Black entrepreneurship is booming. African American women are the fastest growing group of entrepreneurs in America, a new study reveals. The report finds that the number of women-owned business grew 1.5 times the national average, and Black women blow that statistic away. The number of businesses owned by African American women grew 322 percent since 1997, making Black females the fastest growing group of entrepreneurs in the U.S.

The world of business continues to gain speed and evolve, Black entrepreneurs are working hard to keep up and leverage the new technology available to them to help improve their businesses and sales. Small businesses are seeking faster, more convenient lending options — Wells Fargo is offering a lending option at competitive rates via the new FastFlex Small Business Loan. FastFlex is an online, fast-decision loan that is funded as soon as the next business day and offers a competitive interest rate to small businesses with short-term credit needs. Wells Fargo is the only financial institution offering this for the first time ever.

FastFlexSM Small Business Loan builds on Wells Fargo’s focus on small businesses, a market in which the company has set a five-year $100 billion lending goal. Since setting the goal in 2014, Wells Fargo has provided $40.7 billion in new loans to small businesses (January 2014 – March 2016).

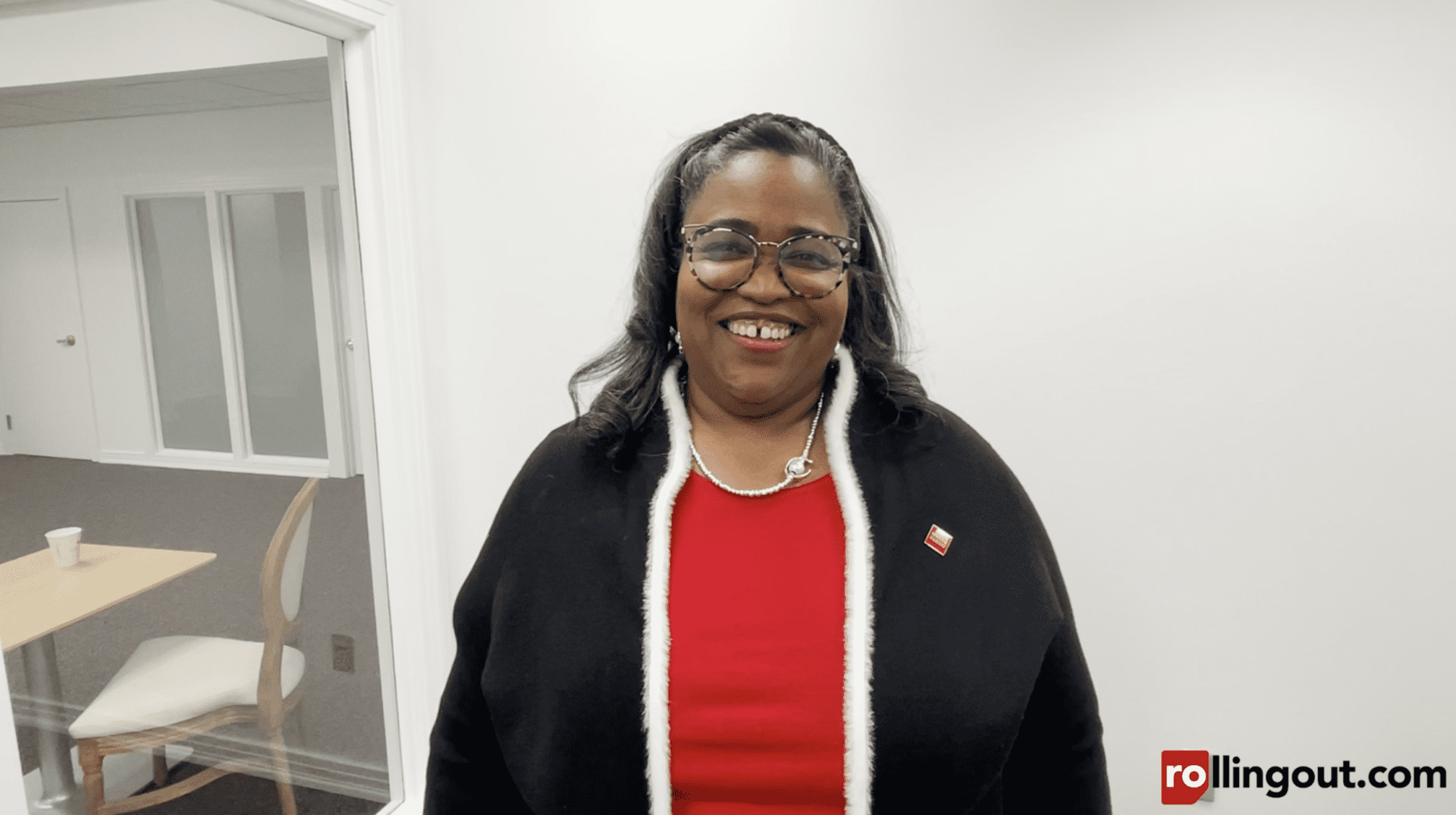

“Because small businesses want faster, more convenient loan options, online and at competitive rates, we created Wells Fargo FastFlex Small Business Loan,” says Lisa Stevens, Wells Fargo’s head of Small Business. “With a $100 billion lending goal, we want to make every responsible small business loan we can. FastFlex Small Business Loan will help by offering short-term credit through an easy, fast-decision application process that includes competitive interest rates, clear terms and as-soon-as next day funding. This will put short-term credit within reach for many small businesses seeking to achieve financial success.”

The FastFlex Small Business Loan will be available with one-year terms, at amounts ranging from $10,000 to $35,000.

From now through June 30, 2016, Wells Fargo is conducting its annual Small Business Appreciation Celebration. During this time, Wells Fargo will provide business owners with special business offers on several products and services.