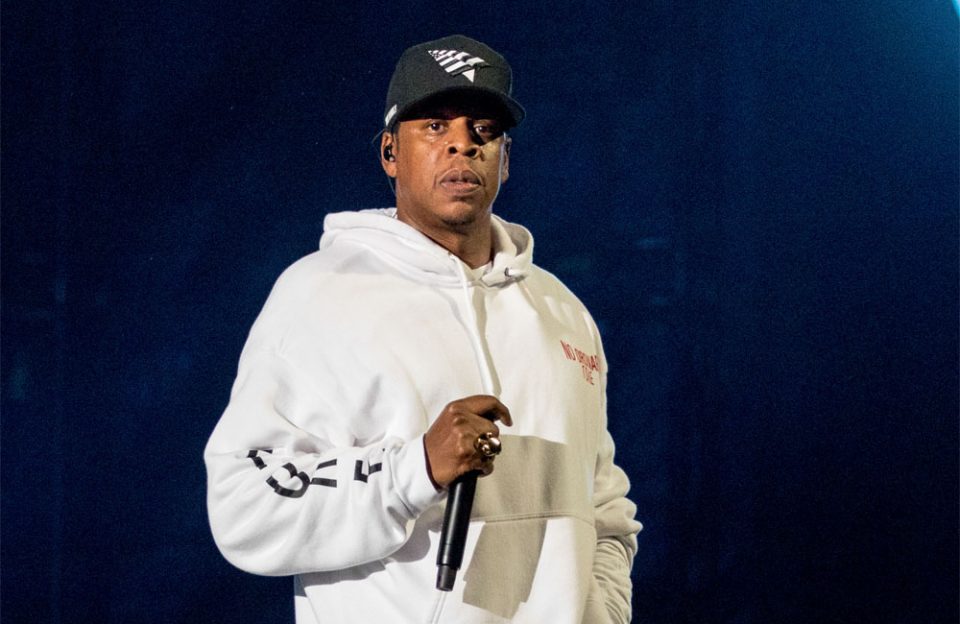

Jay-Z made another mogul move and closed a business deal on Friday, April 30 to sell the majority interest in his streaming platform Tidal to the financial services company Square for $350 million. Square is owned by Jay-Z’s friend and business partner Jack Dorsey. The two announced the deal back in March but it wasn’t finalized until April 29.

According to “TMZ,” Square gets 80 percent ownership of Tidal, along with licensing deals with the major record labels. All of the artists and owners currently involved will remain with the company too. Jay-Z will join Square’s board of directors as part of the agreement and Tidal will continue running as a separate company, but will now have Square’s software technology as one of its resources.

Jay-Z purchased Tidal in 2015 for $56 million in a partnership with several artists, including Beyonce, Rihanna, Kanye West, Madonna, Alicia Keys, and others. Tidal has a catalog of over 70 million songs and 250,000 videos. The streaming service also has listeners in more than 56 countries. “TMZ” also reports that Jay-Z and Roc Nation CEO Desiree Perez, who helped broker the deal, will stay with the company and help run Tidal.

The Roc Nation boss and Twitter’s CEO, Dorsey, have also been making other power plays over the past few months and even pooled their resources together and established a bitcoin endowment. The endowment will be called ₿trust and initially focus on developing the cryptocurrency in India and Africa. According to CNN, their initial investment of 500 bitcoin is worth around $23.6 million.

In related news to expand his empire, Jay-Z invested in a Los Angeles-based exercise company, LIT Method, this week according to People. LIT Method specializes in low-impact, high-intensity training using a strength machine. The strength machine is an all-in-one water rower, Pilates reformer, and resistance band training system that offers more than 500 low-impact exercises including rowing, barre, strength training, physical therapy, and Pilates, according to the company.

The Reasonable Doubt rapper made the investment through his venture capitalist firm Marcy Venture Partners. Details of the investment were not released.