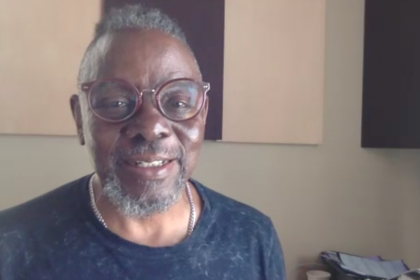

Ian Jakovan Dunlap, the founder of hyperacceleration, is known for his standout advice. Born in East Chicago, Indiana, the father and entrepreneur is a graduate of Indiana University Bloomington. He is a former marketing executive whose past clients include Chevron, Eastern Bank Limited and Reebok, and a fund manager that specializes in a new type of investing.

Here, the business and finance consultant who calls Houston home shares insight on the secrets of investing.

You have a unique investing style compared to others in your industry. Can you describe your style and why you think it has been so effective?

Some have tried to define my brand of “hyper-acceleration” or catastrophic investing as risky or super aggressive but my style are based on 8 simple principles that everyone, even the most skeptical investor, will agree with that will help you tremendously.

- Don’t give up more than 1.6 percent on more than any trade or investment- I don’t care how much you love any company, I don’t want to see you give up more than 1.6 percent on any one trade especially right out of the gate. This is a game of retention and one of the biggest mistakes I see people losing huge because they are emotionally biased toward a stock, pair, or future. I want you to listen to me or you will be in the position that I was once in and down 37 percent in one week.

- Don’t forget the No. 1 rule of investing: Don’t Lose Money- As simple as this sounds it can be hard to execute. Most of my time I am hunting & waiting for the ideal setup to get into the market where I can buy and potentially be in profit within the first 20 minutes. Losing money is a cancer to your account. If you get this right, the return will take care of itself. Most people treat their portfolio like cash in Vegas and they are outright gambling and not using discipline to get in the right areas of the market. Wait until dips in the market occur, flash crashes happen, and or a recession happens to buy opposed to buying at the top which is a huge mistake.

- Only take trades that will not lose- This goes especially for my swing traders and intraday traders, you will not have a great setup everyday, I don’t care how great of a system you have even if you dial down to the smallest time-frame. Wait until you are able to take a trade that will not lose. I know it’s tough to sit and wait for the ideal setup but it’s much better being down 7 percent or several thousand dollars in one day because you were impatient or greedy. Some days, depending on what you are trading, you just have to stay out of the market, the name of the game is to not give back money. Being flat on the day beats being negative any day.

- Get the direction of the market right: I can pull up any stock, etf, currency pair or future and in 30 seconds tell you the predominant trend of it. I don’t care what you do, if you get the direction wrong, it is going to make it incredibly difficult for you to make money. If the market is going south and you are buying north then the outcome is going to be the same as if you are driving north on the highway when are the cars are headed south, utter devastation. At some point it will “come back in your favor” but you probably don’t have the financial liquidity to weather that capital drag. Get the direction right at all cost first. Knowing what direction that stock normally moves in is much more important than the time-frame you trade.

- 11: 1 asymmetric reward to risk ratio: If my stop loss is set to 1 point then my target would be set at least to 11 points. I am risking 1 point in the market to win 11 so even if I lose a few times, I only need one win to be in the money.

- 6. Lock in profit after it breaks in your favor: I call this “auto lock-in profit.” Imagine I came over to your house and delivered $500,000 cash to you in your living room and laid it on your coffee table. The only caveat is, for 24 hours you had to keep it in your house before you deposited it in your bank, would you lock your door after I left? Without the shadow of a doubt you would.And you should do the same in investing. The same people who would lock the door for the $500,000 do not have protective stop in the market to lock in their profits.Some will argue “Well if we hit a bear market my account will go down but the market will eventually recover” which is very true but do you want to wait 2-5 years and be down possibly 45 percent and wait for it to “come back?” I just don’t think it’s the best usage of your money. I believe in protecting the downside at all costs. The mitigation of disaster is all that really matters.

As a rule of thumb:

- I lock in 3 percent profit when you are up 7 percent in any long-term trade when long-terminvesting.

- I lock in 3 ticks worth of profit when you are up 7 ticks when intraday trading.

Will you get whipped out prematurely sometimes? Yes, but more importantly you will get paid to be wrong opposed to going into the negative. Remember we are doing everything we can to avoid losing money on each trade and investment.

