The No Cook County Beverage Tax Coalition is arguing a “proposed regressive tax would cost Cook County residents, raising the prices on hundreds of common grocery store items for working families and destroying local jobs.”

Beverage industry employees, business organizations, small business owners and hundreds of other supporters rally in opposition to the Cook County board’s proposed regressive beverage tax, which proposes a new, penny-per-ounce tax on common beverages families purchase in the grocery store like sports drinks, teas, lemonades, sodas, and juice drinks.

The proposed tax on sweetened drinks doesn’t come without impact or protest. A regressive sales tax, it is touted as a measure to “help pay for public health and emergency services.”

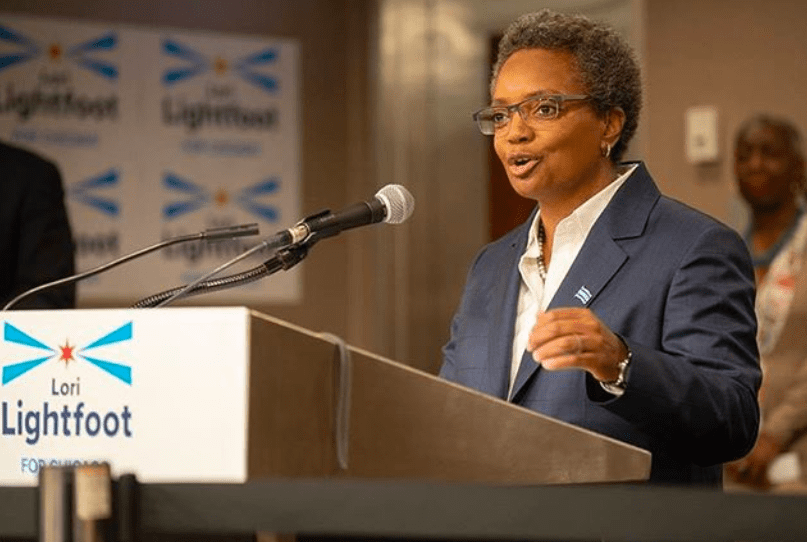

In October, Cook County board president Toni Preckwinkle revealed her 2017 budget includes a plan to start taxing sweetened drinks, adding that she can balance her $4.4 billion dollar budget with a combination of spending cuts and new revenue and this is a way to protect people’s health.

There are many Chicagoans who aren’t buying into this tax and urge the board to be mindful fewer beverages consumed would mean decreased production and cost jobs.

“Taxing sweetened beverages can lower obesity, Type 2 diabetes and tooth decay,” she avers.

Preckwinkle says she will be subjected to cutting spending on healthcare and public safety if the tax doesn’t pass.

We don’t need any more taxes. We need elected officials who can better manage budgets. What will be next? The snack tax. Or perhaps the cupcake tax.

According to the proposal, a “sweetened beverage” contains sugar or artificial sweetener, like carbonated soft drinks, fruit beverages that are not 100 percent fruit juice, sports drinks and energy drinks. Water, different kinds of milk and baby formula are not considered sweetened beverages.

The Illinois Beverage Association’s sent out a release earlier this month that said a $.01 per ounce tax would increase the cost of a $.99 2-liter bottle by $.68, a nearly 70% increase. A 12-pack would be increased in cost by $1.44.

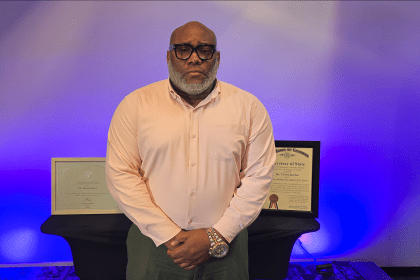

“There are 2,200 Teamsters employed in Cook County whose livelihoods are directly or indirectly dependent upon the non-alcoholic beverage industry. Additionally, there are thousands of small business owners and their hardworking employees who could face layoffs should the county raise another tax,” John T. Coli, president of Teamsters Joint Council 25 and chairman of the Illinois Coalition Against Beverage Taxes says in a statement to press. “Our union stands strongly opposed to beverage taxes.”

A 15-ounce double-shot Starbucks energy drink would cost about 15 cents more.

The American Beverage Association is suing the city of Philadelphia for imposing a similar tax. The ABA says consumers should not have to pay a sales tax and a beverage tax on one item.