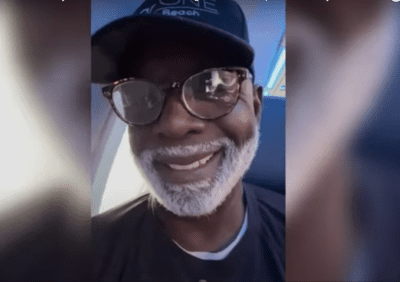

As a young adult, John Cristadoro found himself with a $50,000 in tax debt. After researching options, identifying resources for tax relief assistance, and working with tax guru Deaphalis Sample, the two decided to share their experiences and knowledge with other taxpayers in need. The duo eventually established Alliance Tax Solutions to help spare others from tax trouble trauma and help them navigate the road to tax debt recovery.

Cristadoro joined rolling out for a candid discussion about his personal journey with taxes.

What was your experience like with taxes before you got into the business?

I had a tax problem. As a matter of fact, that’s one of the major reasons I was motivated to be a partner in this firm. I owed probably about $40,000 [which was] tied to my media agency. I have a media agency and we help clients do traditional and digital experiences.

I only had a couple of people at the time. It was just me and an assistant. Some account managers had left [with] a big account. I’d given the company a lot of cash [and] I made money, but that didn’t set aside things from my quarterly, so I can speak from experience.

The tax bill came and they’re like, “You owe us,” at the time I think $20,000 And I’m like, “I don’t have $20,000.” And so I just didn’t pay it. Then the next year, the penalties and interest steadily accrued to the balance, and it grew and grew out of control over $50,000. Then, I had the right — thank goodness — I had the right people and the right connections. They helped me out, I paid some money. I did not pay the full $50,000 because of the professionals — but I was able to get out [of debt], so I can speak from experience.

It can happen to good people, and I consider myself a great person. … I had a tax problem, but I had the right people fix it for me. So again, people make mistakes, good people make mistakes. It is not illegal to owe the IRS, but it is is illegal to not file.

What did you learn personally from joining this industry?

[What] I’ve learned from joining the tax resolution space, and the tax space in general, is it’s very complicated. The tax code — on purpose by the government — is very complicated. They do that because they want to stay a step ahead. They want to make sure that the average Joe doesn’t have the ability to stay abreast or stay on top of the ever-changing tax codes. As a result, they get in trouble.

It doesn’t matter what political persuasion you follow, the government is the government and the way they get money is they charge taxes. The only way they can spend money is if they collect those taxes. [There is] estimated [to be] about $1 trillion of uncollected tax revenue out there.

And so the IRS, they’re about to get aggressive. They’re supposedly hiring about 87,000 new employees over the next decade. And they’re going to increase their efforts to collect those back taxes, especially now with all of the stimulus that was pumped into the economy over the last couple of years.

But some people didn’t necessarily do what they’re supposed to do with that, or a lot of people became gig workers. And that’s great … instead of working for someone else, [they decided] “I’m going to work for myself, I’m going to work from home, I’m going to do my thing.” But then that was a completely different scenario than they were used to. And so again, many people made mistakes, and they just didn’t know any better.

What I’ve learned is because of the complexity of the tax code, and what you’re supposed to do and not do, we will always be here ready to serve people and put them back on that pathway to peace.

How can people get help from Alliance Tax Solutions?

If you, or someone you know, is in need of some help, or need some advice, we’ve partnered with rolling out to get the word out there. Simply pick up the phone, give us a call at 1-800-930-0213 or visit AllianceTaxSolutions.com and fill out the form. We’ll make sure to have someone contact you within at least 24 hours to listen to what you need.

Images courtesy of Alliance Tax Solution