- Stop buying in the middle: I define myself as a catastrophic investor so I like to buy and short at the edges of the market and one of the biggest mistakes I see people making is buying in the middle or going long at the top. You want to buy low and sell high, unfortunately most buy in the middle or the highest price and get upset when the price falls.

- Never trade without a stop loss: Some like to leave their positions naked but in the event of a flash crash, since I am in the futures and stock market, I have learned it’s best to have a stop. Once again, my first thought is always on the mitigation of disaster and limiting the losses.

Who were some of the most influential figures in your life that have helped you become a better businessman and leader?

My mom, dad, and grandmother. There are life lessons that they taught me as a kid that resonate with me now stronger than ever. My mom would tell me “do the work even when you don’t want to” and the thesis of what I preach is to work on your craft everyday.

My dad always told me as a kid “a lie is only good until the truth shows up.” I’ve never forgot that lesson. People crave authenticity / honesty now more than ever and the foundation of me talking about the wins & losses as well as the trials & triumphs that one will go through when investing.

And my grandmother stressed three things.

- Be honest.

- Don’t have any debt.

- And “your attitude determines your altitude.”

As a kid, I hated the mantra but as an adult I appreciate this so much. Negative thoughts will turn into negative actions which will lead to negative results and the same is true for positive thoughts followed by positive actions.

What do you think are the most common mistakes that investors make?

- Taking losses bigger than 1.6 percent.

- Buying in the danger zones: Going long at the top of the market or shorting at the bottom of a market.

- Not knowing the direction of the market: this is critical before you put your money in the market or take a trade. Knowing the direction of the market is more important than any time-frame you trade.

- Trading without a stop loss: this is a death wish on your account.

- Not locking in your profit.

- Over-trading or over-investing which comes from not having a plan: You should know exactly how many trades or investments you are going to make as well how many shares that you will deploy into the market. Once you accept this as truth, you will become more responsible for what you choose to do in the market.

- Blaming the market for bad performance: there is no such thing as a bad market only bad entries into the market. I know that is controversial but if you think the market is going to crash you can always close your positions, either 1⁄2 or 75 percent and go to cash to prevent losses from occurring. There is no rule stating that you have to be all in all the time. It’s sort of like not using your brakes in when you know you are going to get into a collision because you have top of line airbags and a world-class seatbelt.

- Taking huge risks to make small gains. Instead, you want to make a small risk to capture a large rewards

- Day trading: 5:1 reward to risk

- Mini swing trade: 15:1 reward to risk

- Swing term trade: 34:1 or

- Long-term: 50:1 reward to risk

What are your top three pieces of advice?

There are so many pieces of advice that come to mind but the three that stand out the most are:1. Find someone who has achieved the results you are aiming to achieve- ask them to be your adviser or mentor and if they say no offer to pay to learn from them. A great mentor or adviser shortcut your success by years and more important than learning how long they have been in the market learn how successful year over year they have been. There are plenty of people who have been in market 11 years and stopped making improvements 9 years prior. No matter how good you are, if you’re active, the market will teach you something everyday.

- Have a big vision of what your end goal is and work towards it relentlessly.

- Put in the work every day- this is the most important law. I wish I could give everyone the super power of consistency but I know that 95 percent will see and say “that’s a good point” but won’t go out and do anything. If you are reading this chances are you are much smarter than me in a traditional sense but the only “advantage” I have over you is that I do not miss a day. Weekends, Christmas, my birthday, Flag day, it doesn’t matter, vacation it does not matter, I will not miss a day pushing to getting a competitive edge. Seinfeld’s law of not breaking the chain has had a profound impact on my life. The only day that I schedule to not do any work that day is my son’s birthday. There are people who I know who have been sitting on the sideline making 100 excuses for 4 years telling me why they don’t have the time to learn about the market but when I call to check on them on Sundays from 9 a.m.-7 p.m. they are watching football all day. I have associates who are in the league and they don’t watch that many games and that’s their profession. The only shortcut there is, is putting in the work every day. There’s a lot of talking online about that’s “it’s more important to work smart” but the truth is all of the smartest entrepreneurs are working hard and smart simultaneously. Zuckerberg isn’t working 3 hours a day in Menlo Park and then going to the beach with Priscilla for the next 6 hours.

