Unemployed homeowners may also begin process of applying for aid from HomeSafe Georgia

Atlanta’s largest home lender, Wells Fargo, is hosting a free Home Preservation Workshop for its customers facing mortgage payment challenges and at risk of foreclosure. And for the first time, homeowners will be able to begin the process of applying for assistance from HomeSafe Georgia, a state government agency which provides mortgage payment assistance to unemployed and underemployed Georgians.

More than 5,000 Wells Fargo Home Mortgage, Wells Fargo Financial and Wells Fargo Home Equity customers have been invited to the workshop that will be held Tuesday, Sept. 9 from 9 a.m. to 7 p.m. at the Georgia International Convention Center, 2000 Convention Center Concourse in College Park.

“Atlanta has made great progress on the foreclosure issue, but too many homeowners still have problems and they often extend beyond their mortgage payment,” said Hugh Rowden, community outreach director with Wells Fargo Home Mortgage. “Nationwide, 94 percent of our customers are current with their mortgage — but others still need assistance.”

Two nonprofit groups that assist homeowners applying for help from HomeSafe Georgia, D&E Counseling and ClearPoint Credit Counseling Solutions, will be at the event to start the application process for aid from the program. HomeSafe Georgia is a federally funded program that provides up to 24 months of mortgage payment assistance to homeowners who experienced hardship due to unemployment or underemployment during the last 36 months. It is administered by the Georgia Department of Community Affairs. More information is available at www.homesafegeorgia.com.

