Nearly 8,900 local homeowners invited to workshop to help avoid foreclosure

Wells Fargo & Company (NYSE: WFC) is hosting a free Home Preservation Workshop in Atlanta for Wells Fargo Home Mortgage, Wells Fargo Financial and Wells Fargo Home Equity customers facing financial hardships. Wells Fargo has invited nearly 8,900 mortgage customers to the free workshop which will be held on Thursday, Nov. 14 from 9 a.m. to 7 p.m. at the Georgia International Convention Center, Exhibit Hall B, located at 2000 Convention Center Concourse in College Park. Parking is free.

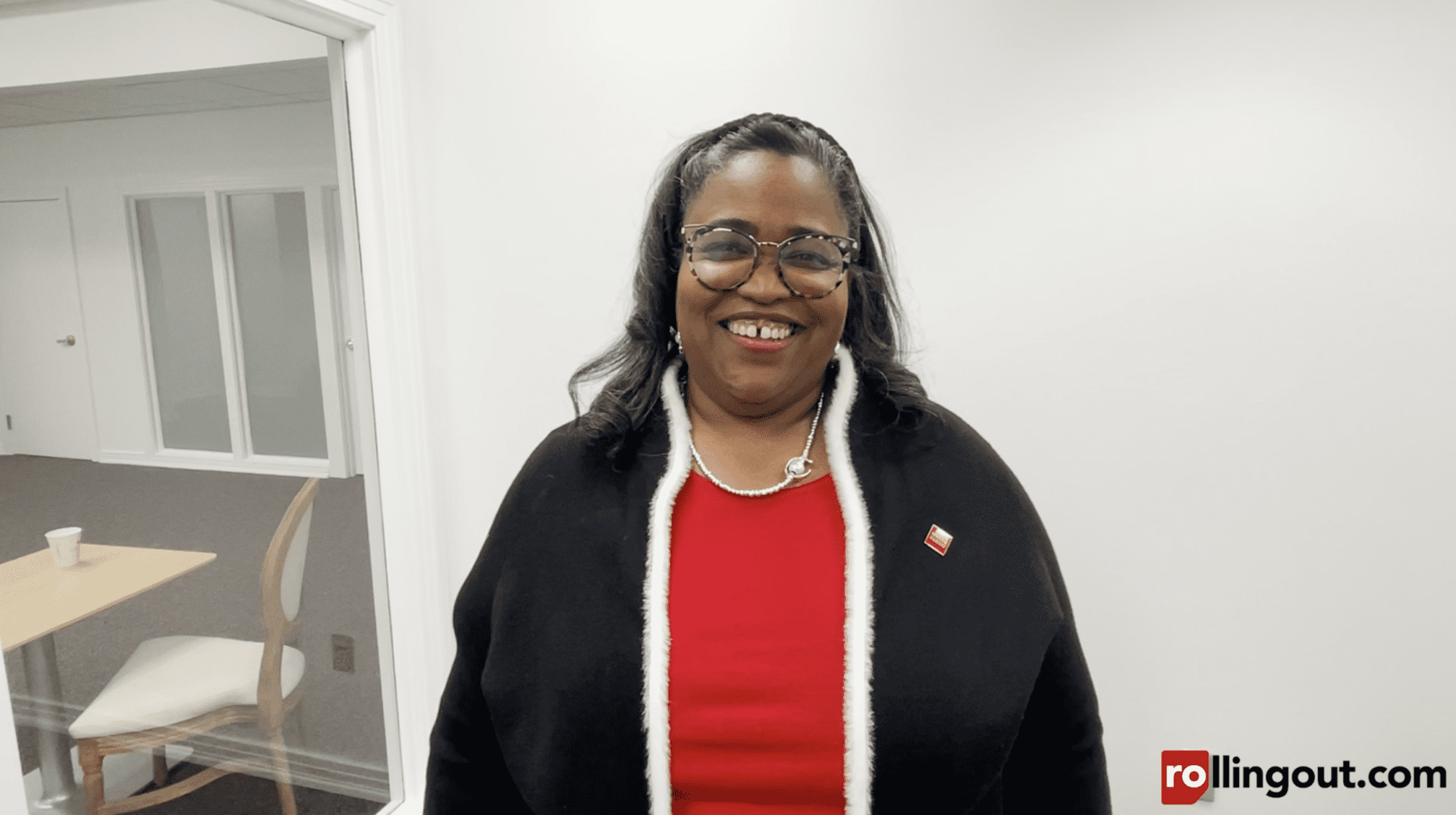

Local nonprofit credit counseling agencies – CredAbility, D & E Financial Education and Training Institute, and Urban League of Greater Atlanta — will be onsite to provide assistance to homeowners who have credit challenges that extend beyond their mortgage payments.

Homeowners whose loans are “under water” – meaning they owe more on their mortgage than the value of their home – may be eligible to refinance their loan based on certain criteria, including demonstrating ability to repay. Depending on eligibility for a loan modification, homeowners who are behind on their payments may also receive a principal reduction on their mortgage.

How to register for Wells Fargo’s Home Preservation Workshops:

Walk-ins are welcome although registration is strongly recommended in order to guarantee the ability to meet one-on-one with a representative. Customers should register by Tuesday, Nov. 12, at www.wfhmevents.com/

“While our foreclosure and delinquency rates are below the industry average, and nationwide we have assisted nearly 886,000 customers with modifications, our goal with this workshop is to help as many homeowners as possible avoid foreclosure,” said Hugh Rowden, Wells Fargo Home Mortgage Community Outreach Manager. “During these free workshops, Wells Fargo Home Mortgage customers who are faced with payment challenges will have the opportunity to meet face-to-face with our home preservation specialists to explore the options available to them.”

Where possible, borrowers will receive a decision on a workout, loan modification or other options, on site or shortly following the workshop. Options include Wells Fargo’s own loan modification program and the federal government’s Home Affordable Modification Program (HAMP). About 75 Wells Fargo home preservation specialist team members, including bilingual specialists, will be on hand at the upcoming workshop to assist customers.

This is the fourth time Wells Fargo has hosted Home Preservation Workshops in the Atlanta area. During the first three workshops combined, more than 4,000 homeowners have attended. This will be the 104th large-scale Home Preservation Workshop Wells Fargo has hosted since September 2009, and the company has participated in more than 1,125 home preservation events during that time. Wells Fargo home preservation specialists have met with nearly 44,000 customers at its Home Preservation Workshops in an effort to help them avoid foreclosure.

Customers facing mortgage payment difficulties also can call 1-800-678-7986 for more information about potential options to avoid foreclosure.

The Facts about Wells Fargo Home Loans:

- Wells Fargo originates nearly one in every four home loans in the country, and services one of every six.

- In the third quarter of 2013, approximately 94 percent of Wells Fargo’s mortgage customers nationwide remained current on their loan payments.

- From January 2009 through August 2013, Wells Fargo has modified more than 885,795 mortgage loans. Of those modifications, 84 percent were done through Wells Fargo’s own modification programs and 16 percent were through the federal government’s Home Affordable Modification Program (HAMP).

- As of the third quarter in 2013, Wells Fargo’s delinquency and foreclosure rates remain significantly below the industry average.

- Less than 1 percent of the loans secured by owner-occupied homes and serviced by Wells Fargo resulted in a foreclosure sale in the last 12 months.

- Just 6.33 percent of mortgage loans Wells Fargo services were past due or in foreclosure in the third quarter of 2013 compared to an industry average of 7.76 percent as of the secondquarter.