What are some of the hidden secrets of investing?

- There is no such thing as a bad market, only bad entries into the market. You can make money whether the market is up or down but you are responsible for your gains and losses.

- Yes the market is rigged, but the market is rigged to stay up for long periods of time.

- Getting the direction right is more important almost everything else. Look at the Dow, S&P 500, Russell 2000, and Nasdaq over the last 10 years and you’ll see exactly what I’m saying.

- The market can only go from a high to a low or from a low to a high.

- Your performance in the market has everything to do with your preparation and what’s floating around in your subconscious. Most people don’t have a strategy problem they usually have some mental hang ups around money that needs to be solved.

Why did you get into this business? What inspired you to get into this industry?

I never planned to even be in this industry. Before doing this I ran a marketing agency for years but almost all of my friends were in investing and as I began investing I noticed that almost everything that we, the public, had ever been told about investing is wrong and doesn’t work. Theory is one thing but when you have money in the market I quickly realized is that a lot of these “lessons” caused me to lose money so I began quickly writing down every insight that I had about the market everyday and it turned into over 600 pages of material that eventually I will take the best lessons and turn it into a blueprint for myself.What makes a company or person a good client?

Someone who is looking for a strong or hyperaccelerated returns in the market, is patient because every day or week will not be a blockbuster week, someone who is looking to have a long-term relationship, and who understands that it takes a lot of work to produce great results and lets us do the work. Usually CEOs, CFOs, business owners, and founders who are already in the market are a great fit. So while they are working on their business I can work on growth for them.What was your biggest challenge?

My biggest challenge is the challenge that almost everyone faces when they are new in an industry which is find a blueprint that works, testing it, and then making it work in the marketplace. It was tough in the beginning learning what works but it has definitely been a blessing to go through that journey.What are some of the biggest mistakes you see others make in investing?

- Getting started in investing too late. I did as well so don’t feel bad but get started today. Start with investing $200 per month. Thinking you don’t have enough to get started- invest $200 per month into the market. Not the most sophisticated way because I don’t like dollar cost averaging but better to begin than sitting on the sidelines and not taking advantage of the upward moving market.

- Not doubling down in a recession or in a bear market.

- And I cannot stress this enough but getting the direction wrong. Almost all of your big losses will come from getting the direction incorrect.

What are the five best books everyone should read on investing?

Money: Master the Game

Market Wizards

Trend Following

Trend Trading for Dummies

The Big Short

- Bonus material:

- The Big Short movie

- In the Money (the video show I produce) Do you have a mentor?

I wouldn’t say that I have one particular mentor I do have at least 8 people that I talk to about the market constantly and teammates I brainstorm with. I read almost 14,000 pages last year alone and chat with several authors of those books but I do not have one mentor that I rely on.

What’s your job title?

InvestorWhat services do you offer?

For those who are looking for hyperaccelerated growth in the market we manage money for five clients a year and for those want to learn how to properly invest in the market we have a masterclass available to the public.Do you sit on any boards?

Not currently but I am looking forward to doing so this year and in the future.What inspired you to become an entrepreneur?

My father was the inspiration for me becoming an entrepreneur. I saw the liberation he was able to achieve as a result and I followed that path. It isn’t always easy but when it works it is an amazing feeling.What are your hobbies?

- Spending time with my family first and foremost.

- Weightlifting- if you are ever in Houston and want to work out shoot me a message on either Facebook or Instagram and we can go together. I’ve recently gotten into kickboxing.

- Reading. I know most people hate reading, because most of the books suggested to most people are incredibly boring but one of things you can do to change your life the fastest is to read amazing books. And I’m looking forward to traveling a lot more over these next 18 months.

How is it being a dad?

It is the most amazing experience I’ve ever head. It’s a wonderful feeling to have Xander run up to me and say “daddy I love you” with a huge smile on his face; I am really lucky.If you could change one thing about yourself, what would it be?

My lack of patience.If you could change one thing about the world, what would it be?

I could take about this for hours but ending all global injustices.What’s the best way to get in contact with you?

Text: 404-496-8021

Visit hyperacceleration.com Fb: facebook.com/ian.dunlap IG: @iandunlap_What’s the final piece of advice you have for everyone?

