take advantage of it. Perhaps you can lower your monthly credit-card payments through a consolidation loan — or even lower your monthly car payment through an auto loan refinance.

When should customers be concerned?

Credit scores above 680 are considered very good and above 740 are excellent, according to the credit agency Experian. Scores below that may be cause for concern — though banks take more than credit scores into consideration in lending. Again, your banker can help but only if you talk to him or her!

Why did Wells Fargo decide to offer this service for free?

It’s a great way to help our customers, especially since most Americans don’t know their credit score. You can’t raise your score or take advantage of it if you don’t know what it is. It’s also Get Smart About Credit month, so it fits right in.

Customers have until Nov. 15, 2012, to get their credit score for free. Credit agencies on average charge a fee of $12 for this service. If you have an account with Wells Fargo, you can visit a bank to receive a personal access code for a credit score.