The U.S. Department of Commerce, under its Minority Business Development Agency, recently launched the Capital Readiness Program grant competition, which dedicates $93.5 million to help “minority and other underserved entrepreneurs” grow and scale their businesses.

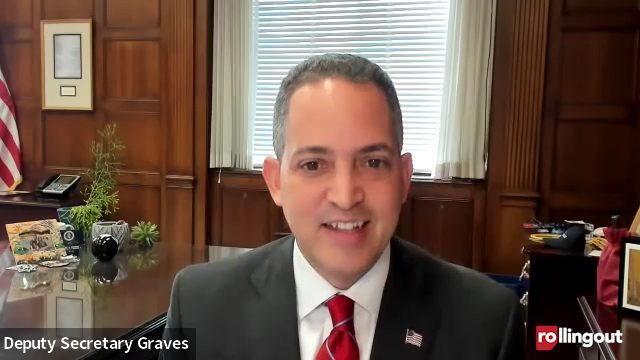

Recently, the department’s deputy secretary Don Graves spoke to rolling out about the largest program of its kind in the department’s history.

What is going on with the near-$100 million the agency is distributing?

The Capital Readiness Program [provides nearly] $100 million to support the growth, long-term, health and success of minority businesses. This program is specifically giving funding to those organizations that are in the trenches working at a ground level, talking every day with minority-owned businesses, with businesses owned by women, veterans and other underserved entrepreneurs.

What we know from generations is underserved businesses always have had a harder time getting contract opportunities, getting access to credit and capital, and having the technical support and connections they need to be successful to grow their business to scale over the long term. What this program is meant to do is make sure that ecosystem, the networks, the technical assistance, the access to credit and capital are actually in place for a minority business owner when they have a great idea, and they just need that little extra bit to turn that idea into, not just success, but lives of dignity for themselves and for everyone they employ.

How can Black and Brown business owners access the grant money?

Let me make one distinction. The Capital Readiness Program … is specifically going to those organizations that provide support to minority businesses. The incubators, accelerators, nonprofits, HBCUs and other minority-serving institutions have programs or centers in place but have never had the type of capacity or resources they need to really adequately serve these minority business owners.

Don’t think we don’t have opportunities for our business owners of color. This is part of a broader $10 billion program … [a] small business credit initiative that’s providing credit and capital to these business owners who just need that little bit of capital to grow their businesses to scale.

The other great thing about it is that you asked. Where can people get information? How can they access this? The Department of Commerce has one agency in the entire Federal government whose sole focus is the support, the long-term health and success of minority-owned businesses and other underserved businesses. That’s the Minority Business Development Agency or the MBDA.