Investing isn’t as hard as everyone loves to make it seem. It isn’t easy but in no way shape or form is it rocket science so I created a super simple seven-step system that anyone can follow.Ian Dunlap 7 step investing blueprint

Step 1: Buy one share of one company

Step 2: Buy one share of one index

Step 3: Laser focus on 3 power stocks for your long-term portfolio

Step 4: Contribute monthly to your long-term portfolio

Step 5: Swing trade for growth twice per week

Step 6: Micro-swing trades for additional income only one per week

Step 7: Help 5 family members / 5 friends / 5 co-workers and 5 people in your community execute this planStep 1: Buy one share of one company

(Facebook, Amazon, Apple, Netflix, Nvidia, Google, Sprint)I am not making any recommendation on any particular company but buy strong companies. There are hundreds to pick from but those in the Dow can be a good starting place.

The purpose of telling you to only buy one share is to get you to take action quickly and not lead a lot of capital to start. Even if you are not making a lot of money currently, everyone with a computer or iphone can buy one share of a company. The biggest mistake people make is not starting investing in the market early enough.

Step 2: Buy one share of one index

S&P 500 (QQQ, SVXY, SPY, VTI, RUT, DIA)An individual stock may go out of business but an index will not. The S&P, Dow, Nasdaq, and Russell are not going to go out of existence so one of the best things you can do for your future is to invest long-term into an index fund and let time do the magic for you.

Step 3: Laser focus on 3 stocks to have in your long-term portfolio.

You don’t need 40 stocks in your portfolio in order to get great returns in the market.It’s often a huge mistake. It causes a drag on your gains because when some of the stocks in your portfolio up are winning the others are losing which causes your to minimize your growth in your account. Focus on 3 companies that historically have been strong and continues to go up over time. Netflix, Amazon, and Google are great examples of this and Microsoft as well over a 5 year period.

Microsoft went from $26.26 to a high of $65.91 in a five-year period, a 250% gain in five years.

Reminder #1: Focus on taking care of the long-term first.

Reminder #2: Don’t rush to get rich from day-trading without having your long-term portfolio taken care of 1st, that is the ultimate sin.Reminder #3: You are looking for at least a 5 year holding period. 20- 30 year holding period.

Step 4: Contribute monthly to your long-term portfolio a. 250 per month (freshman year)

- 500 per month (sophomore year)

- 1000 per month (junior year)

- 2500 per month (senior year)

Even in time of a recession or bear market you want to continue to invest in the market because after the bear period ends we usually see a very strong bearish market. My long standing thesis is that the market is rigged and it’s rigged to stay up for long periods of time.

Step 5: Swing trade for growth (two per week)

- 1⁄2 stocks – because you can get into a swing trade and not have to worryabout expiration and in a bull market / upward moving market you will be able to take advantage of the positive momentum and add more gains to your account.

- 1⁄2 futures- because the payouts are higher but the downside is that they have a 30 day expiration period so you will not be able to hold it for years in the same fashion you would with traditional stocks.

Step 6: Intraday trade for additional income (only when you have your ideal setup)

Insight #1: Only day-trade futures. Some like to day-trade forex but I think futures are a better product overall to day-trade. It has considerably more risk if you lose but when you win the payouts are much higher.

Insight #2: Do not day-trade more than two times per week. Too many people end up losing a lot of money trying to time the market perfectly on an intraday time-frame when day-trading should be used as a supplement for additional growth. And for the record, I am pro day-trading but anyone who has traded more than 100 sessions knows that you can be in at the right price but on the wrong day and things can fall apart within the first hour of the open.

You do not need to trade everyday. I always give the advice to only take your the trades that fit your ideal setup. I truly believe it’s a death-trap to day trade everyday because you are not able to see the market objectively and you also have time working against you instead of for you. You may lose if you have to be in a winning position before 3 p.m. central but if I give anyone four weeks it’s much easier to end up in a winning position because time is on your side.

Insight #3: Stick to a very strict trading plan. You only need 33 trades per year if trading UB, ZB, VX, the ES mini with the right amount of contracts. Before you take one trade you should know exactly how many trades you are going to make for the year. This is to stop you from over trading or over investing.

Step 7: Help 5 family members / 5 friends / 5 co-workers and 5 people in your community. More than 50% of the people of the 20 people that you think of out of this list will have some monetary issues at some point in their adult life. By helping and sharing a blueprint like this will help them tremendously.