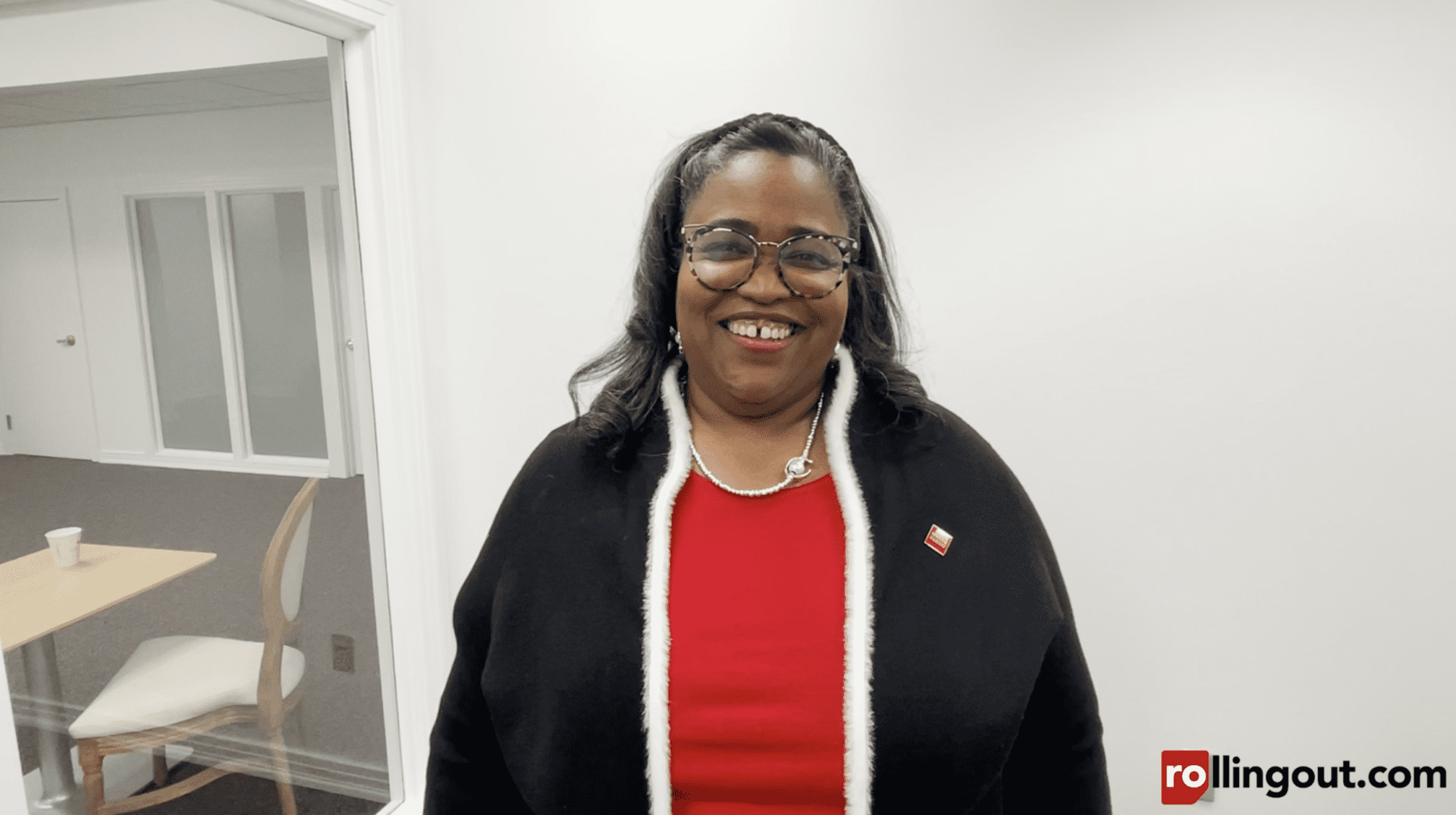

“While the Georgia economy continues to improve, unemployment and underemployment continue to be the main drivers of foreclosures across our state,” said Carmen Chubb, deputy commissioner of housing for the Georgia Department of Community Affairs. “Our program can help a number of homeowners avoid foreclosure, so the assistance HomeSafe Georgia is able to provide goes hand in hand with what Wells Fargo is trying to accomplish. This is a great chance for us to team up.”

As another enhancement, several local nonprofit credit counseling agencies will be bringing their files on clients for homeowners who cannot attend in person so they can work directly with home preservation specialists. And nonprofits will also be on-site to provide assistance to homeowners who have credit challenges that extend beyond their mortgage payments.

How to register for Wells Fargo’s Home Preservation Workshop:

Walk-ins are welcome although registration is strongly recommended in order to guarantee the ability to meet one-on-one with a representative. Customers should register by Sunday, Sept. 7 at www.wfhmevents.com/leadingthewayhome or call 1-800-405-8067 for more information.

“Wells Fargo has already helped thousands of homeowners avoid foreclosure in the Atlanta area,” Rowden said. “If homeowners work with us, we are able to provide options to seven out of 10 that can help them save their homes. We’re doing what we can to reduce this lingering problem.”

Those who attend will have the opportunity to meet face-to-face with home preservation specialists and HUD-approved credit counselors to explore the options available to them.

Where possible, borrowers will receive an on-site decision on a workout, loan modification or other options, or shortly following the workshop.Options include Wells Fargo’s own loan modification program and the federal government’s Home Affordable Modification Program aka HAMP. About 75 Wells Fargo home preservation specialist team members, including bilingual specialists, will be on hand at the upcoming workshop to assist customers.

Homeowners whose loans are “under water” — meaning they owe more on their mortgage than the value of their home — may be eligible to refinance their loan based on certain criteria, including demonstrating ability to repay. Depending on eligibility for a loan modification, homeowners who are behind on their payments may also receive a principal reduction on their mortgage.

This will be the fifth large-scale Home Preservation Workshop Wells Fargo has hosted in Atlanta. Already, they have been attended by more than 4,250 customers. Wells Fargo has hosted 115 such workshops across the country since September 2009 and met with more than 45,000 customers at its Home Preservation Workshops. Overall, Wells Fargo has participated in more than 1,250 outreach events to help its customers with options to avoid foreclosure.

Customers facing mortgage payment difficulties also can call 1-800-678-7986 for more information about potential options to avoid foreclosure.

About Wells Fargo Home Loans

- Wells Fargo originates, and services, nearly one in every five home loans in the country.

- In the second quarter of 2014, more than 94 percent of Wells Fargo’s mortgage customers nationwide remained current on their loan payments.

- From January 2009 through May 2014, Wells Fargo has modified nearly 961,697 mortgage loans. Of those modifications, 85 percent were done through Wells Fargo’s own modification programs and 15 percent were through the federal government’s Home Affordable Modification Program.

- As of the second quarter in 2014, Wells Fargo’s delinquency and foreclosure rates remain significantly below the industry average.

- Less than 1 percent of the loans secured by owner-occupied homes and serviced by Wells Fargo resulted in a foreclosure sale in the last 12 months.

- Just 5.56 percent of mortgage loans Wells Fargo services were past due or in foreclosure in the first quarter of 2014 compared to an industry average of 6.11 percent.