Chad Rhodes wants to help Black business owners in Detroit.

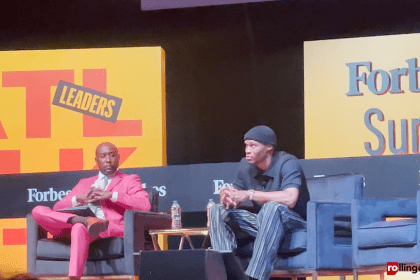

In March, a couple of weeks after the National Business League’s 12th annual State of Black Business Summit in Detroit, Rhodes joined rolling out to discuss what his Detroit chapter has done to help one another.

We’ve previously talked about what you’re doing with real estate as an entrepreneur, but you’re also doing a lot of work with the Detroit Black Chamber of Commerce. What are you guys doing?

We just had our kickoff and I launched a monumental collaboration and coalition of organizations coming together here in the city of Detroit under the umbrella of the National Business League, which, of course, was created by Booker T. Washington in 1900. He had the foresight to really be engaged and [understood] what the Black community needed from a business perspective. It’s a coalition all under the umbrella of the National Business League.

We have the National Business League, Detroit chapter; the Booker T. Washington Association; as well as the Detroit Black Chamber of Commerce, which I am the chairman of. This is an iconic come together to have a bunch of fantastic and multi-talented Black professionals here in the city of Detroit. We just got [sworn] in as chairman and president, each organization has a chairman and president and it’s one big coalition. We’re really moving and working to consolidate information and the dissemination of information in the city of Detroit to our Black business constituents.

It sounds like you guys are building a superteam of Black professionals.

Absolutely, like Megatron. It’s definitely a super team when we all come together.

I think it’s really important, especially when you have practitioners. Individuals who are business owners that are in the city that have been working on hitting all of the potholes and the barriers that come in front of you as a small to medium business owner.

What are some of the things you are teaching in the coalition?

In the city of Detroit, we currently have just under 50,000 Black businesses. Most of those are mom-and-pop shops, [with] one to three employees. … Then, from a lending perspective and the business perspective, there are a lot of things you have to set up in order to be able to walk into a bank and get lending and get funding. Those are some of the main reasons we’re building this coalition, to be able to assist Black businesses for how to be lending ready.