Wells Fargo donated $6 million shared across 59 nonprofits through its 2012 Leading The Way Home® program Priority Markets Initiative to help stabilize and revitalize neighborhoods hard-hit by the economy. The Leading The Way Home® Priority Markets Initiative provides grant support for neighborhood stabilization projects that are located in areas designated for revitalization to stimulate growth, stability and investment in distressed areas.

Wells Fargo donated $6 million shared across 59 nonprofits through its 2012 Leading The Way Home® program Priority Markets Initiative to help stabilize and revitalize neighborhoods hard-hit by the economy. The Leading The Way Home® Priority Markets Initiative provides grant support for neighborhood stabilization projects that are located in areas designated for revitalization to stimulate growth, stability and investment in distressed areas.

According to Hugh Rowden, senior vice president, servicing and community relations at Wells Fargo Home Mortgage, “Wells Fargo’s Leading the Way Home helps communities and stake-holders in the community understand what is needed to stabilize and advance their communities. The education and awareness happens – internally and externally – where information and strategies are shared and partnerships formed.

“These partnerships have enabled us – Wells Fargo and the 59 nonprofits – to assist 7 out of 10 people with avoiding foreclosure.”

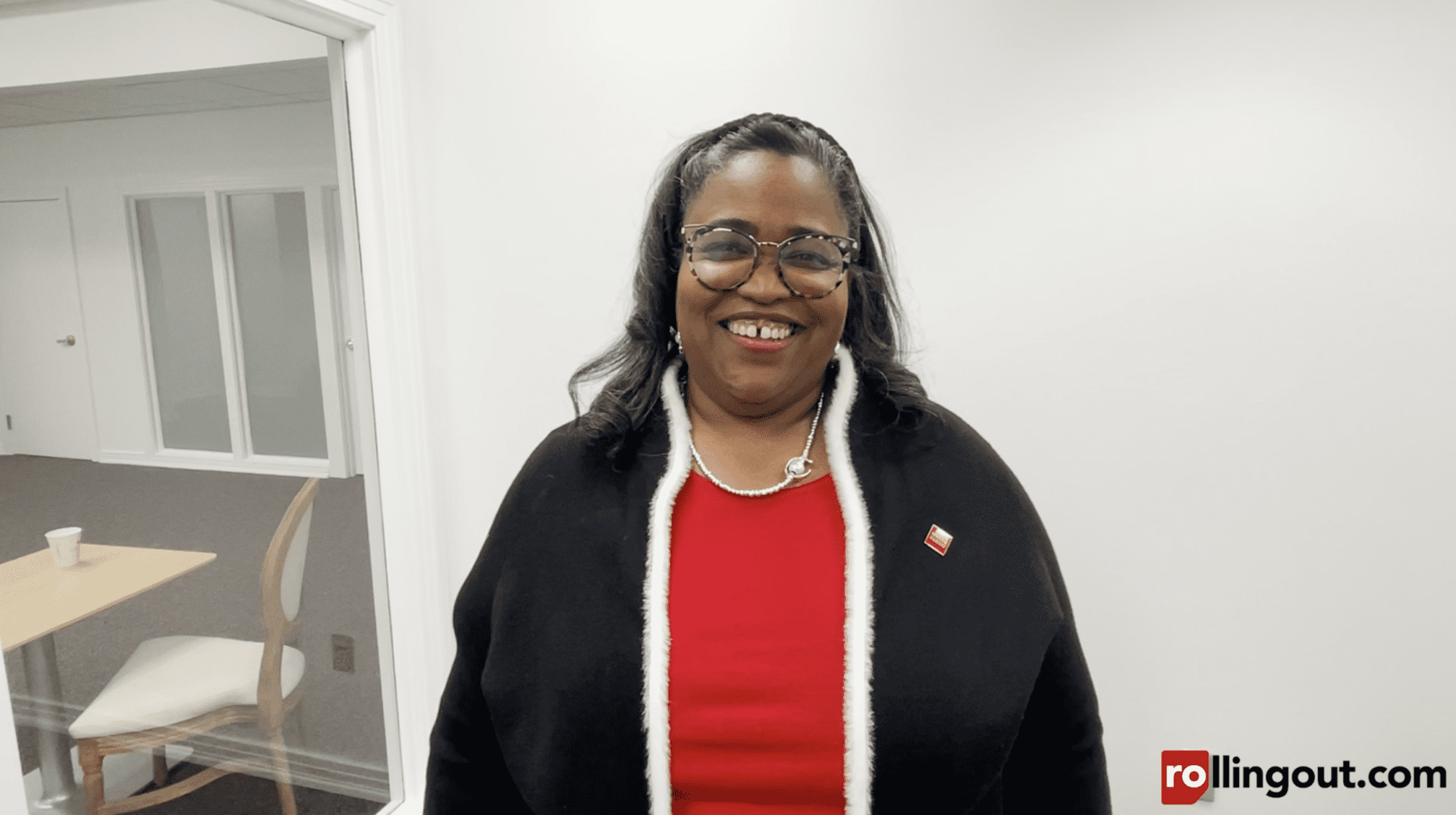

Read what else Rowden has to say about this progressive partnership. –yvette caslin

Why is it important for Wells Fargo to be engaged with nonprofits at this level?

One of our visions as a company is to help our customers succeed financially. Whether a customer is buying a home, paying for education, saving for retirement, investments or for growing a business. We want to be right there with them. The way to do that is to work with local non-profits. In the housing area, we work with HUD-certified non-profits. What our results have shown us, as it relates to keeping people in their homes, together with the non-profits we’re able to encourage 80 percent of the customers who are more than 60 days delinquent to work with us. When they do work with us, Wells Fargo and the HUD-certified nonprofit, seven out of 10 times, they are able to avoid foreclosure. For customers who choose to go that path on their own, only one out of every three is able to avoid foreclosure.

What were three major criteria in the selection process?

HUD-certified

One of the major criteria is for those non-profits to be HUD-certified non-profits. We know they are getting the guidance, the experience[and] the training they need in order to be able to be able to effectively help our customers.

Local in the community with a proven track record of doing pre-purchase counseling and loss litigation

We look for non-profits that are local, in the community and have a track record for helping people that not only have payment challenges, but also helping people get into homes.

Scale appropriate to the area or market need

The last criteria that we look at is that the scale and size of the non-profit complement the needs of that community.

How will the program be evaluated for effectiveness?

When you partner with non-profits who provide pre-purchase counseling and counseling to keep people in their homes, the work is never done. When you see communities stabilized, housing prices [increasing] because people are staying in their homes and when inventory is moving, an increase in pre-purchase counseling for first-time home-buyers which consistently drives results and help people get into and keep their homes are the many ways we measure success.

In 2011, $88 million dollars was cut from funding to HUD-approved agencies. Wells Fargo took a different approach and we actually increased our funding commitment to national and local credit counseling agencies by over 35 percent to $12.4 million. This approach helped us give grants to specific, larger non-profits that helped with education and educating other non-profits. That was about $1 million in that space. Additionally, we gave $3 million to NeighborWorks, who provided a training institute for non-profits, so they do a train the trainer and they also provide scholarships for non-profits. For counseling agencies who meet face-to-face with customers, we gave another increase of $1.2 million. Non-profits know the market, the communities, all of stake-holders in the communities. We have 270,000 U.S.-based employees spread all over the country, it’s always important that we support those non-profits in funding and as it relates to volunteering our time as Wells Fargo employees.