Chris Gardener

Bevon Joseph is hoping to give minorities an invaluable resource, marketable financial skills, and that is why he launched The Greenwood Project. Read on to learn more about the knowledge Joseph plans to impart to young people about working in the financial services industry.

What was the purpose of starting the Greenwood Project?

The mission of the Greenwood Project is a simple one. We want to help introduce minority youth from economically challenged communities to the financial industry. This will help expose them to careers they otherwise wouldn’t have known existed.

Although many trading firms have diversity initiatives, minorities often do not apply to such positions because they are unaware that they exist. My main purpose for starting Greenwood is to close this gap by facilitating and establishing internship opportunities for minorities.

Internships at many firms have become a privilege unfortunately, but Greenwood is on a mission to level the playing field.

How did you determine the target the population for your nonprofit to serve?

The African American and Latino population are drastically underrepresented in the financial services sector in Chicago.

Diversity within the financial industry in Chicago does not reflect the diversity of the city.

– African Americans make up 32 percent of Chicago’s total population but only 12% of Chicago’s financial services industry.

– Hispanics and Latinos make up 28 percent of Chicago’s total population but only 10 percentof Chicago’s financial services industry.

Here is another eye opening statistic — nationwide, African Americans only account for 8 percent of general engineering majors, 7 percent of math majors, and 5 percent of computer majors.

This means that although there has been an increase in college access among African Americans, the vast majority of students are pursuing degrees that lead to low paying careers. Again, this is through no fault of the students.

The financial industry careers that Greenwood is trying to expose young people to are mostly STEM related careers. In my opinion, it just doesn’t make sense to graduate college with $100 thousand dollars in student loan debt, and then get a job paying $25 to $30 thousand dollars a year.

I decided to target young people entering their senior year of high school and also college freshman and sophomores, since this is the time students start looking into colleges, majors or are just not certain of what they will do post high school. I think that exposing young people earlier gets them interested in this sector and via our programs, keeps them engaged for the long term as well.

Describe the three most important educational elements the Greenwood Project provides.

Financial literacy and money management.

Real world working experience.

Personal brand and network building.

Why is this project important to the financial industry?

The Greenwood Project is trying to create early awareness of career opportunities in this sector for students, but also help our financial services partners expand their sources of recruitment of new graduates.

“Wall Street traders set prices more accurately — meaning that financial asset bubbles may be less likely to form — when all of the other traders don’t look like them. Specifically, ethnically diverse groups became 21 percent more accurate over time while ethnically similar groups became 33 percent less accurate over time, according to an academic study.” – by Joann Weiner November 26, 2014 – Washington Post

Chicago’s financial Services Industry is well aware of the lack of diversity. Many. I’ve worked in this industry for nearly 20 years and there are still firms who have less than 1 percent representation of minority employees. Firms want to diversify, but have been struggling to do so. The Greenwood Project’s goal is to help our financial firm partners bridge the gap between the minority community and the industry.

What three skill sets are taught at the Greenwood Project?

Awareness of the financial services industry and the stock market.

Valuable soft skills.

Personal development skills.

What practical application will the students take away from the Greenwood Project?

Interestingly, we began this project less than a year ago wanting the students to take away an exposure and an experience. To our surprise, several of our students have been asked to return next year for internships and two are being heavily recruited for employment by a big bank and a Chicago based financial exchange.

What role models and environments does the Greenwood Project introduce the student to during the program?

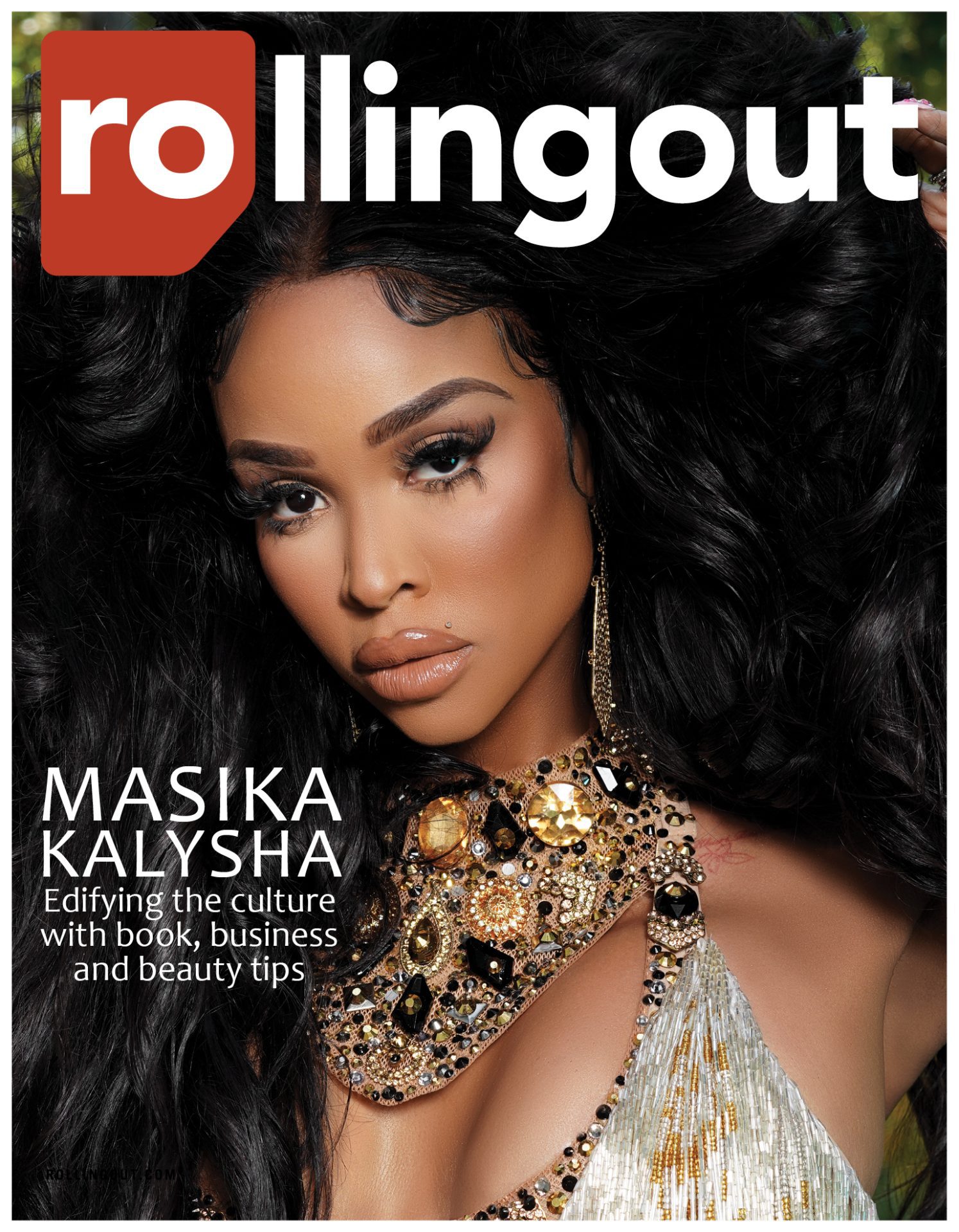

At our closing ceremony we had keynote speaker Chris Gardner [author, The Pursuit of Happyness] talk to our young people about his journey and story. He spoke of being not just good at what you do, but being world class at it. His passion for his work, even before he was successful, proved to be extremely critical to him achieving his long-term goals. Our students were all captivated during his entire speech and left truly inspired.

One of the summer initiatives of The Greenwood Project for our students is a Trading Firms and Financial Services Institutions Summer Tour. We took 60 students to the offices of Chicago trading firms and financial services institutions to get a tour and hear from employees of those firms about what their company does and the many career paths available to the students. We visited a total of five financial firms this summer; Goldman Sachs, CME, CBOE, TD Ameritrade and Group1 Trading.

We believe and observed that just having our students experience the trading floors and office spaces of hedge funds, proprietary trading firms, stock exchanges etc., can spark interest and increase awareness of the industry. This is the type of exposure that minority students need and the Greenwood Project is focused on facilitating.

How does the Greenwood Project aid in the development of future leaders for the community?

By taking them out of the community, introducing and place them with financial institutions whose pay grades are significantly above average. Once they’re in, the sky is the limit. It’s very possible that they too can have a story like Mellody Hobson (Ariel Financial) or Chris Gardner.

What reading materials shared?

Although we encourage reading. There isn’t much reading material that we share. We get the students involved with workshops, training, and scenarios. The students are able to quickly see the results based on demonstrations, opposed to reading about possible outcomes.

Finish the sentence:

The Greenwood Project will … level the playing field by allowing minority students from economically challenged neighborhoods to gain the same type of exposure to the financial industry, as students who have automatic access and are privileged to the same opportunities. Greenwood in just a few months has already been a disruptor startup nonprofit, and our model works and will change the game.

Talent isn’t the problem, [lack of] opportunity and exposure is.

www.facebook.com/

twitter.com/greenwood053121